- Deep Research Global

- Posts

- Airbnb - SWOT Analysis Report (2026)

Airbnb - SWOT Analysis Report (2026)

The short-term rental industry continues to undergo significant transformation as we approach 2026. At the center of this evolution stands Airbnb, Inc. $ABNB ( ▲ 0.75% ) a company that has fundamentally altered how millions of people travel and experience destinations worldwide.

For investors seeking to understand the company’s competitive positioning and future prospects, our comprehensive Airbnb SWOT analysis provides essential insights into both the opportunities and challenges that lie ahead.

Table of Contents

Airbnb recently reported its Q3 2025 financial results, demonstrating robust performance with revenue of $4.1 billion, representing 10 percent year-over-year growth. The company achieved a remarkable 34 percent net income margin and generated $1.3 billion in free cash flow.

These figures underscore the platform’s operational efficiency and market strength, yet they tell only part of the story. Understanding the internal strengths and weaknesses, alongside external opportunities and threats, reveals a more nuanced picture of what investors can expect from Airbnb in the coming years.

This analysis examines Airbnb’s position as it navigates regulatory headwinds, intensifying competition from traditional hospitality players, and the imperative to diversify beyond its core accommodations business.

With the company projecting Q4 2025 revenue growth between 7 and 10 percent, and consensus estimates projecting 17 percent EPS growth and 10 percent revenue growth for 2026, the stakes for maintaining operational excellence while pursuing strategic expansion have never been higher.

Core Strengths: Understanding Airbnb’s Competitive Advantages

Financial Performance and Profitability Metrics

Airbnb’s financial strength remains one of its most compelling attributes for investors. The company has consistently demonstrated an ability to generate substantial free cash flow while maintaining healthy profit margins.

In Q3 2025, Airbnb achieved an adjusted EBITDA of $2.1 billion, representing a 50 percent adjusted EBITDA margin. This level of profitability is exceptional in the travel technology sector and reflects the asset-light nature of Airbnb’s marketplace model.

Q3 2025 Financial Performance Summary

Revenue: $4.1 billion (+10% YoY)

Net Income: $1.4 billion (34% net income margin)

Adjusted EBITDA: $2.1 billion (50% adjusted EBITDA margin)

Free Cash Flow: $1.3 billion (33% FCF margin)

Trailing Twelve Month FCF: $4.5 billion (38% FCF margin)

The company’s trailing twelve-month free cash flow of $4.5 billion, with a margin of 38 percent, provides Airbnb with substantial financial flexibility. This cash generation capability enables the company to invest in technology infrastructure, pursue strategic initiatives, and return value to shareholders without compromising its balance sheet. For investors, this consistent profitability demonstrates that Airbnb has moved beyond the growth-at-all-costs mentality that characterizes many technology companies, achieving a mature balance between expansion and financial discipline.

Metric | Q3 2025 | YoY Growth |

|---|---|---|

Revenue | $4.1B | +10% |

Gross Booking Value | Increased | +14% |

Nights and Seats Booked | 133.6M | +9% |

Net Income Margin | 34% | Expanded |

Free Cash Flow Margin | 33% | Strong |

Platform Network Effects and Market Position

Airbnb’s marketplace operates on powerful network effects that create a defensible competitive moat. As of 2025, the platform hosts millions of listings across more than 220 countries and regions. This extensive inventory attracts guests, which in turn incentivizes more hosts to list their properties, creating a self-reinforcing cycle that becomes increasingly difficult for competitors to replicate.

The platform’s brand recognition serves as a significant competitive advantage. For many travelers, “Airbnb” has become synonymous with short-term rentals, similar to how “Google” became synonymous with internet search. This brand equity reduces customer acquisition costs and provides pricing power that smaller competitors cannot match.

In Q3 2025, Airbnb demonstrated accelerating growth momentum, with Nights and Seats Booked increasing 9 percent year-over-year, representing an acceleration from Q2 2025. Particularly noteworthy is the international performance: when excluding North America, Nights and Seats Booked grew double-digits year-over-year, indicating successful geographic diversification.

Technology Infrastructure and AI Integration

Airbnb has committed to transforming into what CEO Brian Chesky describes as an “AI-first application.” This strategic pivot represents one of the company’s most significant investments in future competitiveness. The company is integrating artificial intelligence across multiple dimensions of the platform to enhance personalization, streamline customer service, and improve matching between guests and properties.

The AI-powered customer support initiative has already shown measurable results. Airbnb’s AI assistant has reduced the need for human agent intervention by approximately 15 percent in the United States, while cutting typical resolution times from hours to seconds for many issues. The company is expanding this capability internationally, starting with Spanish-language support in Mexico, with additional countries and languages planned.

AI Technology Implementation Timeline

Phase 1 (Completed): AI-powered customer support in U.S.

- 15% reduction in human agent contact needs

- Resolution time reduced from hours to seconds

Phase 2 (In Progress): International expansion

- Spanish language support in Mexico launched

- Additional languages and countries planned

Phase 3 (Development): AI-powered search

- Conversational trip planning interface

- Personalized recommendation engine

- Dynamic pricing optimization

Beyond customer service, Airbnb is developing AI-powered search capabilities that will enable guests to have conversational interactions with the platform about their travel preferences. This natural language interface aims to simplify the booking process and surface more relevant options, potentially increasing conversion rates and customer satisfaction.

Product Innovation and Service Diversification

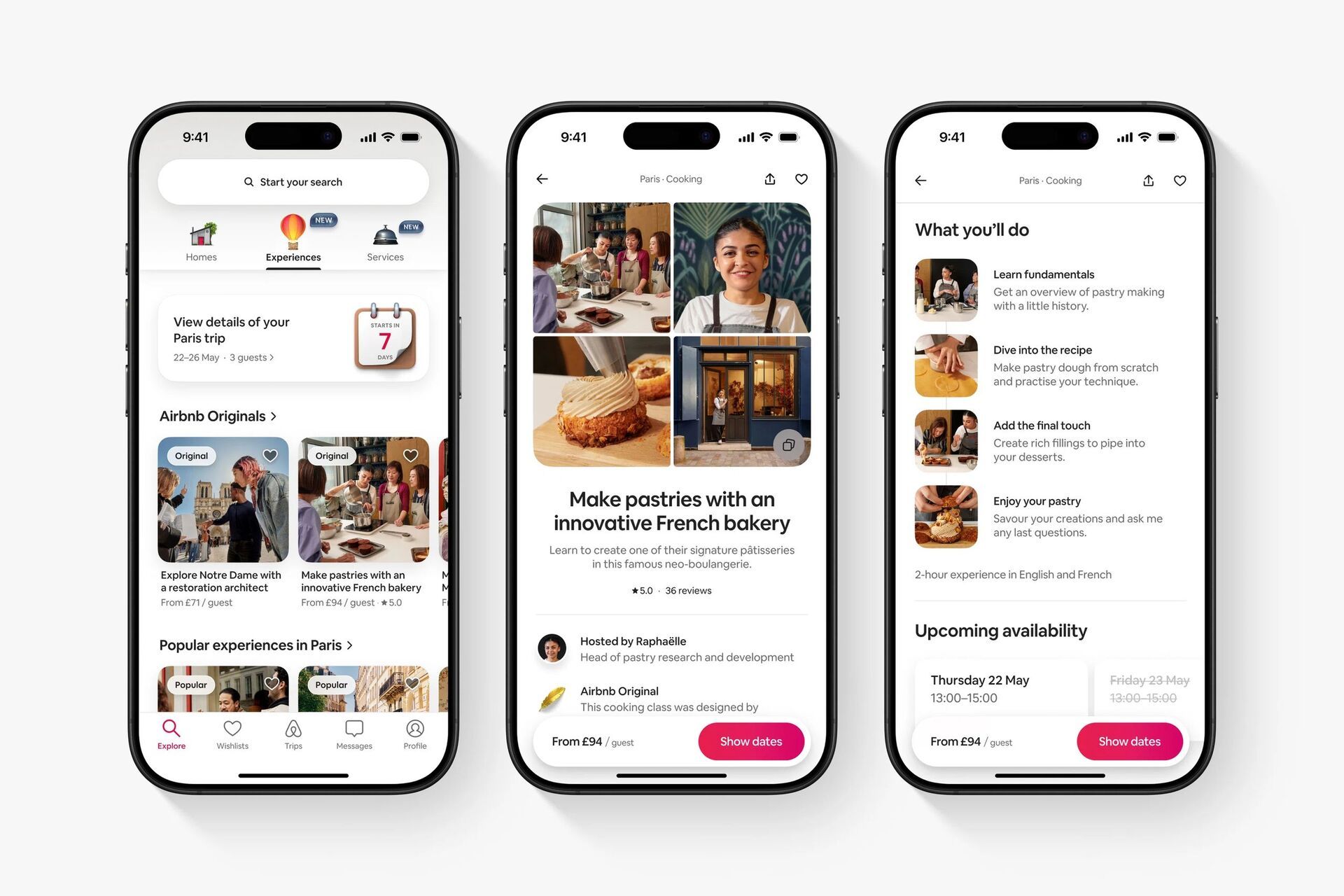

In May 2025, Airbnb launched a significant platform expansion with the introduction of Airbnb Services and reimagined Airbnb Experiences. This strategic move represents the company’s first major step beyond accommodations, addressing a long-standing competitive disadvantage compared to full-service online travel agencies.

Airbnb Services enables guests to book in-home services such as private chefs, massage therapists, hair stylists, and other conveniences directly through the platform. Meanwhile, the enhanced Experiences offering has been redesigned to emphasize social connections, allowing travelers to see who else is attending activities, message other participants, and build connections through shared experiences.

The early reception has been overwhelmingly positive, with services and experiences receiving an average rating of 4.93 out of five stars. More significantly, in Q3 2025, almost half of experiences bookings were not attached to an Airbnb accommodations booking, indicating that the company is successfully attracting customers who may not be using Airbnb for lodging. Since launch, the company has received over 110,000 applications from potential services and experiences hosts.

The platform has also introduced several guest-focused features designed to improve the booking experience and increase conversion rates:

Feature | Purpose | Impact |

|---|---|---|

Reserve Now, Pay Later | Flexible payment with $0 upfront | Drove acceleration in Nights and Seats Booked in Q3 |

Updated Cancellation Policies | Balance host earnings with guest flexibility | Reducing customer service cases, increasing bookings |

Improved Maps | Enhanced location context with landmarks, transit | Better informed booking decisions |

Flexible Carousels | Surface alternative options | Drive bookings for properties that might be missed |

Addressing Airbnb’s Weaknesses: Internal Challenges

Geographic Revenue Concentration

Despite Airbnb’s global presence, the company exhibits significant revenue concentration in North America, with the United States and Canada accounting for approximately 43.7 percent of total revenue. This geographic dependence creates vulnerability to regional economic fluctuations, regulatory changes, and market saturation in mature markets.

The concentration issue extends beyond revenue to supply dynamics. The U.S. market has experienced slowing supply growth compared to the platform’s international expansion markets. While this maturity is natural for an established market, it limits Airbnb’s ability to maintain historical growth rates without successfully scaling operations in newer geographies.

For investors, this concentration means that North American economic conditions, consumer confidence, and regulatory developments have outsized impacts on Airbnb’s overall performance. The company has recognized this vulnerability and is actively investing in international expansion, but the transition will take years to meaningfully reduce geographic concentration risk.

Regulatory Compliance Complexity and Costs

Airbnb operates in one of the most complex regulatory environments in the technology sector. The company must comply with regulations across 192 national jurisdictions, each with distinct rules governing short-term rentals, taxation, consumer protection, and data privacy. This regulatory patchwork creates substantial compliance costs and operational complexity.

The regulatory burden extends beyond mere compliance. Airbnb must invest significant resources in government relations, legal teams, and technology infrastructure to navigate diverse requirements. These costs reduce operating margins and divert resources from product development and market expansion. Moreover, the regulatory environment remains fluid, with many jurisdictions actively debating or implementing new restrictions on short-term rentals.

Regulatory Compliance Challenges by Category

Tax Collection and Remittance:

- Varying tax rates across jurisdictions

- Complex reporting requirements

- Quarterly compliance updates needed

Licensing and Registration:

- Host registration mandates increasing

- Property-level permits required in many cities

- Verification and monitoring systems necessary

Operational Restrictions:

- Minimum stay requirements

- Maximum occupancy limits

- Host presence mandates

- Annual rental day caps

The regulatory challenge creates a paradoxical situation. While established regulations can serve as barriers to entry for potential competitors, the ongoing uncertainty and risk of adverse regulatory changes creates material downside risk for investors. The New York City situation exemplifies this risk, where Local Law 18 effectively banned most short-term rentals, eliminating more than 18,000 listings overnight in September 2023.

Supply Growth Pressures in Mature Markets

Airbnb faces a structural challenge in mature markets where supply growth is decelerating. In the United States, active listing growth has slowed significantly compared to earlier years, with the market reaching 1.76 million active listings by June 2025. While this represents a 6.1 percent increase from the prior year, the growth rate has moderated from historical levels.

This supply constraint creates multiple business challenges. Without sufficient supply growth, Airbnb must rely increasingly on pricing optimization and take rate management to drive revenue growth. However, both of these approaches have natural limits. Excessive price increases risk making Airbnb less competitive versus hotels, while raising take rates alienates hosts who already express concerns about the platform’s commission structure.

The supply challenge is particularly acute in high-demand urban markets where regulatory restrictions limit new listings. Hosts in these markets face hosting restrictions, registration requirements, and in some cases, outright bans on certain types of short-term rentals. These constraints prevent Airbnb from fully capitalizing on demand in some of its most valuable markets.

Host and Guest Experience Inconsistencies

Unlike traditional hotel chains that maintain brand standards across properties, Airbnb’s marketplace model results in significant variation in quality and experience. While this diversity is partly intentional and contributes to the platform’s appeal, it also creates consistency challenges that affect customer satisfaction and retention.

Guest complaints about hidden fees, cleaning charges, and extensive house rules have become increasingly common. Some hosts have implemented onerous check-in procedures, extensive cleaning requirements, and unexpected charges that diminish the guest experience. These issues have contributed to a perception among some travelers that Airbnb has lost the value proposition that originally differentiated it from hotels.

On the host side, concerns about platform fees, algorithmic ranking changes, and competition from other hosts have led to frustration. Some experienced hosts report declining occupancy rates and pricing power as markets become oversupplied. The platform must balance the needs of both guests and hosts, often facing conflicting demands that are difficult to reconcile.

Image source: airbnb.com

Strategic Opportunities for Growth and Expansion

International Market Expansion Potential

International expansion represents Airbnb’s most significant growth opportunity for 2026 and beyond. The company has identified several key expansion markets where short-term rental penetration remains relatively low and travel demand is growing rapidly. These markets offer substantially higher growth rates than Airbnb’s mature North American base.

In Q3 2025, the average growth rate of nights booked on an origin basis in Airbnb’s expansion markets was twice that of core markets over the previous 12 months. This performance validates the company’s international strategy and suggests that significant runway remains for geographic diversification.

Specific markets showing particularly strong momentum include:

Region | Performance Highlights | Growth Drivers |

|---|---|---|

Asia-Pacific | First-time bookers up nearly 50% YoY in India | Rising middle class, domestic travel growth |

Japan | First-time bookers up over 20% YoY | Tourism recovery, cultural interest |

Latin America | Strong nights booked growth | Regional travel expansion, favorable economics |

Southern Europe | Consistent demand growth | Alternative to traditional hotels, unique properties |

The company’s international expansion strategy includes attracting new users to the platform while increasing engagement among existing users. Investment of $200 million to $250 million in new ventures for 2025 has prioritized emerging markets in Latin America and the Asia Pacific, with focused efforts to build local market awareness, develop partnerships, and adapt the platform to regional preferences.

Airbnb’s brand recognition and user-friendly platform provide competitive advantages when entering new markets. The company can leverage its existing technology infrastructure, trust and safety systems, and marketplace dynamics to achieve faster market penetration than would be possible for newer entrants.

Boutique Hotel Integration Strategy

In September 2025, CEO Brian Chesky announced that Airbnb is “getting serious about hotels”, launching a pilot program to integrate boutique and independent hotels into its core shopping experience. This strategic expansion addresses a long-standing gap in Airbnb’s offering and opens access to a new customer segment that prefers hotel amenities and services.

The hotel strategy focuses specifically on independent and boutique properties rather than large chain hotels. Airbnb plans to position these hotels alongside home rentals in search results, creating a seamless shopping experience where travelers can compare different accommodation types. The pilot is launching in several cities, including New York, where ironically, short-term rental regulations have severely restricted Airbnb’s traditional home-sharing business.

The strategic rationale for this expansion is compelling. Airbnb research indicates that the vast majority of platform users book hotels at some point during their travels. By offering hotel options within the Airbnb ecosystem, the company can capture more of this booking activity and increase customer lifetime value. Additionally, boutique and independent hotels often struggle with distribution, making Airbnb’s global reach and strong brand attractive compared to traditional OTA partnerships.

Airbnb Hotel Strategy: Key Elements

Target Properties:

- Boutique hotels (unique design, local character)

- Independent hotels (not part of major chains)

- Bed and breakfasts (personal service orientation)

- Small hotel groups (under 50 properties)

Value Proposition for Hotels:

- Competitive commission rates vs. traditional OTAs

- Access to Airbnb's global customer base

- Integration with Airbnb's trusted brand

- Technology platform for bookings and guest communication

Value Proposition for Guests:

- One-stop shopping for all accommodation types

- Consistent booking interface and experience

- Ability to compare homes and hotels directly

- Unified loyalty and payment systems

For investors, the hotel expansion represents both opportunity and risk. If successful, it could significantly expand Airbnb’s addressable market and create new revenue streams with potentially attractive margins. Hotels typically generate higher average booking values than home rentals, which could increase gross booking value without proportional increases in operational costs. However, execution challenges include avoiding brand dilution, maintaining the platform’s distinctive character, and managing potential channel conflict with hotels that also use traditional OTAs.

Experiences and Services Ecosystem Development

The launch of Airbnb Services and reimagined Experiences in May 2025 represents a strategic move to transform Airbnb from a lodging platform into a comprehensive travel ecosystem. While still early in development, this expansion addresses a fundamental competitive disadvantage: traditional online travel agencies offer complete trip planning and booking capabilities, while Airbnb has historically focused almost exclusively on accommodations.

The services component enables guests to book in-home services during their stays, including private chefs, massage therapists, photographers, personal trainers, and beauty services. This offering addresses a common pain point for travelers staying in Airbnb properties who previously had to find and coordinate such services independently. For hosts, the integration of services can differentiate their listings and justify premium pricing.

The reimagined Experiences platform emphasizes social connections and community building. New features include the ability to see who else is attending an experience before booking, direct messaging between participants, and a connections section in user profiles. These social features aim to differentiate Airbnb’s experiences from competitor offerings by emphasizing real-world connections rather than just activities.

Early results suggest significant potential. With almost half of experiences bookings not attached to accommodations, Airbnb is successfully attracting standalone demand for activities and services. The average rating of 4.93 out of 5 stars indicates strong customer satisfaction. However, scaling high-quality supply remains the primary challenge, with the company noting that building a robust services and experiences inventory will take time.

The long-term opportunity is substantial. If Airbnb can establish itself as the platform for booking complete travel experiences, it could significantly increase customer engagement, frequency of platform visits, and revenue per customer. The services and experiences expansion also creates defensibility, as coordinating accommodations, activities, and services within a single platform provides convenience that would be difficult for competitors to replicate.

Artificial Intelligence and Personalization Advancement

Airbnb’s commitment to becoming an “AI-first application” represents one of the most significant opportunities to enhance competitive positioning and operational efficiency. The company has rebuilt its technology stack specifically to enable advanced AI integration, creating a foundation for increasingly sophisticated personalization and automation.

The near-term AI roadmap focuses on several high-impact applications:

Personalized Search and Discovery: Airbnb is developing conversational AI that will enable guests to describe their travel preferences in natural language and receive tailored recommendations. This capability could dramatically simplify the search process, particularly for travelers planning complex or multi-destination trips. By understanding user preferences, travel patterns, and past behavior, the AI can surface properties and experiences that are more likely to result in bookings and satisfaction.

Dynamic Pricing Optimization: AI-driven revenue management has become increasingly important as the short-term rental market matures. Airbnb can help hosts optimize pricing based on demand patterns, local events, seasonality, and competitive positioning. More sophisticated pricing algorithms benefit both hosts through higher revenue and the platform through increased gross booking value.

Automated Customer Service: The expansion of AI-powered customer support beyond the United States represents a significant operational efficiency opportunity. Customer service represents one of Airbnb’s largest cost centers, and AI that can resolve common issues autonomously drives substantial margin improvement. The 15 percent reduction in human agent contact in the U.S. pilot suggests that meaningful cost savings are achievable at scale.

Trust and Safety Enhancement: AI can enhance the platform’s trust and safety systems through improved fraud detection, listing verification, and risk assessment. Advanced AI capabilities in image recognition could automatically verify property photos, identify potential safety issues, and flag suspicious listings or users before problems arise.

The competitive advantage from AI investments compounds over time. As Airbnb accumulates more data about user preferences, booking patterns, and satisfaction outcomes, its AI systems become increasingly effective at matching guests with properties and experiences. This creates a data moat that newer entrants would find difficult to replicate.

External Threats and Market Headwinds

Regulatory Crackdowns and Policy Restrictions

Regulatory pressure represents the single greatest external threat to Airbnb’s business model. Cities and regions worldwide are implementing increasingly restrictive policies on short-term rentals, driven by concerns about housing affordability, neighborhood disruption, and tourism impacts. These regulatory actions can rapidly and dramatically reduce Airbnb’s available inventory in affected markets.

The New York City case illustrates the severity of regulatory risk. Local Law 18, which came into full enforcement in September 2023, eliminated more than 18,000 Airbnb listings virtually overnight. The law requires short-term rental hosts to register with the city, mandates that hosts be physically present during guest stays, limits occupancy to two guests, and prohibits locking off separate spaces within an apartment. These restrictions essentially banned the types of short-term rentals that made Airbnb’s business model successful in New York.

A recent attempt to ease these restrictions failed in December 2025, with a bill that would have allowed homeowners to rent out their properties for up to 60 days per year without being present dying in committee. This outcome demonstrates the political challenges Airbnb faces, as hotel industry groups, affordable housing advocates, and city officials form coalitions opposing short-term rental expansion.

The regulatory threat extends far beyond New York. Cities across Europe, Asia, and North America are actively debating or implementing similar restrictions. Common regulatory approaches include:

Regulatory Approach | Markets Implementing | Impact on Airbnb |

|---|---|---|

Registration Requirements | Barcelona, Paris, Berlin, San Francisco | Reduces listing availability, increases host compliance burden |

Annual Day Limits | Amsterdam (30 days), Paris (120 days) | Caps host income potential, reduces professional hosting |

Host Presence Mandates | New York City, Japan | Eliminates investment properties and multi-unit hosts |

Specific Zone Restrictions | Barcelona, Prague | Concentrates impact in historic/tourist areas |

Complete Bans | Certain resort communities | Total elimination of short-term rental inventory |

For investors, the regulatory landscape creates two distinct challenges. First, sudden regulatory changes can materially impact financial performance in specific markets, as demonstrated in New York. Second, the cumulative effect of regulations across multiple markets could constrain Airbnb’s long-term growth potential and require significant ongoing investment in compliance infrastructure and government relations.

Intensifying Competition from Traditional Hospitality

The hotel industry has responded aggressively to the short-term rental threat, investing in technology, renovating properties, and adapting offerings to compete more effectively with Airbnb’s value proposition. This competitive response is gaining traction, particularly among travelers who prioritize consistency, amenities, and service over the unique character of home rentals.

Recent consumer research indicates that 53 percent of Americans still prefer hotels over Airbnbs, citing trust, amenities, and lack of surprise fees as primary reasons. During the 2025 holiday travel season, 62 percent of travelers chose hotels compared to 38 percent choosing short-term rentals. These preferences suggest that Airbnb has not displaced traditional hospitality as comprehensively as some analysts initially predicted.

Hotels have adopted several strategies to compete more effectively:

Technology Investment: Major hotel chains have developed mobile apps, contactless check-in, personalized recommendations, and other digital capabilities that narrow the technology gap with Airbnb. Many hotels now offer the convenience and ease of booking that previously differentiated online platforms.

Flexible Offerings: Hotels are introducing residential-style accommodations, extended-stay concepts, and kitchen-equipped rooms that appeal to travelers seeking home-like amenities. Brands like Marriott’s Homes & Villas collection directly compete with Airbnb’s core value proposition.

Transparent Pricing: Hotels have emphasized all-inclusive pricing without cleaning fees or surprise charges, addressing a significant pain point with Airbnb listings. This transparency resonates with travelers frustrated by the total cost revelations that often occur late in the Airbnb booking process.

Loyalty Programs: Established hotel loyalty programs provide tangible value to frequent travelers through points, status benefits, and guaranteed experiences. Airbnb has struggled to create a comparable loyalty proposition, as the fragmented nature of its host network makes consistent benefits difficult to deliver.

The competitive pressure from hotels is particularly acute in urban markets where business travel and convention activity drive demand. In these segments, hotels’ advantages in location, meeting space, and business amenities often outweigh Airbnb’s differentiation. While Airbnb maintains strength in leisure travel, vacation destinations, and longer stays, the company faces an ongoing battle to defend market share across the full spectrum of travel occasions.

Macroeconomic Volatility and Travel Demand Sensitivity

Airbnb’s business is inherently cyclical, with performance closely tied to consumer confidence, discretionary spending, and macroeconomic conditions. Travel demand is highly sensitive to economic downturns, as travel represents discretionary spending that consumers quickly curtail during periods of financial stress or uncertainty.

Several macroeconomic factors could impact Airbnb’s performance in 2026 and beyond:

Recession Risk: Economic slowdowns or recessions typically lead to reduced travel spending, both leisure and business. While leisure travel has historically proven resilient during mild economic downturns, severe recessions create meaningful headwinds. Airbnb’s fixed cost structure means that revenue declines flow through significantly to profitability.

Currency Fluctuations: As Airbnb expands internationally, currency volatility increasingly impacts reported results. Dollar strength, for example, makes international travel more expensive for Americans while reducing the dollar value of revenue generated in foreign currencies. The company’s Q4 2025 guidance accounts for these dynamics, but sustained currency moves could pressure growth rates.

Inflation Pressure: Elevated inflation affects Airbnb through multiple channels. Higher costs for utilities, maintenance, and property-related expenses reduce host profitability, potentially leading some hosts to exit the platform. Simultaneously, inflation erodes consumer purchasing power, potentially shifting travel preferences toward lower-cost accommodations or reducing overall travel frequency.

Interest Rate Environment: Rising interest rates increase financing costs for hosts who have mortgaged properties specifically for short-term rental income. Higher debt service can make hosting uneconomical, particularly in markets where occupancy rates or average daily rates have declined. This dynamic could reduce supply or increase the number of distressed host departures.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.

Reply