- Deep Research Global

- Posts

- JPMorgan Chase - SWOT Analysis (2026)

JPMorgan Chase - SWOT Analysis (2026)

JPMorgan Chase & Co. stands as a financial titan on the global stage, commanding $4.6 trillion in assets as of September 2025.

As the world’s fifth-largest bank and America’s most valuable financial institution, JPMorgan Chase has demonstrated remarkable resilience through economic cycles, regulatory changes, and technological disruptions.

With the financial sector facing unprecedented challenges from digital transformation, economic uncertainty, and evolving consumer expectations, understanding the bank’s strategic position becomes critical for investors and industry analysts.

This comprehensive SWOT analysis examines JPMorgan Chase’s competitive advantages, internal challenges, growth opportunities, and external threats as the institution positions itself for sustained leadership.

Table of Contents

Image source: jpmorganchase.com

Strengths: The Pillars of Financial Dominance

Unparalleled Market Position and Financial Scale

JPMorgan Chase has solidified its position as the undisputed leader in American banking, with a market capitalization exceeding €739.27 billion as of November 2025. The bank’s dominance extends beyond mere size. Its total assets reached $4.56 trillion by June 2025, representing an 8.32% year-over-year increase. This scale provides significant competitive advantages through economies of scope, enhanced bargaining power with vendors, and the ability to weather economic downturns better than smaller competitors.

The firm’s financial performance demonstrates operational excellence across all business segments. For the third quarter of 2025, JPMorgan Chase reported net income jumping 12% year-over-year despite market challenges. The Commercial & Investment Bank segment alone generated $6.9 billion in net income, a 21% increase compared to Q3 2024, with revenue rising 17% during the same period. These numbers reflect not just strong market conditions but also the bank’s ability to capitalize on opportunities across diverse revenue streams.

Perhaps most remarkably, JPMorgan’s market value surpasses that of its three largest competitors combined. With Bank of America valued at $344 billion, Citigroup at $168 billion, and Wells Fargo trailing behind, JPMorgan’s nearly $800 billion market capitalization represents a commanding lead that speaks to investor confidence in the bank’s strategic direction and execution capabilities.

Diversified Revenue Streams and Business Model Resilience

JPMorgan Chase operates through four major business segments, each contributing substantially to overall performance. This diversification protects the bank from sector-specific downturns and creates multiple pathways for growth. The Consumer & Community Banking division serves 84 million customers, while the Asset & Wealth Management arm manages trillions in client assets. The Corporate & Investment Bank maintains leadership positions in both debt and equity underwriting, and the Commercial Banking segment serves businesses of all sizes.

J.P. Morgan Payments exemplifies this strength, delivering $4.9 billion in Q3 2025 revenue, up 13% year-over-year, with major client wins and participation in marquee events. This payments business alone would rank among the top fintech companies globally if it were standalone. The division’s success demonstrates how JPMorgan leverages its massive customer base and technological infrastructure to capture value across the financial ecosystem.

The bank’s 2024 annual performance set new records, with full-year profits reaching $58 billion—the highest in American banking history. For the final quarter of 2024 alone, the bank generated $14 billion in profits, showcasing consistent execution quarter after quarter. This financial strength provides resources for continued investment in technology, talent, and market expansion.

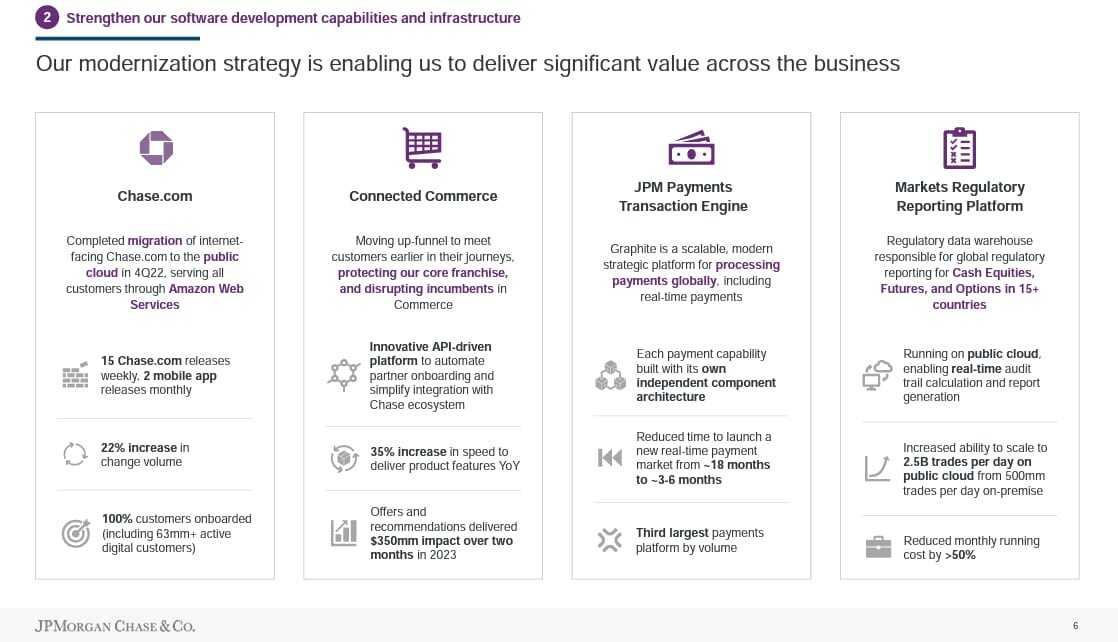

Technology Leadership and AI Innovation

JPMorgan Chase has emerged as the banking industry’s technology leader, with a $18 billion technology investment planned for 2025—the highest ever from any financial firm. This massive commitment reflects the bank’s understanding that technological superiority translates directly into competitive advantages in operational efficiency, customer experience, and product innovation.

The bank’s AI strategy has moved well beyond experimentation into full-scale deployment. JPMorgan ranks number one on the 2025 Evident AI Index for AI maturity among global banks, and the firm was named world’s best AI bank at The Digital Banker’s AI Innovation Awards. The bank now operates over 1,000 AI and machine learning applications across its operations, from fraud detection to trading algorithms to customer service.

In 2024, J.P. Morgan Payments launched Turbo, an AI testing platform for financial institutions that transforms payment processing. Meanwhile, the bank has begun deploying agentic AI to handle complex multi-step tasks for employees, representing early progress in its blueprint to become the first fully AI-powered megabank. These initiatives reduce costs, improve accuracy, and free human employees to focus on higher-value activities.

The bank’s digital platforms have also achieved market leadership. J.P. Morgan Access and Chase Connect both secured number one positions in the 2024 Coalition Greenwich Digital Transformation Benchmarking Study, reflecting superior user experience and functionality. With 84 million customers increasingly accessing services through digital channels, these platform advantages translate directly into customer satisfaction and retention.

Global Investment Banking Dominance

JPMorgan maintains its position as the world’s largest investment bank, operating comprehensive capabilities across mergers and acquisitions advisory, equity and debt underwriting, and trading operations. The firm’s deep relationships with corporate clients, governments, and institutional investors provide consistent deal flow even during market downturns.

Global dealmaking activity has shown strong momentum, with M&A volumes up 27% and IPO market volumes climbing around 12% compared to the previous year. JPMorgan’s advisory teams have participated in many of the largest and most complex transactions globally, including cross-border megadeals requiring sophisticated structuring and regulatory navigation.

The investment banking division’s performance reflects this market leadership. Revenue from the Commercial & Investment Bank grew 17% year-over-year in Q3 2025, with particularly strong results in advisory and underwriting fees. This performance demonstrates the bank’s ability to capture market share during recovery periods while maintaining profitability through all market conditions.

Strong Capital Position and Financial Resilience

JPMorgan Chase maintains one of the strongest capital positions in global banking, with $360 billion in stockholders’ equity as of September 30, 2025. This robust capital base exceeds regulatory requirements by comfortable margins, providing flexibility for growth investments, shareholder returns, and crisis absorption.

The bank’s fortress balance sheet proved its value during previous financial crises and continues to differentiate JPMorgan from competitors. This financial strength enables the bank to take advantage of distressed asset opportunities, acquire struggling competitors, and maintain lending capacity during economic downturns when credit becomes scarce. Customers and counterparties recognize this stability, often preferring to work with JPMorgan during uncertain times, which reinforces the bank’s market position.

Weaknesses: Internal Challenges and Vulnerabilities

Regulatory Compliance Burden and Legal Costs

Despite its operational excellence, JPMorgan Chase faces ongoing regulatory challenges that consume significant management attention and financial resources. The bank has paid more than $40 billion in total fines and settlements to regulators, enforcement agencies, and lawsuits as of November 2024. This substantial figure reflects both the bank’s massive scale—which creates more potential compliance touchpoints—and historical issues with risk management systems.

In March 2024, the bank faced $348.2 million in penalties from U.S. bank regulators for inadequate trade monitoring programs. The OCC found that JPMorgan failed to surveil billions of instances of trading activity on at least 30 global trading venues, representing significant gaps in compliance infrastructure. The Federal Reserve simultaneously imposed approximately $98.2 million in additional fines for related issues.

More recently, JPMorgan faces dual compliance pressures, including a German anti-money laundering fine and a U.S. debanking investigation. These ongoing challenges test the bank’s franchise resilience amid regulatory and political scrutiny. In November 2024, two JPMorgan affiliates agreed to pay $151 million to settle five separate enforcement actions for misleading disclosures, demonstrating that compliance issues span multiple business lines and jurisdictions.

These regulatory challenges create multiple problems beyond immediate financial costs. They damage the bank’s reputation, distract senior management from strategic initiatives, and potentially limit business expansion into certain product lines or geographies. Each enforcement action requires remediation efforts that can take years and cost hundreds of millions in systems upgrades and additional compliance personnel.

JPMorgan’s enormous scale, while providing competitive advantages, also creates organizational challenges. Operating across more than 60 countries with approximately 250,000 employees requires complex management structures, extensive coordination mechanisms, and sophisticated information systems. This complexity can slow decision-making, reduce agility, and make it difficult to implement changes consistently across the organization.

The bank’s 2024 Annual Report acknowledges supervision and regulation as potential business risks that could impact operations and market position. The regulatory framework governing “systemically important financial institutions” imposes higher capital requirements, stress testing obligations, and operational restrictions that smaller competitors avoid. These “too big to fail” designations, while providing implicit government backing during crises, also limit strategic flexibility and increase compliance costs.

Cultural integration across acquired entities and diverse business lines presents ongoing challenges. Each business segment—consumer banking, investment banking, asset management, and commercial banking—traditionally operates with distinct cultures, risk appetites, and performance metrics. Maintaining cohesion while preserving the entrepreneurial spirit needed for innovation requires constant management attention and can sometimes lead to internal friction or missed opportunities for collaboration.

Technology Legacy Systems and Modernization Needs

Despite industry-leading technology investments, JPMorgan operates significant legacy infrastructure that dates back decades. The bank runs thousands of applications built on older technology stacks, with some critical systems still relying on mainframe computers and programming languages like COBOL. While these systems have proven reliable, they limit agility, increase maintenance costs, and make integration with modern technologies challenging.

JPMorgan’s technology modernization budget reached approximately $3 billion in 2024, representing ongoing efforts to replace or upgrade legacy systems. However, modernization programs in banking face unique challenges. Systems must maintain continuous operation—banks cannot simply shut down for major upgrades—and regulatory requirements mandate extensive testing and documentation for any changes to core systems.

The complexity of these modernization efforts creates execution risks. Each system replacement or upgrade risks service disruptions, data migration errors, or unforeseen compatibility issues with dependent systems. These risks explain why many banks, including JPMorgan, pursue gradual modernization strategies rather than wholesale replacements, but gradualism extends timelines and perpetuates inefficiencies.

Dependence on Net Interest Income

Like all traditional banks, JPMorgan’s profitability depends significantly on net interest income—the spread between interest earned on loans and interest paid on deposits. This revenue source faces pressure from multiple directions in 2025. The Federal Reserve has cut interest rates by 25 basis points, bringing the funds rate to 4.0-4.25%, with market expectations pointing toward additional cuts. Lower rates compress net interest margins, reducing the profitability of the bank’s massive loan portfolio.

JP Morgan Research currently predicts a 40% chance of U.S. recession by the end of 2025, down from a previous 60% estimate but still representing significant risk. Recession would likely trigger additional rate cuts, increased loan defaults, and reduced loan demand—all negative for net interest income. The bank’s size magnifies this vulnerability, as even small margin compression across trillions in assets translates to billions in reduced revenue.

Competition for deposits intensifies during rate cut cycles, as customers seek higher yields. The proliferation of digital-first banks and fintech companies offering attractive savings rates puts pressure on JPMorgan’s deposit costs, further squeezing margins. While the bank’s deposit franchise remains strong, maintaining deposit levels without increasing interest expense requires careful balance.

Opportunities: Pathways for Continued Growth

Artificial Intelligence and Digital Transformation

JPMorgan Chase stands at the forefront of AI adoption in financial services, with opportunities to expand these capabilities dramatically. The bank’s AI testing platform Turbo and deployment of agentic AI represent early stages of what could become complete automation of routine banking operations. Expanding AI across customer service, underwriting, risk management, and trading could generate billions in cost savings while improving service quality.

The shift toward agentic AI—systems capable of autonomous decision-making and complex task completion—offers particular promise. JPMorgan has begun deploying these capabilities to handle multi-step processes that previously required human intervention. As these systems prove their reliability, expanding their use could fundamentally transform how the bank operates, potentially reducing headcount needs while increasing processing speed and accuracy.

AI also creates revenue opportunities through new products and services. The bank could license its AI platforms to other financial institutions, monetizing its significant R&D investments. AI-enhanced investment products, personalized financial advice delivered at scale, and predictive banking services that anticipate customer needs before they arise all represent potential new revenue streams. With hyperscalers spending roughly $300 billion on AI infrastructure in 2025—a 40% increase over last year—the ecosystem supporting advanced AI applications continues maturing rapidly.

Geographic and Market Expansion

Despite its global presence, JPMorgan continues finding expansion opportunities in both developed and emerging markets. The bank entered 10 new markets in 2024, opened approximately 150 new branches, and made multi-billion dollar investments in its branch network. This physical expansion targets underserved communities, including low-to-moderate income and rural areas with limited access to traditional banking services.

Emerging markets present substantial growth potential despite near-term challenges. JPMorgan analysis projects emerging markets will show resilience with 4.0% growth in 2025, maintaining a 2.0% growth advantage over developed economies by Q4 2025. Countries with growing middle classes, increasing digital adoption, and liberalizing financial regulations offer opportunities to establish market positions before competition intensifies.

Asia-Pacific markets deserve particular attention. M&A activity rebounds signal opportunities for investment banking expansion, while wealth management services face increasing demand from newly affluent populations. China’s economy, despite recent challenges, continues generating millionaires and billionaires who need sophisticated financial services. India’s rapid economic growth and digital infrastructure development create opportunities across all banking segments.

The bank’s Chase brand expansion strategy also targets specific demographic groups underserved by traditional banking. Younger customers, gig economy workers, and small business owners often need banking solutions different from legacy offerings. Developing targeted products and services for these segments could capture significant market share from both traditional competitors and fintech challengers.

Wealth Management and Asset Management Growth

JPMorgan’s Asset & Wealth Management division manages trillions in client assets, but penetration remains low relative to total addressable market. The global wealth management industry continues consolidating, with clients preferring integrated solutions from large, trusted institutions. JPMorgan’s brand strength, technological capabilities, and comprehensive product suite position it advantageously to capture market share.

Assets under management increased 18% in Q2 2025, reflecting both market appreciation and net new client assets. This growth trajectory could accelerate as baby boomers transition retirement savings into drawdown phases, requiring sophisticated wealth management advice. The largest intergenerational wealth transfer in history is currently underway, with trillions passing from older to younger generations who may seek different relationships with financial institutions than their parents maintained.

Private banking services for ultra-high-net-worth individuals represent particularly attractive opportunities. These clients require complex services spanning tax planning, estate management, philanthropic giving, and alternative investments. JPMorgan’s ability to deliver comprehensive solutions through integrated teams combining private bankers, investment advisors, and lending specialists creates sticky relationships with high lifetime value.

The firm’s strength in alternative investments also positions it to capitalize on growing institutional appetite for private markets. Private market dealmaking related to AI exceeded $140 billion in 2024 versus $25 billion the previous year, demonstrating rapid growth in sectors where JPMorgan maintains significant expertise. Building out alternative investment platforms accessible to qualified wealth management clients could generate substantial management fees while deepening client relationships.

Infrastructure and Climate Finance

JPMorgan’s $1.5 trillion Security and Resiliency Initiative announced in October 2025 represents massive opportunity to finance critical infrastructure projects. The initiative includes up to $10 billion in direct equity investments addressing pressing needs in areas ranging from energy and communications infrastructure to supply chain security and national defense manufacturing.

Climate finance represents a particularly large opportunity. Governments worldwide have committed trillions toward renewable energy, grid modernization, and climate adaptation infrastructure. JPMorgan’s capital markets capabilities, project finance expertise, and global reach position it to capture significant advisory and financing fees from these projects. The bank has committed to facilitating substantial green financing, aligning business opportunities with environmental responsibility.

Energy transition financing alone could generate decades of advisory work and lending opportunities. Traditional energy companies need financing for transitions toward cleaner operations, while renewable energy developers require project financing for solar, wind, and battery storage installations. The intersection of AI and energy also creates opportunities, as data centers supporting AI development require massive electrical infrastructure investments that JPMorgan is well-positioned to finance.

Infrastructure investment extends beyond energy. America’s aging transportation infrastructure, water systems, and telecommunications networks require hundreds of billions in upgrades and replacements. The bank’s commercial banking and investment banking teams can structure public-private partnerships, advise on project selection, and arrange financing for these long-term capital projects.

Payments and Fintech Partnerships

J.P. Morgan Payments’ strong performance—$4.9 billion in Q3 2025 revenue, up 13% year-over-year—demonstrates the value of the bank’s payments infrastructure. Opportunities exist to expand these capabilities through strategic partnerships, technology licensing, and new product development.

Digital innovation is transforming cross-border payments through API advancements, improved transparency, virtual account solutions, and blockchain-based settlement systems. JPMorgan’s blockchain platform already processes hundreds of billions in transactions annually and could expand to capture more international payment flows. Cross-border payments remain relatively expensive and slow compared to domestic transfers, creating opportunities for disruptive innovations.

Rather than viewing fintech companies solely as competitors, JPMorgan increasingly partners with innovative startups to deliver enhanced capabilities to customers. These partnerships allow the bank to offer cutting-edge features while avoiding some risks associated with in-house development. Strategic investments in fintech companies also provide windows into emerging technologies and potential acquisition targets as markets mature.

Real-time payments infrastructure represents another growth area. As consumers and businesses demand instant payment settlement, JPMorgan’s investments in real-time payment capabilities position it to capture processing fees and related services. The shift from batch processing to real-time settlement also changes working capital dynamics, creating opportunities for new credit products and treasury management services.

Threats: External Risks and Challenges

Intensifying Competition from Multiple Directions

JPMorgan faces competition from traditional banks, fintech startups, big tech companies, and even non-financial corporations entering banking services. The competitive landscape grows more complex as boundaries between financial and technology companies blur. Each competitor category presents distinct challenges requiring different defensive strategies.

Bank of America, Citigroup, and Wells Fargo remain JPMorgan’s primary traditional competitors, though the firm’s market value advantage provides significant breathing room. More concerning is the emergence of digitally native challengers unconstrained by legacy infrastructure. Companies like Chime, SoFi, and Robinhood target specific customer segments with superior user experiences and lower fees, potentially eroding JPMorgan’s customer base from the edges.

Big tech companies pose perhaps the most significant competitive threat. Apple, Google, Amazon, and other technology giants possess enormous customer bases, superior technology platforms, and strong brand loyalty. These companies increasingly offer financial services—payment processing, lending, savings accounts—directly competing with traditional banks. Their ability to integrate financial services into existing ecosystems creates powerful network effects that traditional banks struggle to match.

JPMorgan recently hustled Plaid for deals in bitter fights over data access, illustrating tensions between banks and fintech aggregators. These conflicts pose real potential threats to the financial industry’s ability to control customer relationships. As regulators potentially mandate open banking standards, JPMorgan could lose exclusive access to customer data that currently provides competitive moats.

Cybersecurity Threats and Technology Risks

Cybersecurity risks pose evolving threats to financial stability, with cyber incidents becoming more frequent and sophisticated. JPMorgan operates one of the largest technology infrastructures in the financial sector, creating an enormous attack surface for malicious actors. The bank’s 2024 Annual Report acknowledges cyber attacks—both directly on the bank and on critical infrastructure like energy and communications—as significant risks.

The financial sector faces particular vulnerability because successful attacks yield direct financial rewards for criminals. Ransomware attacks on financial institutions, sophisticated phishing campaigns targeting customers, and attempts to manipulate trading systems represent constant threats requiring vigilant defense. JPMorgan invests billions in cybersecurity, but determined attackers continuously develop new techniques and exploit newly discovered vulnerabilities.

Third-party risks compound these challenges. JPMorgan’s CISO warns that SaaS security represents rising risks for financial institutions. The bank relies on hundreds of technology vendors and service providers, each potentially introducing security vulnerabilities. A breach at any critical vendor could compromise JPMorgan’s systems or data, creating reputational damage and regulatory consequences even though the vulnerability originated externally.

AI can enhance threat detection, allowing organizations to swiftly neutralize threats, but adversaries also leverage AI to create more sophisticated attacks. AI-generated phishing emails appear increasingly legitimate, automated vulnerability scanning accelerates attack deployment, and machine learning systems can identify patterns in defensive measures to develop evasion techniques. This technological arms race between attackers and defenders continues escalating.

Image source: constellationr.com

Economic Uncertainty and Recession Risks

Despite recent probability reductions, JP Morgan Research maintains a 40% chance of U.S. and global recession occurring in 2025. Economic downturns create multiple challenges for banks. Loan defaults increase, reducing net interest income and requiring higher provisions for credit losses. Investment banking activity typically declines during recessions as companies delay mergers, acquisitions, and capital raises. Trading revenues face pressure as market volatility—while sometimes beneficial short-term—generally indicates underlying stress that reduces client activity.

Federal Reserve interest rate policy adds complexity to economic planning. Rate cuts benefit borrowers but compress net interest margins for banks. JPMorgan’s massive loan portfolio faces repricing risks as fixed-rate assets roll over at lower rates while deposit costs may prove sticky. The Fed has already cut rates to 4.0-4.25%, with market expectations pointing toward additional reductions. Each quarter-point cut reduces potential interest income by hundreds of millions annually given the bank’s asset scale.

Global economic divergence creates additional challenges. While the U.S. economy shows resilience, other regions face distinct pressures. Emerging markets growth is expected to slow to 3.4% in 2025 from 4.1% in 2024 according to JPMorgan predictions. Trade tensions, currency volatility, and capital flow disruptions could create losses in international operations even as domestic business remains strong. Managing this geographic complexity requires sophisticated risk management and potentially limits expansion opportunities in affected regions.

Commercial real estate exposure represents another economic risk factor. Many banks, including JPMorgan, maintain significant commercial real estate loan portfolios. The shift toward remote work has reduced demand for office space, while higher interest rates have depressed property values and made refinancing difficult for borrowers. While JPMorgan’s diversification limits this exposure relative to regional banks, any severe commercial real estate downturn would impact loan performance and require increased loss reserves.

Regulatory Changes and Political Uncertainty

Banking regulation remains in flux, with potential changes from both domestic and international regulators. Basel III Endgame rules, currently under consideration, could require additional capital for large banks like JPMorgan. Any increase in capital requirements forces the bank to hold more equity relative to assets, reducing return on equity and potentially limiting lending capacity.

Political uncertainty in the United States and globally creates regulatory unpredictability. Different administrations and political parties maintain distinct philosophies regarding financial regulation, ranging from strict oversight emphasizing consumer protection and systemic risk reduction to lighter touch approaches prioritizing economic growth and competitiveness. This variability makes long-term strategic planning challenging, as rules governing permissible activities, capital requirements, and enforcement priorities can shift substantially with election results.

Congressional investigations into “debanking”—allegations that banks close accounts based on customers’ political views or lawful but controversial business activities—illustrate how banking can become entangled in political disputes. While maintaining robust compliance programs remains essential, banks face criticism from both sides of these debates, with some accusing them of excessive caution that limits access to banking services and others arguing they enable harmful activities.

International regulatory coordination creates additional complexity. JPMorgan operates across dozens of jurisdictions, each with distinct regulatory frameworks and enforcement approaches. Divergence between U.S. and European regulations regarding capital requirements, privacy protection, or anti-money laundering standards creates compliance challenges and limits the bank’s ability to operate uniformly across geographies. Maintaining compliance across all jurisdictions requires substantial resources and limits operational efficiency.

As America’s largest bank, JPMorgan faces intense scrutiny regarding its social and environmental impacts. Any perceived failure to meet stakeholder expectations—whether customers, employees, investors, or society broadly—creates reputational damage that can translate into business losses. The bank’s $40 billion in fines and settlements demonstrates how past missteps create lasting skepticism about corporate culture and priorities.

Environmental, social, and governance (ESG) expectations continue rising. Investors increasingly demand transparency regarding climate-related risks and transition plans. Customer surveys show growing preferences for banking with institutions aligned with personal values. Employees, particularly younger workers, expect employers to demonstrate commitment to social responsibility beyond profit maximization. Meeting these expectations requires authentic commitment backed by measurable actions, not merely public relations messaging.

Climate finance presents particular reputational challenges. JPMorgan faces criticism from environmental advocates for financing fossil fuel projects while simultaneously facing pressure from energy-dependent communities concerned about economic impacts of rapid transition. Navigating these conflicting pressures while maintaining profitable relationships with clients across the energy spectrum requires careful balance and clear communication about the bank’s principles and decision-making frameworks.

Workforce diversity and inclusion have become reputational imperatives. Banks historically struggled with representation of women and minorities in senior leadership positions. Addressing these gaps requires sustained effort in recruitment, development, promotion, and retention of diverse talent. Any perception of backsliding or insufficient progress creates negative publicity and potentially impacts the bank’s ability to attract top talent, particularly from younger generations who prioritize workplace diversity.

Strategic Positioning for 2026 and Beyond

JPMorgan Chase enters 2026 from a position of considerable strength, backed by unmatched financial resources, technological capabilities, and market positions. However, the banking industry faces transformation as profound as any period in its history. The intersection of artificial intelligence, changing customer expectations, regulatory evolution, and economic uncertainty creates both tremendous opportunities and significant risks.

The bank’s strategic priorities center on maintaining leadership through technology investment, expanding high-value business segments like wealth management and payments, improving operational efficiency through AI deployment, and carefully navigating regulatory requirements while serving customers effectively. Success requires balancing competing pressures: investing for the future while maintaining current profitability, innovating rapidly while managing risks prudently, and serving diverse stakeholder needs while maintaining financial discipline.

JPMorgan’s scale provides advantages but also creates vulnerabilities. The bank’s success depends not just on executing its own strategy but on maintaining trust with regulators, customers, and the broader public. As financial services evolve, JPMorgan must demonstrate that large, established institutions can match the innovation speed of fintech challengers while providing the stability and reliability that only scale and experience enable.

The next several years will test whether JPMorgan can maintain its market leadership through industry transformation. The bank possesses the resources and capabilities required for success, but execution challenges should not be underestimated. For investors, customers, and industry observers, JPMorgan Chase represents both the current pinnacle of traditional banking and a test case for whether established institutions can successfully navigate the transition to a digitally-driven, AI-enabled financial services future.

Reply