- Deep Research Global

- Posts

- AI Cold War: All You Need to Know, An In-Depth Analysis

AI Cold War: All You Need to Know, An In-Depth Analysis

The Battle for Technological Supremacy

The world has entered a new era of technological competition, the “AI Cold War.”

Unlike the nuclear standoff of the 20th century, this 21st-century rivalry centers on algorithms, artificial intelligence (AI), and the race to dominate the technologies that will define global power for generations to come.

The stakes have never been higher for investors seeking to understand how this technological arms race will reshape markets, industries, and geopolitical dynamics.

Want an audio version? Listen to the in-depth analysis on our Deep Research Global Podcast 👇

Table of Contents

Understanding the AI Cold War: The New Technological Battlefield

The term “AI Cold War” describes the intensifying strategic competition between the United States and China for technological supremacy in artificial intelligence.

This rivalry extends far beyond corporate competition or academic research. It represents a fundamental contest over which values, authoritarian control or democratic innovation, will shape the future of human civilization.

According to recent analysis from the Atlantic Council, this technological race draws direct comparisons to the Cold War and the great scientific clashes that characterized that era.

However, the implications of the AI race are even more profound. While the original Cold War centered on nuclear weapons, a single category of strategic technology, the AI race encompasses virtually every aspect of modern life, from healthcare and transportation to military operations and economic systems.

Frederick Kempe, President of the Atlantic Council, notes that failure to maintain U.S. leadership on AI could have generational consequences. “The outcome of this contest will determine which values, authoritarian efficiency or democratic dynamism, set global norms on everything from digital commerce to autonomous warfare,” Kempe writes.

Image source: gfmag.com

The Economic Scale: Market Size and Investment Trends

Global AI Market Growth

The financial stakes in the AI Cold War are staggering. The global artificial intelligence market is experiencing exponential growth that dwarfs most other technological revolutions.

Global AI Market Projections:

- 2025: $757.58 billion

- 2030: $15.7 trillion (projected GDP contribution)

- 2033: $4.8 trillion (market size projection)

- 2034: $3.68 trillion (alternative projection)

According to UNCTAD research, the global AI market is projected to soar from $189 billion in 2023 to $4.8 trillion by 2033, representing a 25-fold increase.

PwC research shows that global GDP could be up to 14% higher in 2030 as a result of AI, equivalent to an additional $15.7 trillion.

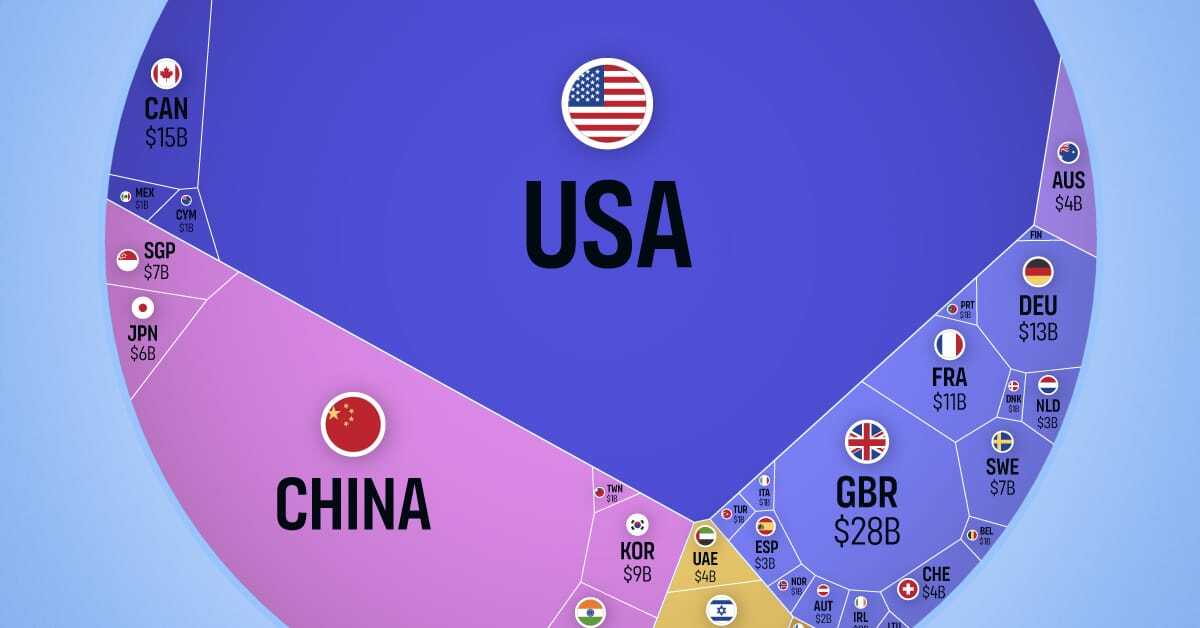

Investment Disparity: US Dominance

The investment gap between the United States and its competitors has widened dramatically.

According to the 2025 Stanford AI Index Report, in 2024, U.S. private AI investment grew to $109.1 billion, dwarfing China’s $9.3 billion and the U.K.'s $4.5 billion.

Country | 2024 AI Investment | Multiple vs China |

|---|---|---|

United States | $109.1 billion | 12x |

China | $9.3 billion | 1x |

United Kingdom | $4.5 billion | 0.48x |

Generative AI saw particularly strong momentum, attracting $33.9 billion globally in private investment, an 18.7% increase from 2023.

This massive capital deployment demonstrates the market’s confidence in AI’s transformative potential and the U.S. ecosystem’s ability to attract global investment capital.

Image source: visualcapitalist.com

The Technology Battleground: Key Areas of Competition

Semiconductor Supremacy

The foundation of AI power rests on advanced semiconductors. The United States has implemented unprecedented restrictions on semiconductor exports to China since October 2022, which have been expanded in 2023 and 2024.

Recent reports from The Wall Street Journal confirm that America’s chip restrictions are having a significant impact. Shortages of advanced AI chips in China are so acute that Beijing is intervening, and tech companies are resorting to workarounds to access restricted technology.

President Trump announced in November 2025 that China and other countries cannot have access to Nvidia’s cutting-edge Blackwell chips, according to Reuters reporting. This represents an escalation in chip export restrictions that could fundamentally reshape global AI development.

In a countermove, China banned foreign AI chips from state-funded data centers in November 2025, affecting U.S. chipmakers Nvidia $NVDA ( ▲ 1.02% ) , AMD $AMD ( ▼ 1.58% ) , and Intel $INTC ( ▼ 1.14% ) . This retaliatory measure signals Beijing’s confidence in its domestic chip industry’s capabilities.

Also read:

AI Model Development: The Quality Gap Narrows

While the United States leads in producing notable AI models, China is rapidly closing the performance gap. According to the Stanford AI Index 2025:

2024 Notable AI Model Production:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

United States: 40 models

China: 15 models

Europe: 3 models

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

However, the quality gap has narrowed dramatically. Performance differences on major benchmarks such as MMLU and HumanEval shrank from double digits in 2023 to near parity in 2024.

This convergence suggests that China’s approach to AI development, while producing fewer models, is becoming increasingly effective at matching U.S. capabilities.

The breakthrough moment came with DeepSeek’s R1 model in early 2025. According to CSIS analysis, DeepSeek’s achievement was particularly significant because it came from a company that did not benefit heavily from state largess, demonstrating the resilience and innovation capacity of China’s AI ecosystem even under export restrictions.

Also read:

Critical Resources: The Rare Earth Mineral Leverage

China maintains overwhelming dominance in rare earth elements and critical minerals essential for AI infrastructure. This control represents a significant strategic advantage in the technology competition.

China’s Rare Earth Dominance

Resource Category | China’s Global Share |

|---|---|

Mining | 70% |

Refining | 90% |

Magnet Production | >90% |

Lithium Processing | 58% |

Cobalt Processing | 70% |

On October 9, 2025, China’s Ministry of Commerce announced the strictest rare earth and permanent magnet export controls to date through Announcement No. 61 of 2025. These restrictions threaten U.S. defense supply chains and demonstrate China’s willingness to weaponize its supply chain dominance.

The IEA notes that with new export controls on critical minerals, supply concentration risks have become a reality. This development forces Western nations to accelerate efforts to develop alternative supply chains and domestic production capabilities.

Military Applications: Defense Spending and Strategic Implications

Pentagon AI Investment

The military dimension of the AI Cold War represents one of its most consequential aspects. Global military spending on AI is projected to reach $38.8 billion by 2028, representing a nearly 750% increase from 2022, according to defense analysts.

Pentagon AI & Autonomy Budget:

══════════════════════════════════

FY 2025: $25.2 billion (3% of total DoD budget)

FY 2026: $13.4 billion (dedicated AI budget line)

[First dedicated AI budget allocation]

══════════════════════════════════

The Pentagon’s FY 2026 defense budget request includes a record $13.4 billion investment in artificial intelligence and autonomy, marking the first time the Department of Defense has allocated a dedicated budget line for these capabilities.

The Army alone is pouring $486 million into basic AI research and development, $35 million for robotics development, and $144 million for autonomous systems, according to Defense One reporting.

Military AI Applications

AI is being integrated across military operations:

Autonomous Systems: Drones, unmanned vehicles, and robotic platforms

Intelligence Analysis: Pattern recognition and threat assessment

Cyber Operations: Defensive and offensive cyber capabilities

Command and Control: Decision support and strategic planning

Logistics Optimization: Supply chain and resource management

Strategic Approaches: Contrasting Systems

China’s Centralized Model

China’s approach to AI development is characterized by deep integration between state direction and private enterprise. The Chinese government views AI as crucial for “comprehensive national power,” according to Atlantic Council analysis.

Key features of China’s approach:

Unified State Strategy: Government direction across all sectors

AI-Plus Initiative: Rapid integration into surveillance, manufacturing, military

State-Private Alignment: Corporate incentives aligned with national goals

Application Focus: Emphasis on deployment over pure research

Resource Mobilization: Direct state intervention to assist champions

China announced an additional venture capital guidance fund dedicating approximately $138 billion over 20 years to AI and quantum technology in March 2025, according to the Federal Reserve analysis.

United States’ Decentralized Model

The U.S. approach relies heavily on private sector dynamism, open research culture, and international alliances. Key characteristics include:

Private Sector Leadership: Companies drive innovation

Academic Freedom: Open research and publication

Market Competition: Multiple competing approaches

Alliance Network: International partnerships and collaboration

Regulatory Complexity: Multiple stakeholders, varying regulations

However, this approach faces challenges. The U.S. government struggles to coordinate private stakeholders and universities on a national scale. Companies focus on market competition and profits rather than unified national objectives.

Nvidia CEO Jensen Huang warned that “China is going to win the AI race,” pointing to Beijing’s looser regulations, energy subsidies, and direct intervention, according to Financial Times reporting. Huang urged the U.S. to “run fast” to maintain its competitive position.

Talent Competition: The Human Factor

Global AI Talent Shortage

The competition for AI talent represents a critical dimension of the technological rivalry. By 2027, there will likely be a 700,000 AI jobs shortage globally. Specialists with AI proficiency receive a 56% salary premium, reflecting acute demand.

According to a report, today 94% of leaders face AI talent shortages, with around one-third reporting gaps of 40-60% in AI-critical roles. By 2028, shortages are expected to ease somewhat, but 44% of leaders still anticipate 20-40% gaps.

Comparative Talent Dynamics

Aspect | United States | China |

|---|---|---|

Salary Strategy | $100M+ packages for top researchers | Lower direct compensation, state incentives |

Research Environment | Open publication, academic freedom | Directed research, state priorities |

Immigration | Attracts global talent | Primarily domestic development |

Education Scale | 22% increase in CS graduates (10 years) | Massive state investment in STEM |

While American companies offer pay packages of $100 million or more to top AI researchers, China’s pitch is less about money and more about national purpose, state support, and rapid deployment opportunities.

Business Adoption and Productivity Impact

AI business usage is accelerating dramatically. According to Stanford’s AI Index, 78% of organizations reported using AI in 2024, up from 55% the year before. This rapid adoption rate demonstrates AI’s transition from experimental technology to essential business infrastructure.

A growing body of research confirms that AI boosts productivity and, in most cases, helps narrow skill gaps across the workforce. However, the productivity gains are unevenly distributed across sectors and skill levels.

Enterprise AI Investment Table

Investment Category | 2024 Global Investment | Growth Rate |

|---|---|---|

Generative AI | $33.9 billion | +18.7% YoY |

AI Infrastructure | $375 billion (projected 2025) | N/A |

Total Private AI Investment | $109.1B (US) + $9.3B (China) + Others | Varies by region |

According to CNBC reporting, global AI spending is projected to reach $375 billion in 2025 and $500 billion by 2026, fueling GDP growth and market optimism.

Image source: goldmansachs.com

Policy and Governance: The Regulatory Dimension

United States Regulatory Acceleration

In 2024, U.S. federal agencies introduced 59 AI-related regulations, more than double the number in 2023, issued by twice as many agencies. This regulatory expansion reflects growing government recognition of AI’s transformative impact and potential risks.

The Trump administration has taken an aggressive stance on AI export controls. However, industry leaders worry that the administration focuses more on restricting what U.S. firms can sell to China than on energetically helping American companies win the race, according to industry feedback.

Global Governance Evolution

Globally, legislative mentions of AI rose 21.3% across 75 countries since 2023, marking a ninefold increase since 2016.

Organizations, including the OECD, EU, U.N., and African Union, have released frameworks focused on transparency, trustworthiness, and responsible AI principles.

However, a significant gap persists between recognizing responsible AI risks and taking meaningful action. AI-related incidents are rising sharply, yet standardized responsible AI evaluations remain rare among major industrial model developers.

Government Investment Commitments (2025)

Major Government AI Investments:

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Canada: $2.4 billion

China: $47.5 billion (semiconductor fund)

$150 billion through 2030 (total AI)

France: €109 billion

India: $1.25 billion

Saudi Arabia: $100 billion (Project Transcendence)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Investment Implications: What Investors Need to Know

Key Investment Themes

For investors navigating the AI Cold War, several critical themes emerge:

1. Infrastructure Investment

The massive build-out of AI data centers, semiconductor manufacturing, and energy infrastructure represents multi-trillion-dollar opportunities.

Companies involved in data center construction, cooling systems, power generation, and network infrastructure are positioned to benefit from sustained long-term demand.

2. Semiconductor Value Chain

Despite export restrictions, the global demand for advanced semiconductors continues to grow. Investors should focus on:

Leading chip designers (Nvidia, AMD, etc.)

Semiconductor manufacturing equipment suppliers

Memory and storage technology providers

Alternative chip architectures and specialized AI processors

3. Geographic Diversification

The bifurcation of technology ecosystems means investors need exposure to both U.S. and Chinese AI leaders. However, geopolitical risks require careful assessment of regulatory exposure and supply chain dependencies.

4. Vertical AI Applications

Beyond infrastructure, AI’s deployment in specific industries offers investment opportunities:

Healthcare AI (FDA approved 223 AI-enabled medical devices in 2023, up from 6 in 2015)

Autonomous transportation (Waymo provides 150,000+ rides weekly)

Financial services AI

Industrial automation

Defense and cybersecurity

5. Talent and Education

Companies providing AI training, workforce development, and talent placement services benefit from the severe talent shortage affecting 94% of organizations.

Risk Factors for Investors

Critical Risk Categories:

═════════════════════════════════════════

→ Regulatory Risk: Export controls, sanctions

→ Geopolitical Risk: Escalating tensions

→ Technology Risk: Rapid obsolescence

→ Competition Risk: Narrowing performance gaps

→ Supply Chain Risk: Critical mineral access

→ Valuation Risk: High market expectations

═════════════════════════════════════════

The intensifying competition creates both opportunities and risks.

Export restrictions can suddenly render business models unviable.

Geopolitical escalation could lead to asset freezes or forced divestitures.

Technology leadership can shift rapidly as the quality gap between U.S. and Chinese AI models narrows.

The Energy Equation: Power Requirements

AI’s explosive growth demands enormous energy resources. Training large AI models and operating data centers at scale requires electricity on a scale that challenges existing infrastructure.

The World Economic Forum notes that as of mid-2025, the geopolitics of AI stands at a crossroads regarding energy access and sustainability. Countries with abundant, cheap, sustainable energy have significant advantages in AI development.

China’s approach includes substantial energy subsidies for AI development. The United States faces challenges balancing AI’s energy demands with climate commitments and grid capacity limitations.

Current State Assessment: Who’s Winning?

United States Advantages

Investment Capital: 12x China’s private AI investment

Model Production: 40 notable models vs China’s 15 in 2024

Compute Power: 39.7 million petaflops (50% of global total)

Ecosystem Strength: Leading tech companies, research institutions

Alliance Network: International partnerships and collaboration

China Advantages

Publication Leadership: Leads in AI research papers and patents

Application Deployment: Faster integration across economic sectors

State Coordination: Unified strategy and resource mobilization

Supply Chain Control: Rare earth minerals, manufacturing capacity

Determination: Long-term commitment regardless of short-term costs

Performance Parity

The most significant development is the rapid convergence in AI model performance. The gap between top U.S. and Chinese models has shrunk from double digits to near parity in just one year. This suggests the technology race is far from decided.

According to Asia Times analysis, while the U.S. maintains advantages in compute power and investment, China’s focus on application and its ability to overcome technical barriers through alternative approaches means neither side has a decisive advantage.

Also read:

Future Scenarios: What Comes Next?

Scenario 1: Continued Bifurcation

Technology ecosystems fully separate into U.S./Western and Chinese spheres. Each develops parallel standards, infrastructure, and applications. Global companies must operate dual technology stacks. Developing countries choose alignment.

Investment Implications: Need exposure to both ecosystems; reduced efficiency from duplicated infrastructure; innovation potentially slows from reduced collaboration.

Scenario 2: Détente and Cooperation

Recognition of mutual benefits leads to agreements on AI safety, standards, and limited technology sharing. Competition continues but within agreed frameworks.

Investment Implications: Reduced regulatory risk; potential for global standards benefiting large players; supply chain efficiency improves.

Scenario 3: U.S. Dominance Maintained

U.S. technological advantages prove decisive. Export controls effectively slow Chinese progress. Western alliance maintains united front.

Investment Implications: U.S. tech companies capture global markets; Chinese alternatives struggle; higher valuations for Western AI leaders.

Scenario 4: Chinese Breakthrough

China achieves technological parity or superiority through indigenous innovation. Alternative chip architectures, novel AI approaches, or superior implementations overcome Western restrictions.

Investment Implications: Need for exposure to Chinese AI leaders; potential reversal of current market leaders; geopolitical tensions escalate.

Most Likely Outcome: Competitive Coexistence

Experts suggest the most probable scenario involves sustained competition without a clear victor. Each side maintains advantages in different areas. Some cooperation exists in specific domains while rivalry continues in others.

Strategic Recommendations for Investors

Based on this comprehensive analysis of the AI Cold War dynamics, investors should consider the following strategic approach:

Portfolio Construction

Core Holdings (40-50%)

Diversified exposure to U.S. AI infrastructure leaders

Semiconductor value chain companies with proven technology moats

Cloud computing platforms with AI capabilities

Geographic Diversification (20-30%)

Selective exposure to Chinese AI leaders (considering regulatory risks)

European AI companies (different regulatory environment)

Emerging market AI adopters and infrastructure plays

Thematic Opportunities (10-20%)

Vertical AI applications (healthcare, finance, industrial)

Alternative compute architectures

AI security and governance solutions

Energy infrastructure for AI

Risk Management (5-10%)

Companies with limited geopolitical exposure

Traditional technology companies adapting to AI

Cash for opportunistic deployment

Monitoring Framework

Investors should track key indicators:

Technology Metrics: Model performance benchmarks, compute efficiency, training costs

Investment Flows: Private AI investment by geography and sector

Regulatory Developments: Export controls, data localization, AI governance

Geopolitical Events: Trade negotiations, diplomatic incidents, alliance shifts

Talent Flows: Where top AI researchers are moving

Energy Developments: Power infrastructure build-out, cost trends

Time Horizon Considerations

Investment Timeframes:

══════════════════════════════════════════════════

Short-term (1-2 years):

→ High volatility from geopolitical events

→ Regulatory announcements drive price swings

→ Focus on established leaders with pricing power

Medium-term (3-5 years):

→ Infrastructure build-out phase

→ Application adoption accelerates

→ Competitive landscape becomes clearer

Long-term (5+ years):

→ Geopolitical structure solidifies

→ Technology winners/losers determined

→ Economic impact becomes measurable

══════════════════════════════════════════════════

My Final Thoughts: The Defining Competition of Our Era

The AI Cold War represents the defining technological and geopolitical competition of the 21st century. Unlike previous technology races, AI’s pervasive impact means the outcome will shape virtually every aspect of human civilization, from economic systems and military power to individual privacy and democratic governance.

For investors, the AI Cold War presents both extraordinary opportunities and significant risks. The market has already recognized AI’s transformative potential, with valuations reflecting optimistic scenarios. However, the path forward involves substantial uncertainty regarding technology evolution, competitive dynamics, and geopolitical outcomes.

The competition between the United States and China is not simply about which country develops better algorithms or faster chips. It represents a fundamental contest over values, economic systems, and the future organization of global power. Democratic innovation competes against authoritarian efficiency. Decentralized dynamism faces centralized coordination. Open research confronts directed development.

As Frederick Kempe of the Atlantic Council observes, “The design of the internet, its core protocols and standards, reflected a bias toward openness, self-organization, and free speech that have shaped two generations of lives online and trillions of dollars in consumer technology. This moment in the AI era offers the same pivotal opportunity for influence.”

The outcome remains undecided. While the United States maintains significant advantages in investment capital, compute power, and model production, China’s unified strategy, application focus, and supply chain control provide formidable competitive strengths. Most significantly, the rapid narrowing of the performance gap between U.S. and Chinese AI models suggests that technological leadership is far from secure.

For investors with the appropriate risk tolerance and time horizon, the AI Cold War represents a generational opportunity to participate in technologies that will fundamentally reshape the global economy. However, success requires careful portfolio construction, continuous monitoring of rapidly evolving competitive dynamics, and realistic assessment of both opportunities and risks in this new era of great power technological competition.

The AI Cold War has only just begun. Its ultimate outcome will determine not just which country leads in technology, but what values and systems govern the AI-powered future of human civilization.

For investors seeking to understand and benefit from this transformation, staying informed about technological developments, geopolitical shifts, and competitive dynamics is essential to navigating the opportunities and challenges ahead.

Reply