- Deep Research Global

- Posts

- Baker Hughes - SWOT Analysis Report (2026)

Baker Hughes - SWOT Analysis Report (2026)

The energy services sector stands at a critical transformation point. Companies must balance traditional oil and gas operations while simultaneously accelerating into lower-carbon technologies and industrial digitalization.

Baker Hughes $BKR ( ▼ 0.56% ) , with its dual focus on conventional energy services and emerging energy transition technologies, represents a fascinating case study.

As we enter 2026, understanding this company’s strategic positioning becomes essential for any investor considering exposure to the energy technology sector.

Table of Contents

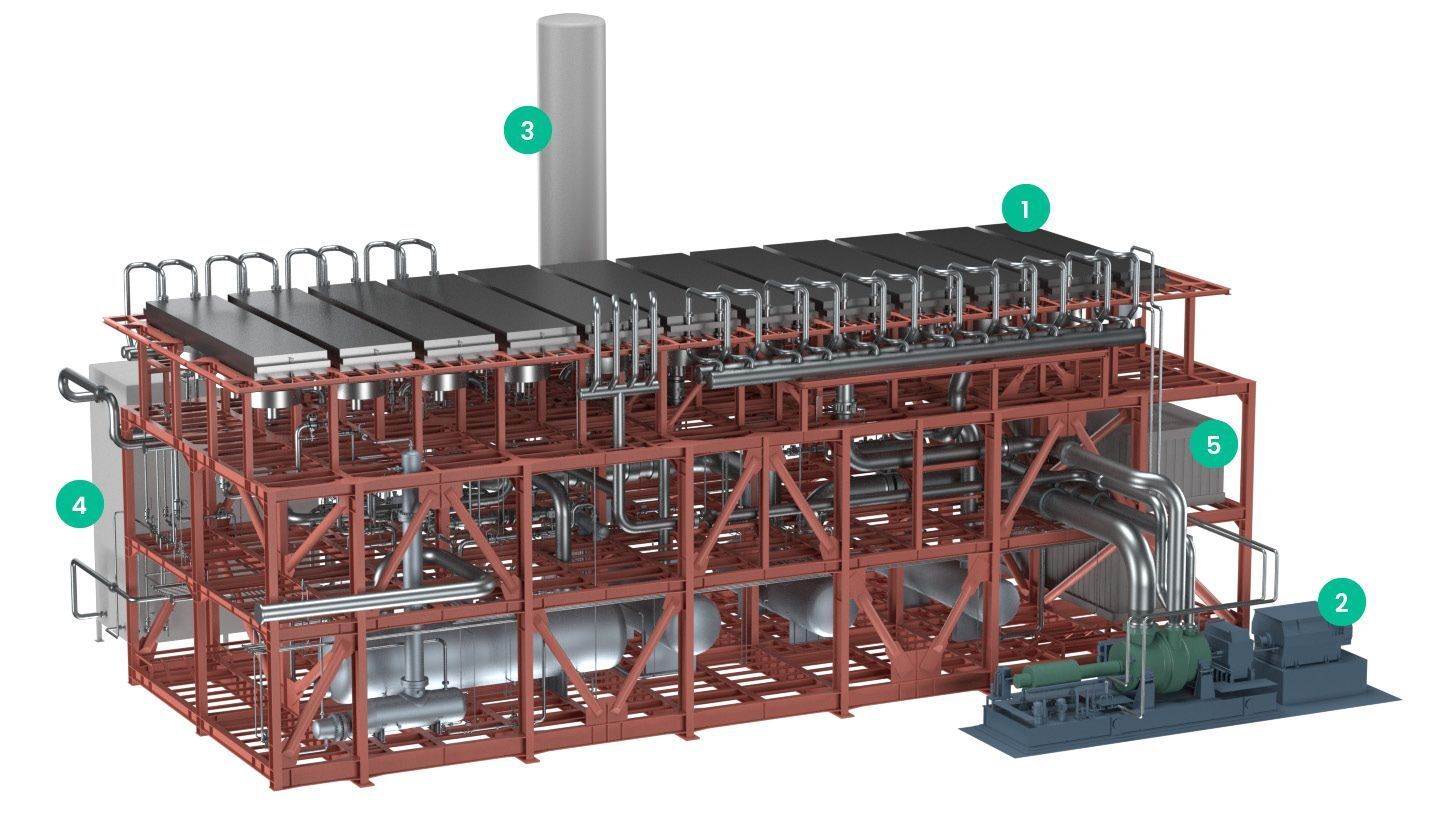

Image source: bakerhughes.com

Company Overview: A Bifurcated Business Model

Baker Hughes operates through two distinct reporting segments: Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET).

The OFSE segment serves traditional upstream oil and gas exploration and production companies. This division encompasses well construction, completions, subsea systems, and production solutions.

The IET segment focuses on equipment and services for LNG facilities, gas processing, power generation, and industrial applications. This diversification sets Baker Hughes apart from pure-play oilfield services competitors like Schlumberger and Halliburton.

In the third quarter of 2025, Baker Hughes reported revenue of $7.0 billion. The company achieved adjusted EBITDA of $1,238 million with orders totaling $8.2 billion.

The company maintains operations in over 120 countries. This global footprint provides geographic diversification while exposing the organization to varying regulatory environments and market dynamics.

Strengths: Building Competitive Advantages

Dominant Position in LNG Infrastructure

Baker Hughes has established commanding market share in liquefied natural gas equipment and services.

The company secured multiple significant LNG contracts throughout 2025. In Q3 alone, Baker Hughes received orders for gas turbine and refrigerant compressor technology for NextDecade’s Rio Grande LNG Facility Train 4 and Sempra Infrastructure’s Port Arthur Phase 2 project Trains 3 and 4.

These wins demonstrate Baker Hughes’ technical leadership in critical LNG infrastructure. The equipment supplied forms the core processing systems that enable natural gas liquefaction for global export.

Additional contract awards included Commonwealth LNG’s liquefaction equipment order in December 2025. The cumulative value of these projects positions Baker Hughes as the preferred technology provider for U.S. LNG expansion.

LNG Project Metric | Performance |

|---|---|

Q3 2025 IET Orders | $4.1 billion |

IET Remaining Performance Obligations | $32.1 billion (record) |

IET Book-to-Bill Ratio | 1.2 |

The company’s IET backlog reached a record $32.1 billion in Q3 2025. This backlog provides exceptional revenue visibility extending multiple years into the future.

LNG demand fundamentals remain robust. Global energy transitions favor natural gas as a lower-carbon alternative to coal. Meanwhile, energy security concerns following geopolitical disruptions have accelerated LNG infrastructure investments.

Baker Hughes’ technology portfolio spans the entire LNG value chain. The company supplies gas turbines, compressors, digital monitoring systems, and aftermarket services.

Strategic Acquisition of Chart Industries

Baker Hughes announced its intent to acquire Chart Industries for approximately $13.6 billion in July 2025.

Chart Industries manufactures cryogenic equipment for LNG, hydrogen, carbon capture, and industrial gas applications. The acquisition expands Baker Hughes’ capabilities across the energy transition technology spectrum.

The transaction closed in mid-year 2026 following regulatory approvals. Integration efforts are now underway to capture identified synergies.

Chart’s product portfolio complements Baker Hughes’ existing offerings. Chart specializes in storage, distribution, and end-use applications while Baker Hughes dominates production and processing equipment.

The combined entity creates comprehensive solutions for customers developing LNG export facilities, hydrogen infrastructure, and carbon capture projects. Cross-selling opportunities should emerge as the companies integrate their sales organizations.

Management projects significant cost synergies. These include procurement savings from increased scale, manufacturing footprint optimization, and elimination of duplicate corporate functions.

The acquisition transforms Baker Hughes’ exposure to emerging energy markets. Chart’s hydrogen and carbon capture capabilities accelerate the company’s energy transition positioning.

Robust Digital Solutions Portfolio

Baker Hughes has developed advanced digital transformation capabilities serving energy and industrial customers.

The company’s digital portfolio includes the Cordant platform for asset health monitoring. This system employs sensors, connectivity, and analytics to predict equipment failures before they occur.

Predictive maintenance solutions reduce unplanned downtime for customers. Oil and gas producers, LNG facilities, and power generation plants can avoid costly production interruptions by scheduling maintenance during planned outages.

Digital solutions typically command higher margins than traditional equipment sales. The recurring revenue model from software subscriptions and monitoring services provides stable cash flows.

Baker Hughes partnered with EPAM Systems in February 2025 to accelerate AI implementations across the energy sector. The collaboration focuses on deploying advanced analytics and machine learning models.

Industrial IoT adoption continues accelerating across energy-intensive sectors. Baker Hughes’ early investments in digital capabilities position the company to capture this growth.

Diversified Revenue Streams Beyond Cyclical Oil Markets

Unlike pure-play oilfield services competitors, Baker Hughes generates substantial revenue outside upstream oil and gas spending.

The IET segment contributed approximately 48% of total company revenue in Q3 2025. This diversification reduces sensitivity to volatile oil prices and drilling activity fluctuations.

Power generation equipment sales have surged. Baker Hughes secured orders for 25 aeroderivative gas turbines from Dynamis Power Solutions for mobile power generation in North American oil and gas applications during Q3 2025.

The company is also capturing demand from AI data centers requiring reliable power infrastructure. Data center operators need continuous electricity supply with minimal downtime tolerance.

Baker Hughes supplies gas turbines that can provide behind-the-meter power generation for data centers. These installations reduce grid dependence and provide backup power capabilities.

New energy solutions represent another growth vector. Baker Hughes received an award to design and deliver equipment for five geothermal power plants at Fervo Energy’s Cape Station project in Utah.

The company also won contracts for low-carbon ammonia production. The Blue Point Number One facility in Louisiana will produce 1.4 million metric tons of low-carbon ammonia annually using Baker Hughes turbomachinery and carbon capture equipment.

Revenue Diversification Metric | Q3 2025 Performance |

|---|---|

OFSE Revenue | $3.6 billion |

IET Revenue | $3.4 billion |

International Revenue (OFSE) | $2.7 billion |

North America Revenue (OFSE) | $980 million |

Strong Subsea and Offshore Technology Leadership

Baker Hughes maintains technological advantages in subsea production systems and offshore equipment.

The company secured multiple significant subsea contracts during 2025. Turkish Petroleum awarded Baker Hughes a contract to supply integrated subsea production and intelligent completion systems for Sakarya Gas Field Phase 3.

Petrobras awarded several contracts following open tenders. Baker Hughes will provide up to 50 subsea trees and associated services to support offshore production across multiple Brazilian fields.

These contracts also include 66 km of flexible pipe systems for hydrocarbon production, CO2 injection, and gas lift across the Marlim Sul, Roncador, Iracema, Atapu, Mero, and Buzios fields.

All-electric integrated completions systems represent technological differentiation. These systems enable more precise subsurface control compared to traditional hydraulic solutions.

Electric completions reduce maintenance requirements and operational carbon footprint. The simplified installation process delivers cost savings for customers.

Offshore drilling activity appears more resilient than North American onshore markets. Water depth capabilities and subsea technology expertise position Baker Hughes to benefit from offshore spending growth.

Weaknesses: Challenges to Address

Exposure to Volatile Commodity Markets

Despite diversification efforts, Baker Hughes remains significantly exposed to oil and gas price fluctuations.

The OFSE segment generated $3.6 billion in Q3 2025 revenue. This represents approximately 52% of total company revenue, creating ongoing sensitivity to upstream exploration and production spending.

Baker Hughes management expects global upstream spending to decline in the high-single digit percentage range for 2025. Tariff impacts and oil price volatility contribute to customer spending caution.

OFSE margins compressed during 2025. Segment EBITDA margin was 18.5% in Q3 2025, down from 19.3% in the prior-year period.

The margin compression reflects challenging market conditions. North American rig counts declined as producers exercised capital discipline. International markets showed mixed performance with weakness in Europe and Sub-Saharan Africa.

Oil and gas companies increasingly prioritize returns to shareholders over production growth. This strategic shift limits spending on new drilling and completion activities where Baker Hughes generates OFSE revenue.

Natural gas prices in North America remained depressed throughout much of 2025. While positive for LNG economics, low domestic gas prices reduce drilling activity in gas-focused basins.

Integration Execution Risks from Chart Acquisition

The Chart Industries acquisition represents the largest transaction in Baker Hughes’ recent history.

Large-scale integrations carry inherent execution risks. Cultural integration challenges can emerge when combining organizations with different operating models and corporate cultures.

Baker Hughes assumed approximately $13.6 billion in transaction value. The company’s net debt increased substantially following the deal closure.

Chart Acquisition Financial Impact

- Enterprise Value: $13.6 billion

- Estimated Net Debt Increase: ~$5.8 billion

- Expected Close: Mid-2026

- Integration Timeline: 12-24 months

Management must deliver projected synergies to justify the acquisition premium. Cost savings require difficult decisions around workforce reductions and facility consolidations.

Revenue synergies depend on successful cross-selling. Sales teams must learn new product portfolios and develop integrated solutions for customers.

Technology integration presents additional complexity. Combining Chart’s cryogenic expertise with Baker Hughes’ turbomachinery and digital platforms requires coordinated engineering efforts.

The acquisition timing coincides with challenging market conditions. Oil and gas industry spending constraints may limit near-term growth opportunities for the combined entity.

Geographic Concentration in Challenged Regions

Baker Hughes maintains significant operations in geopolitically sensitive areas.

The company’s international OFSE revenue declined 11% year-over-year in Q3 2025. Europe/CIS/Sub-Saharan Africa revenue dropped 36% year-over-year to $599 million.

Geopolitical tensions impact business operations. Sanctions, trade restrictions, and political instability create operational challenges and revenue uncertainty.

Currency fluctuations affect international earnings. A stronger U.S. dollar reduces the translated value of revenue generated in local currencies.

Some international markets face corruption risks and governance challenges. Operating in these environments requires robust compliance programs and carries reputational exposure.

Energy transition policies vary dramatically across regions. European markets increasingly favor renewable energy over fossil fuel development, potentially limiting Baker Hughes’ traditional services opportunities.

Lagging Digital Adoption Compared to Pure-Play Technology Firms

While Baker Hughes has developed digital capabilities, the company faces intense competition from specialized industrial software vendors.

Pure-play digital companies often demonstrate faster innovation cycles. These firms can pivot more quickly to emerging technologies like generative AI and advanced analytics.

Baker Hughes’ digital solutions compete against established industrial software providers. Companies like Aspen Technology, Emerson, and Honeywell possess deep process optimization expertise and installed bases.

Customer adoption of digital solutions progresses slower than anticipated. Many energy companies maintain legacy systems and organizational resistance to digital transformation.

The digital transformation business model differs fundamentally from traditional equipment sales. Transitioning sales teams from capital equipment to software subscriptions requires significant training and cultural change.

Proving return on investment for digital solutions can be challenging. Customers demand clear evidence that monitoring systems and analytics deliver measurable operational improvements.

Margin Pressure from Competitive Intensity

Oilfield services markets remain intensely competitive despite recent consolidation.

Competitors include Schlumberger, Halliburton, Weatherford, and TechnipFMC in various product lines. These companies compete aggressively on pricing to maintain market share.

Baker Hughes’ OFSE operating margins lag behind stated targets. The company aims to achieve 20% OFSE margins but faced headwinds throughout 2025.

Pricing discipline erodes when market conditions weaken. Customers leverage competitive dynamics to negotiate lower pricing during periods of reduced activity.

Equipment and service commoditization limits pricing power in mature product lines. Customers increasingly view certain technologies as interchangeable, intensifying price competition.

Opportunities: Pathways for Growth

Global LNG Expansion Wave

Global LNG infrastructure investments present massive opportunities.

Multiple large-scale LNG export projects advanced to final investment decisions during 2025. U.S. Gulf Coast projects dominated the order pipeline, but international developments also progressed.

Energy security considerations accelerated project approvals. European countries seeking alternatives to pipeline natural gas imports increased LNG import terminal investments.

Asian demand continues expanding. Countries like China, India, and emerging Southeast Asian markets require growing natural gas imports to fuel economic development while reducing coal consumption.

Baker Hughes’ technology leadership positions the company to capture disproportionate share of LNG equipment spending. The company’s installed base creates aftermarket service opportunities spanning decades.

LNG project lifespans typically extend 20-30 years. Initial equipment sales generate follow-on revenue from maintenance, spare parts, and periodic equipment upgrades.

The Chart Industries acquisition enhances LNG capabilities. The combined company can provide integrated solutions from gas production through liquefaction, storage, and distribution.

LNG Market Opportunity | Growth Drivers |

|---|---|

U.S. Gulf Coast Projects | Export capacity expansions to serve European and Asian markets |

Middle East Developments | Qatar and UAE expanding production capacity |

African Projects | Mozambique and other nations monetizing gas reserves |

Asian Import Terminals | China, India, and Southeast Asia increasing import capacity |

Power Generation Demand from AI Data Centers

Artificial intelligence workloads drive exponential growth in data center energy requirements.

AI training and inference operations consume significantly more electricity than traditional computing applications. Large language models and other AI applications require continuous power availability.

Baker Hughes’ gas turbine technology addresses data center power needs. The company secured orders for power generation solutions targeting AI data center applications during 2025.

Behind-the-meter generation provides energy security for hyperscale data center operators. On-site power generation reduces grid dependence and provides backup capabilities during outages.

Gas turbine installations can be deployed faster than connecting to grid power infrastructure. This speed-to-market advantage appeals to data center developers racing to capture AI demand.

The data center power market exhibits different characteristics than traditional industrial markets. Customers prioritize reliability and availability over lowest initial cost, creating opportunities for premium pricing.

Baker Hughes can leverage existing turbomachinery expertise for this new application. Modest engineering adaptations enable existing product platforms to serve data center requirements.

Carbon Capture and Hydrogen Technologies

Energy transition technologies represent significant growth adjacencies.

Baker Hughes’ carbon capture capabilities include compression systems and the Chilled Ammonia Process for CO2 removal. The company is investing in CCUS technology to improve decarbonization economics.

Government incentives are improving carbon capture project economics. The U.S. Inflation Reduction Act provides substantial tax credits for carbon sequestration, while European programs offer similar support.

Baker Hughes won the Blue Point Number One low-carbon ammonia project. The facility will capture CO2 for geological storage while producing ammonia as a clean fuel and chemical feedstock.

Hydrogen infrastructure requirements create equipment opportunities. Compression, storage, and transportation systems require specialized equipment that leverages Baker Hughes’ engineering capabilities.

The company can repurpose existing industrial equipment for hydrogen applications. Gas turbines can be adapted to burn hydrogen fuel, creating retrofit opportunities within the installed base.

Industrial decarbonization mandates are tightening globally. Companies operating energy-intensive facilities must reduce emissions, driving demand for carbon capture and clean fuel technologies.

Geothermal and New Energy Technologies

Geothermal energy is experiencing renewed interest as a reliable renewable power source.

Enhanced geothermal systems employ horizontal drilling techniques similar to shale oil and gas development. Baker Hughes’ oilfield services expertise directly translates to geothermal applications.

The company secured the Fervo Energy contract to provide equipment for 300 megawatts of geothermal power generation. This project demonstrates Baker Hughes’ technical capabilities and market positioning.

Geothermal power provides baseload renewable energy. Unlike solar and wind, geothermal facilities generate consistent output regardless of weather conditions.

Drilling and completion technologies developed for oil and gas can reduce geothermal development costs. Baker Hughes’ subsurface expertise enables more efficient geothermal well construction.

Government support for clean energy accelerates geothermal development. Tax incentives and renewable energy mandates improve project economics for developers.

International Market Recovery Potential

While near-term international spending faces headwinds, longer-term fundamentals support recovery.

Global oil and gas demand continues growing driven by emerging market consumption. International energy companies must invest to maintain production from maturing fields.

Offshore developments require significant services spending. Deepwater projects in Brazil, West Africa, and Southeast Asia offer growth opportunities for Baker Hughes’ subsea technologies.

Middle East NOCs maintain ambitious production capacity expansion plans. Countries like Saudi Arabia, UAE, and Iraq continue investing despite near-term price volatility.

Natural gas monetization projects extend beyond LNG. Gas processing, NGL extraction, and petrochemical facilities create equipment opportunities for Baker Hughes’ IET segment.

International markets typically exhibit less volatility than North American shale basins. Long-cycle offshore and international projects provide more stable revenue streams.

Sustained Weakness in Upstream Oil and Gas Spending

Industry capital discipline continues constraining oilfield services demand.

Oil and gas producers prioritize shareholder returns over production growth. Companies returned record cash to investors through dividends and share buybacks rather than increasing drilling budgets.

Baker Hughes management forecasts high-single-digit percentage declines in global upstream spending for 2025. This cautious outlook reflects conversations with customers about 2026 budget plans.

North American rig counts declined throughout 2025. The U.S. rig count, particularly in gas-focused basins, fell as natural gas prices remained depressed.

Private equity-backed exploration and production companies face pressure from lenders to moderate spending. Debt covenants and return requirements limit growth capital availability.

International markets show mixed signals. While Middle East NOCs maintain spending plans, other regions face budget constraints from government fiscal pressures.

The transition from growth to returns optimization represents a fundamental industry shift. This new paradigm limits OFSE segment growth potential absent significant oil price increases.

Accelerating Energy Transition Policy Pressures

Government policies increasingly favor renewable energy over fossil fuels.

European markets implemented aggressive decarbonization targets. Countries are phasing out fossil fuel subsidies and implementing carbon pricing mechanisms.

U.S. climate policies face political uncertainty. Different administrations pursue varying levels of climate action, creating regulatory unpredictability for energy companies.

Financial institutions are restricting fossil fuel project financing. Major banks face pressure from shareholders and regulators to limit exposure to oil and gas developments.

Some institutional investors divested from fossil fuel companies. This reduces available equity capital for energy companies and their service providers.

Social license to operate erodes in some jurisdictions. Opposition to pipelines, export terminals, and production facilities slows project development.

Baker Hughes must balance traditional energy services with energy transition positioning. Over-pivoting risks alienating core oil and gas customers, while insufficient transition speed leaves the company exposed to declining markets.

Technology Disruption from Digitalization and Automation

Digital technologies are reshaping energy services business models.

Automation reduces labor requirements in oilfield operations. Remotely operated drilling rigs and automated well completions decrease services spending intensity.

Digital twins and simulation software enable customers to optimize operations internally. Some capabilities previously purchased from service companies can be developed in-house.

Software-centric business models challenge traditional equipment sales. Customers increasingly value data and insights over physical hardware.

Smaller, specialized technology companies compete for digital services budgets. These firms often demonstrate greater agility and innovation speed than large industrial conglomerates.

Cybersecurity threats grow as operations become more connected. Industrial control systems face risks from state-sponsored attacks and criminal activity targeting critical infrastructure.

Baker Hughes must continuously invest in technology innovation to maintain competitiveness. However, R&D spending reduces near-term profitability and competes with shareholder return priorities.

Supply Chain Disruptions and Inflation Pressures

Supply chain challenges persisted throughout 2025.

Component shortages affect equipment manufacturing. Semiconductor availability, specialized materials, and long-lead items create production constraints.

Tariffs and trade restrictions increase costs. Baker Hughes faces headwinds from import duties on components and finished equipment.

Labor shortages impact operations. Skilled technicians and engineers remain difficult to recruit and retain across the energy services sector.

Transportation costs elevated from pre-pandemic levels. Shipping equipment internationally and mobilizing personnel to remote project sites increased operational expenses.

Inflation affects customer spending capacity. Higher costs throughout the value chain squeeze customer economics, potentially delaying project final investment decisions.

Baker Hughes must absorb input cost increases or pass them to customers. Pricing discipline becomes challenging when market conditions weaken and competitors pursue volume over margins.

Increased Competition from National Oil Companies

National oil companies increasingly develop in-house capabilities.

Saudi Aramco, ADNOC, Petrobras, and other NOCs built internal service capabilities. This vertical integration reduces spending with external providers like Baker Hughes.

NOCs leverage their market position to negotiate aggressive pricing. Service companies face pressure to accept lower margins to maintain relationships with major customers.

Technology transfer requirements in some markets force sharing intellectual property. Joint venture structures and local content requirements expose proprietary technologies.

Geopolitical considerations affect contract awards. Government-owned customers sometimes prioritize domestic providers or politically aligned international suppliers.

Chinese oilfield services companies expand internationally. These competitors often offer attractive pricing supported by government backing and accept lower margins than Western firms.

Baker Hughes must differentiate through superior technology and service quality. Maintaining premium pricing requires demonstrable performance advantages that justify the cost differential.

Strategic Outlook for 2026 and Beyond

Baker Hughes pursues a dual strategy addressing near-term headwinds while positioning for long-term opportunities.

The company targets 20% EBITDA margins by 2028. Management plans to achieve 20% IET margins by 2026 and overall company margins of 20% by 2028.

Cost reduction initiatives continue throughout the organization. The company deployed business system improvements to drive operational efficiency and structural cost reductions.

IET segment growth remains the strategic priority. Management targets at least $40 billion in IET orders over the next three years, excluding Chart Industries’ contribution.

Portfolio management actions optimize the business mix. Baker Hughes evaluates underperforming assets for potential divestiture while acquiring capabilities in high-growth markets.

Digital transformation initiatives accelerate. The company invests in artificial intelligence, machine learning, and advanced analytics to enhance product offerings and internal operations.

Baker Hughes Financial Targets

Operating Margin Goal: 20% by 2028

IET Margin Target: 20% by 2026

IET Orders Target: $40 billion+ (2026-2028)

Free Cash Flow Conversion: 45-50%

Shareholder Returns: 60-80% of FCF

The Chart Industries integration represents a major 2026 focus. Successfully combining operations and capturing synergies is critical to delivering on acquisition promises.

Capital allocation balances growth investments with shareholder returns. Baker Hughes raised its dividend by 10% and maintains share repurchase optionality depending on market conditions.

The company maintains flexibility to adjust strategies as market conditions evolve. While committed to energy transition technologies, Baker Hughes will not sacrifice profitable traditional energy services opportunities.

My Final Thoughts

Baker Hughes occupies a unique position straddling conventional energy services and emerging transition technologies.

The company’s LNG market leadership provides exceptional long-term visibility. Record IET backlog of $32.1 billion demonstrates strong demand for the company’s equipment and services in this critical growth market.

However, OFSE segment challenges cannot be ignored. Sustained weakness in upstream spending threatens roughly half of current revenues and pressures consolidated margins.

The Chart Industries acquisition represents both opportunity and risk. If integration proceeds smoothly and synergies materialize, the combined company enhances its energy transition positioning. Execution challenges could distract management and consume financial resources without delivering projected returns.

For investors, Baker Hughes offers leveraged exposure to natural gas infrastructure and emerging energy technologies. The business model provides more stability than pure-play oilfield services companies while maintaining upside to energy market recoveries.

Valuation multiples reflect market skepticism about OFSE prospects while acknowledging IET growth potential. Investors must develop informed views on LNG market trajectory, energy transition timelines, and the company’s ability to navigate this complex landscape.

The pathway to management’s 20% operating margin target appears challenging but achievable. Success requires sustained IET growth, OFSE margin stabilization, Chart integration execution, and disciplined capital allocation.

Baker Hughes merits consideration for patient investors comfortable with energy sector volatility. The company is strategically positioning itself for long-term secular trends while managing near-term cyclical headwinds.

This positioning, if executed successfully, could generate attractive returns as the global energy landscape continues transforming.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.

Reply