- Deep Research Global

- Posts

- Databricks - SWOT Analysis (2026)

Databricks - SWOT Analysis (2026)

The data analytics and artificial intelligence (AI) sectors are experiencing unprecedented transformation, and few companies exemplify this shift better than Databricks.

As organizations worldwide grapple with increasingly complex data challenges while racing to harness AI capabilities, understanding the strategic positioning of key players becomes essential.

This comprehensive analysis examines Databricks through a strategic framework, evaluating its strengths, weaknesses, opportunities, and threats as the company approaches a potential public offering and continues its aggressive expansion.

Table of Contents

Image source: databricks.com

Understanding Databricks: Company Overview

Founded by the original creators of Apache Spark, Databricks has established itself as a pioneering force in the data lakehouse category. The company’s Data Intelligence Platform combines data lake storage, data warehouse analytics, and machine learning capabilities in a unified cloud-hosted environment. More than 20,000 organizations worldwide, including over 60% of the Fortune 500, rely on Databricks to manage their data and AI workloads. Companies like Block, Comcast, Condé Nast, Rivian, and Shell have integrated Databricks into their core data infrastructure (Databricks).

The platform addresses a fundamental challenge that enterprises face: managing diverse data types across multiple systems while enabling advanced analytics and AI applications. By unifying these capabilities, Databricks eliminates the traditional silos between data engineering, data science, and business analytics teams.

Image source: docs.databricks.com

Strengths: The Pillars of Databricks’ Market Position

Exceptional Revenue Growth and Financial Performance

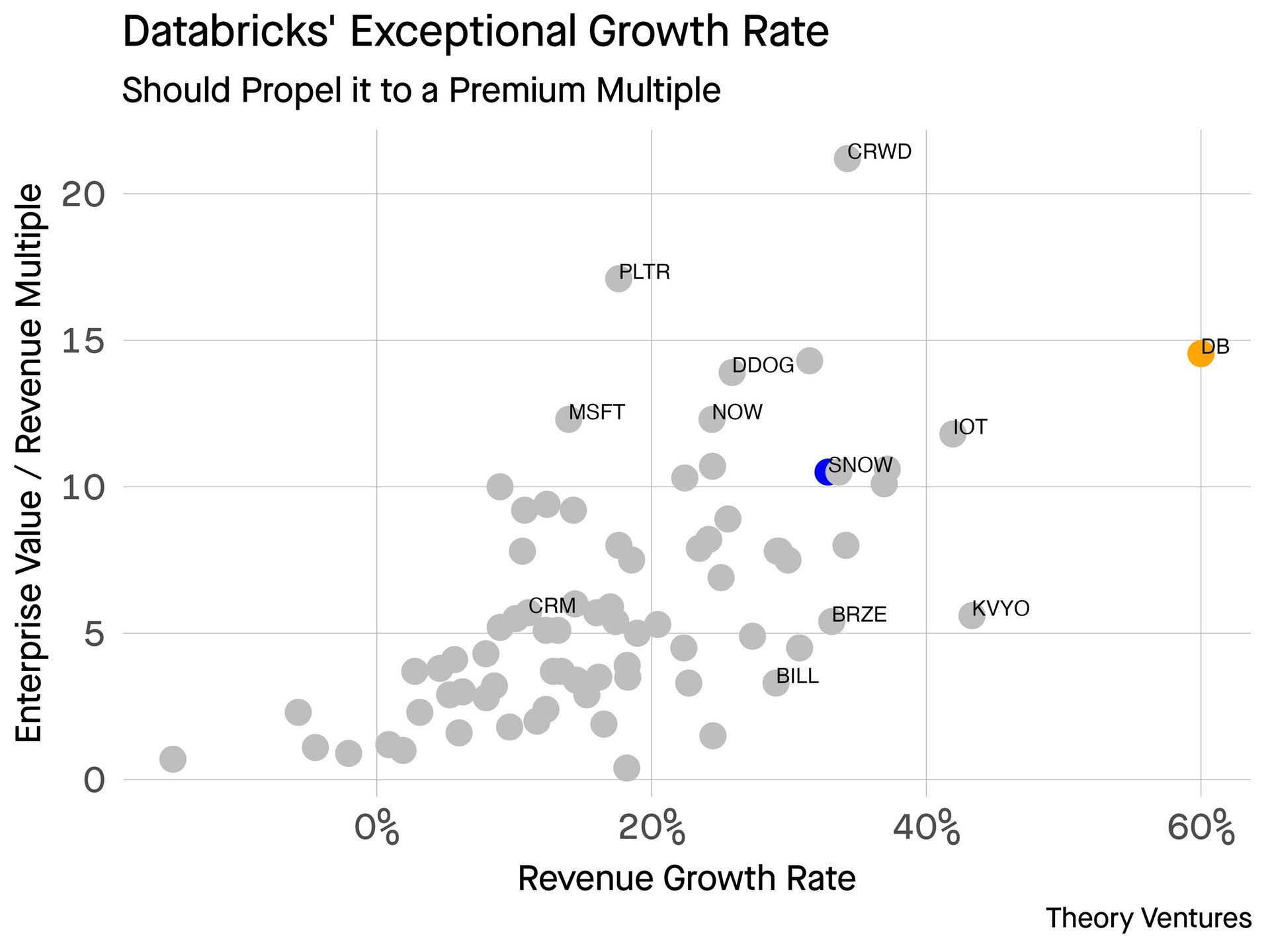

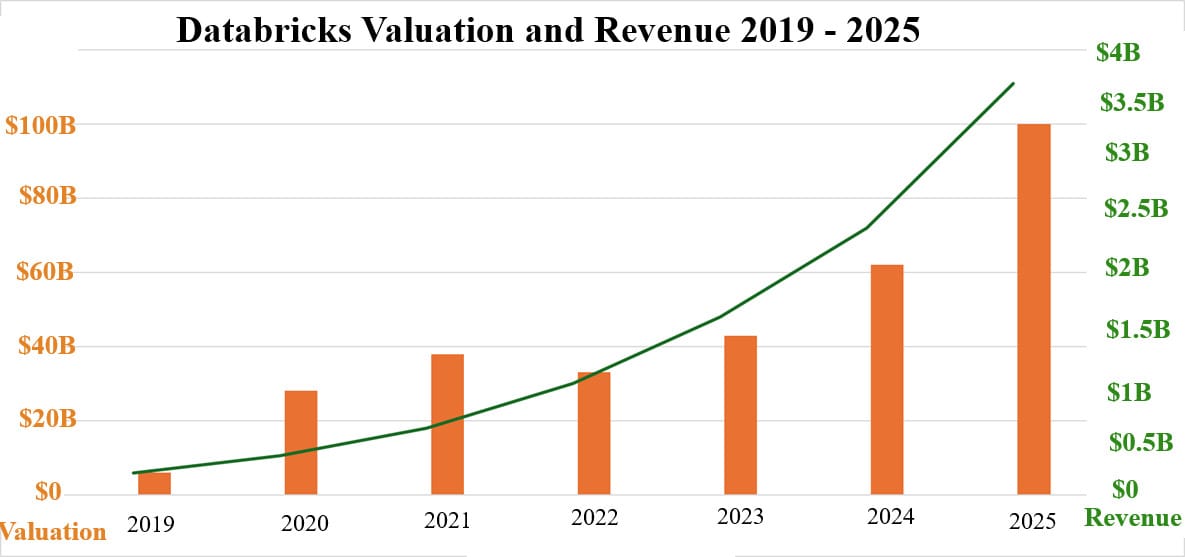

Databricks has demonstrated remarkable financial momentum that sets it apart in the enterprise software sector. The company surpassed $4 billion in annualized revenue during the second quarter of 2025, representing growth exceeding 50% year-over-year. More impressively, Databricks’ AI products alone recently crossed $1 billion in annualized revenue run-rate (Databricks).

According to Sacra’s analysis, Databricks reached $4 billion in annual recurring revenue (ARR) in August 2025, up from $3.0 billion at the end of 2024. This 57% growth rate significantly outpaces major competitors. The company maintains gross margins of approximately 80% and has achieved positive free cash flow over the last 12 months, demonstrating both scale and operational efficiency.

The company’s net retention rate exceeds 140%, indicating that existing customers are substantially increasing their spending over time. With over 650 customers consuming more than $1 million in annual revenue run-rate, Databricks has proven its ability to land and expand within enterprise accounts (Databricks).

Image source: tomtunguz.com

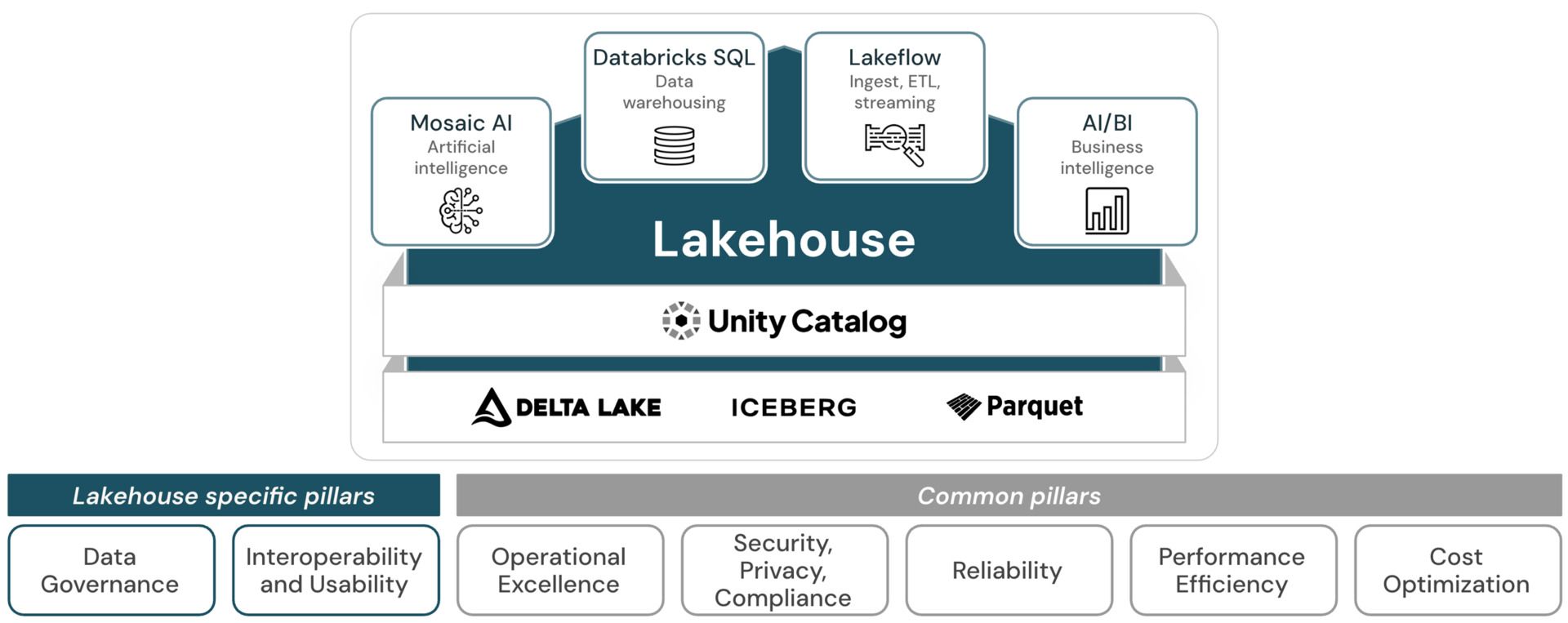

Unified Platform Architecture

The Data Intelligence Platform represents a significant competitive advantage through its architectural approach. Rather than forcing organizations to stitch together disparate tools for different workloads, Databricks provides an integrated environment that handles data engineering, analytics, and machine learning within a single platform.

At the foundation sits Delta Lake, an open-source storage layer that brings database-like reliability and performance to data lakes. Unity Catalog provides comprehensive governance, managing permissions, lineage, and metadata across all data and AI assets with fine-grained access controls (Sacra).

This unified architecture creates substantial switching costs. Once organizations build integrated data pipelines, train models, and establish governance policies on the platform, migrating to alternative solutions requires significant re-engineering effort. The consolidation also reduces operational complexity and enables faster time-to-value for data initiatives.

Strategic Cloud Provider Partnerships

Databricks has cultivated deep partnerships with all three major cloud providers: Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform (GCP). Azure Databricks, developed jointly with Microsoft, operates as a first-party service with seamless integration into the Azure ecosystem. This multi-cloud strategy provides several advantages.

First, it reduces dependence on any single hyperscaler, mitigating concentration risk. Second, it enables customers to avoid vendor lock-in by running Databricks across their cloud provider of choice. Third, these partnerships provide access to each hyperscaler’s customer base and distribution channels.

Databricks won the 2024 Google Cloud Technology Partner of the Year award for Data, Artificial Intelligence, and Machine Learning. The company has also extended its strategic partnership with Microsoft Azure and maintains strong relationships with AWS.

Leadership in AI and Machine Learning

While competitors scramble to add AI capabilities, Databricks built its platform with machine learning workloads as a core focus from inception. The company’s early investment in ML infrastructure has positioned it favorably for the current AI boom.

The acquisition of MosaicML in June 2023 for $1.3 billion significantly enhanced Databricks’ capabilities in training large language models and image generation models (Sacra). MosaicML developed tools and infrastructure that simplify and reduce the cost of training LLMs, making enterprise AI more accessible.

More recently, Databricks introduced Agent Bricks, a framework for building production-ready AI agents that can access and reason over enterprise data while maintaining governance controls. The company also announced a multiyear partnership with OpenAI, committing at least $100 million to integrate OpenAI’s latest models directly into its platform (Sacra).

Image source: market.us

Open Source Foundation and Community

Databricks’ commitment to open source provides both technical and strategic advantages. The company created and maintains several critical open-source projects including Apache Spark, Delta Lake, MLflow, and Unity Catalog. This open-source foundation enables interoperability, reduces vendor lock-in concerns, and fosters a vibrant developer community.

The open-source strategy also accelerates innovation. By making core technologies freely available, Databricks attracts contributions from developers worldwide while building mindshare and adoption. Enterprises often prefer solutions built on open standards, as they provide flexibility and reduce long-term risk.

Strong Customer Retention and Expansion

With a net retention rate exceeding 140%, Databricks demonstrates exceptional ability to grow within existing accounts. Customers typically start with specific use cases like data engineering or business intelligence, then expand into additional workloads as they consolidate their data stack onto the platform.

The consumption-based pricing model aligns incentives between Databricks and its customers. As organizations derive more value from their data and AI initiatives, their usage naturally increases without requiring new sales cycles. This model also makes Databricks accessible to companies of different sizes, as smaller organizations can start with limited workloads and scale as needed.

Weaknesses: Challenges to Address

Profitability and Operating Margins

Despite impressive revenue growth, Databricks continues to operate at a loss. The company expected operating losses of approximately $400 million in 2024 (Wing VC). While Databricks achieved positive free cash flow over the last 12 months and expects to maintain free cash flow profitability, the company remains about 20-25 percentage points behind competitor Snowflake on operating margins.

This profitability gap reflects Databricks’ aggressive investment strategy in product development, sales expansion, and strategic acquisitions. While this approach has fueled rapid growth, it creates pressure as the company approaches a potential IPO. Public market investors increasingly scrutinize the path to sustained profitability, and Databricks will need to demonstrate margin improvement while maintaining growth momentum.

Implementation Complexity and Technical Barriers

Despite efforts to broaden accessibility, Databricks remains a sophisticated platform requiring significant technical expertise to implement and optimize. Organizations with limited data engineering capabilities may struggle to realize full value from the platform, potentially limiting adoption among mid-market customers.

The platform’s power and flexibility come with a steeper learning curve compared to more simplified solutions. Data teams need expertise in Spark, SQL, Python, and various ML frameworks to fully utilize capabilities. This complexity creates implementation challenges and may slow time-to-value for some customers.

Databricks has attempted to address this through improved documentation, training programs, and the introduction of more user-friendly features like Databricks SQL for analysts. However, the fundamental challenge remains that extracting maximum value requires substantial technical investment.

Dependency on Cloud Infrastructure Providers

While partnerships with AWS, Azure, and GCP provide distribution advantages, they also create dependency risks. Databricks runs on infrastructure provided by these hyperscalers and pays them for underlying compute and storage resources. This relationship has several implications.

First, the hyperscalers could change pricing or terms in ways that impact Databricks’ economics. Second, these partners are simultaneously competitors, offering their own data platform solutions. AWS provides services like Redshift and SageMaker; Microsoft offers Azure Synapse Analytics and Azure Machine Learning; Google has BigQuery and Vertex AI.

The hyperscalers have structural advantages including zero-egress pricing for data movement within their ecosystems, tight integration with other cloud services, and the ability to bundle data platform costs into broader enterprise agreements. Managing these complex coopetition relationships requires careful strategic navigation.

Competition from Established Players

Snowflake represents Databricks’ most direct competitor, with both companies targeting enterprise data teams and offering consumption-based pricing models. According to Wing VC’s analysis, Snowflake maintains a revenue scale approximately 27% larger than Databricks and operates with significantly higher profitability.

While Databricks grows faster, Snowflake’s market position and profitability demonstrate that multiple strong players can succeed in this space. Competition has intensified as both platforms expand into each other’s core areas. Snowflake has added machine learning capabilities through Snowpark and Cortex, while Databricks has expanded analytics through Databricks SQL.

The broader competitive environment includes not only direct competitors but also the hyperscalers’ integrated offerings and emerging AI-native platforms. Each presents different challenges requiring distinct competitive responses.

Opportunities: Paths for Expansion

Operational Database Market Entry

Databricks is expanding beyond analytical workloads into the operational database market through its Lakebase offering and the acquisition of Neon, a serverless Postgres platform, for approximately $1 billion in May 2025 (Sacra). This strategic move addresses the $100 billion operational database market and enables support for real-time applications and transactional workloads alongside analytics.

The integration of operational and analytical data on a single platform eliminates traditional boundaries between OLTP (online transaction processing) and OLAP (online analytical processing) systems. This unified approach proves particularly valuable for AI applications that need access to both historical data for training and real-time data for inference.

By supporting the full spectrum of data workloads, Databricks can capture more of the total data infrastructure spend within existing customer accounts while attracting new customers who need operational database capabilities.

AI Agent Development Market

The emergence of AI agents represents a substantial expansion opportunity as organizations move beyond traditional analytics to autonomous AI systems. Enterprise AI agents require access to governed data, model serving infrastructure, and monitoring capabilities—all areas where Databricks has existing strengths.

Agent Bricks provides a framework specifically designed for building production AI agents that can access enterprise data while maintaining security and compliance controls. As AI agents become more prevalent in business processes, the consumption of compute resources for model inference and data processing is expected to grow substantially.

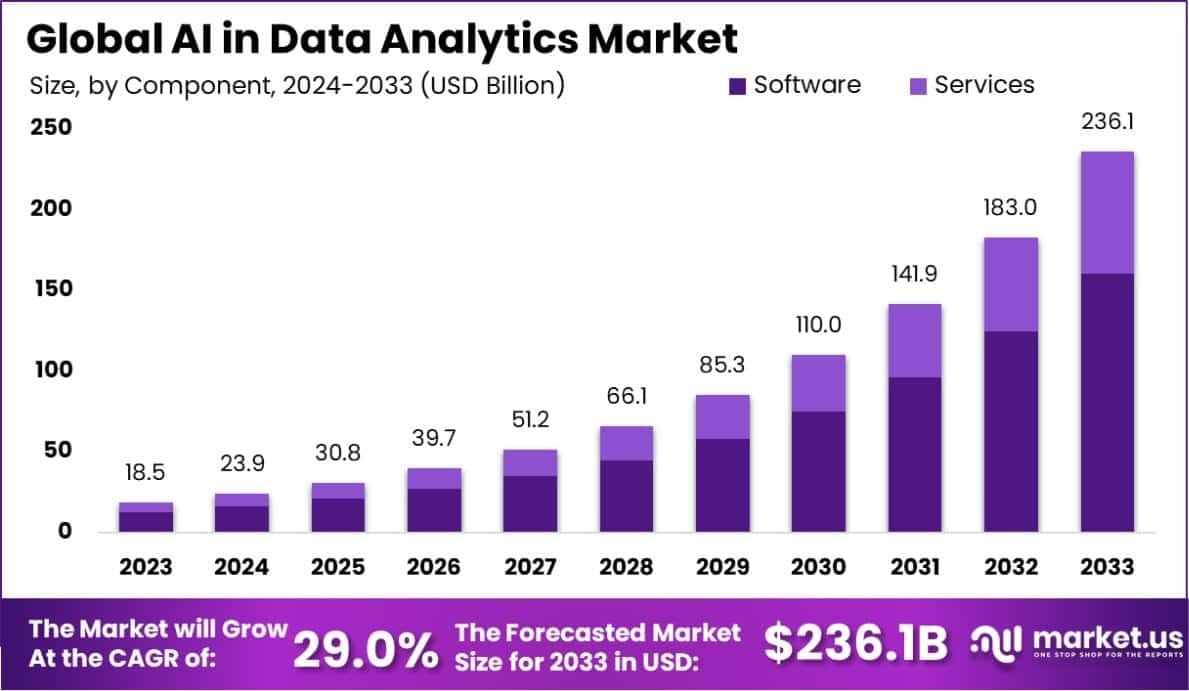

The global AI market is projected to reach $402.70 billion by 2032, exhibiting a compound annual growth rate of 25.5%. Databricks’ positioning in the AI agent development space could capture significant value from this expansion.

Vertical Industry Solutions

Databricks is developing industry-specific solutions that package platform capabilities for particular sectors including cybersecurity, financial services, and healthcare. These vertical solutions enable more effective competition against specialized vendors while commanding premium pricing for domain-specific functionality.

The approach also accelerates sales cycles by providing pre-built solutions addressing common industry use cases. Rather than requiring customers to build everything from scratch, these solutions offer templates and frameworks tailored to specific industry needs.

Partnerships with companies like SAP and Palantir create additional channels for reaching vertical markets and integrating with existing enterprise software ecosystems.

International Market Expansion

While Databricks has established strong presence in North America, significant opportunity exists for international expansion. The global data analytics market was valued at $82.23 billion in 2025 and is projected to reach $402.70 billion by 2032 (Fortune Business Insights).

Geographic expansion requires investment in local sales teams, partnerships, and compliance with regional data regulations. However, the cloud-based delivery model enables scalable international growth without significant infrastructure investment in each region. As enterprises worldwide accelerate their digital transformation initiatives, international markets represent substantial untapped potential.

Anticipated IPO and Public Market Access

Databricks is expected to pursue an initial public offering in late 2025 or early 2026 (EBC). The company closed a $1 billion Series K funding round in September 2025 at a valuation exceeding $100 billion (Databricks).

Going public would provide several strategic benefits. Access to public equity markets enables capital raising for continued expansion and acquisitions. Public market valuation can serve as currency for strategic transactions. The IPO process also creates transparency that can enhance enterprise credibility with potential customers.

However, operating as a public company brings increased scrutiny, quarterly reporting requirements, and pressure to demonstrate consistent growth and margin improvement. The timing and execution of the IPO will significantly impact Databricks’ strategic flexibility.

Image source: bigdatawire.com

Hyperscaler Platform Competition

The most significant strategic threat comes from the cloud infrastructure providers themselves. AWS, Microsoft Azure, and Google Cloud Platform each offer integrated data and AI services that compete directly with Databricks’ unified platform approach.

These hyperscalers possess structural advantages. They can offer zero-egress pricing for data movement within their ecosystems, providing economic incentives for customers to use their native services. They maintain tight integration with other cloud services that enterprises use. They can bundle data platform costs into broader enterprise agreements, potentially obscuring pricing comparisons.

Microsoft’s Fabric platform, AWS’s combination of Redshift and SageMaker, and Google’s integrated BigQuery and Vertex AI offerings each represent comprehensive alternatives to Databricks. While partnerships provide some protection—particularly the joint development of Azure Databricks—the competitive tension remains inherent in the relationship.

AI Technology Commoditization Risk

The rapid advancement of open-source AI tools and models could reduce demand for proprietary AI capabilities. If foundation models become commoditized and AI development tools become freely available, organizations might choose to build their own solutions rather than pay for an integrated platform.

The democratization of AI technology presents a double-edged sword. While it expands the market by making AI more accessible, it also potentially reduces differentiation for platform providers. Databricks must continually innovate to provide value beyond what organizations can achieve with freely available tools.

The company’s strategy of combining open-source foundations with proprietary governance, security, and enterprise features helps address this risk. However, maintaining sustainable competitive differentiation requires ongoing investment in capabilities that justify platform premium pricing.

Economic Downturn and IT Budget Pressures

Economic uncertainty and potential recession could pressure enterprise IT budgets, impacting growth rates across the sector. While Databricks’ consumption-based model provides some flexibility—customers can scale usage down if needed—prolonged economic challenges could slow new customer acquisition and expansion within existing accounts.

The company’s focus on AI and data analytics positions it favorably, as these areas often receive prioritization even during budget constraints due to their potential to drive efficiency and competitive advantage. However, Databricks is not immune to broader macroeconomic trends affecting enterprise software spending.

Data Privacy and Regulatory Compliance

As data regulations become more stringent globally, compliance requirements increase in complexity. Databricks must ensure its platform meets evolving standards including GDPR in Europe, CCPA in California, and various industry-specific regulations. Failure to maintain compliance could result in customer losses, legal liabilities, and reputational damage.

The company’s Unity Catalog provides governance capabilities designed to address these requirements, but regulatory landscapes continue to evolve. International expansion compounds this challenge, as each jurisdiction may impose different requirements for data handling, storage, and processing.

Talent Competition and Retention

Success in the data and AI platform market depends heavily on attracting and retaining top technical talent. Databricks competes for engineers, data scientists, and researchers with major technology companies, well-funded startups, and the hyperscalers themselves.

The company has made significant investments in talent acquisition, including signing new office leases in San Francisco and Sunnyvale to attract top AI talent. Recognition as one of Fortune’s Best Workplaces in Technologysupports recruitment efforts. However, maintaining competitive compensation packages and compelling career opportunities requires ongoing investment and attention.

Strategic Outlook for 2026 and Beyond

Databricks enters 2026 from a position of considerable strength. The company has achieved remarkable revenue growth, crossed the $4 billion ARR threshold, and established itself as a leader in the data lakehouse category. The platform’s unified architecture, strong customer retention, and favorable positioning for AI workloads provide a solid foundation.

However, significant challenges remain. The company must demonstrate a clear path to sustained profitability while maintaining growth momentum. Managing complex relationships with hyperscaler partners who are simultaneously collaborators and competitors requires sophisticated strategic navigation. Competition from both established players like Snowflake and emerging AI-native platforms continues to intensify.

The opportunities ahead are substantial. Expansion into operational databases through Lakebase and the Neon acquisition opens new market segments. The emergence of AI agents creates demand for exactly the type of integrated, governed data platform that Databricks provides. Vertical solutions and international expansion offer additional growth vectors.

As the company approaches its anticipated IPO, execution becomes paramount. Successfully transitioning to public company status while continuing to invest in product innovation, expanding the customer base, and improving operational efficiency will determine whether Databricks can sustain its impressive trajectory.

The data and AI markets remain in early stages of a multi-decade transformation. Organizations worldwide continue to recognize that competitive advantage increasingly depends on effectively using data and artificial intelligence. Databricks has positioned itself at the center of this transformation, building infrastructure that enterprises will rely on for years to come.

Whether the company can fully capitalize on this opportunity depends on navigating the complex interplay of technological innovation, market competition, strategic partnerships, and operational execution. The strategic analysis presented here provides a framework for understanding both the promise and the challenges that lie ahead.

Reply