- Deep Research Global

- Posts

- Netflix SWOT Analysis (2026): A Comprehensive Strategic Assessment

Netflix SWOT Analysis (2026): A Comprehensive Strategic Assessment

The streaming entertainment industry has undergone seismic shifts over the past decade, and at the center of this transformation stands Netflix, the company that revolutionized how millions of people consume content.

As we approach 2026, understanding Netflix's strategic position through a comprehensive SWOT analysis becomes essential for investors, industry analysts, and business enthusiasts who want to grasp where this entertainment giant is headed.

With a market capitalization of $527.48 billion as of October 2025, Netflix has firmly established itself as the 18th most valuable company globally.

The streaming leader generated $39 billion in revenue in 2024, representing a 15.7% year-over-year increase, while serving 301.6 million paid subscribers worldwide.

However, the path forward presents both remarkable opportunities and significant challenges that will shape the company's trajectory through 2026 and beyond.

Table of Contents

Understanding Netflix's Current Market Position

Before diving into the SWOT framework, it's crucial to understand where Netflix stands today. The company reported strong Q3 2025 results, with revenue growing 17% year-over-year to $11.51 billion and net income reaching $2.55 billion ($5.87 per share). The streaming platform now captures approximately 8% of total TV viewing time and 20% of streaming time in the United States, cementing its position as the industry leader.

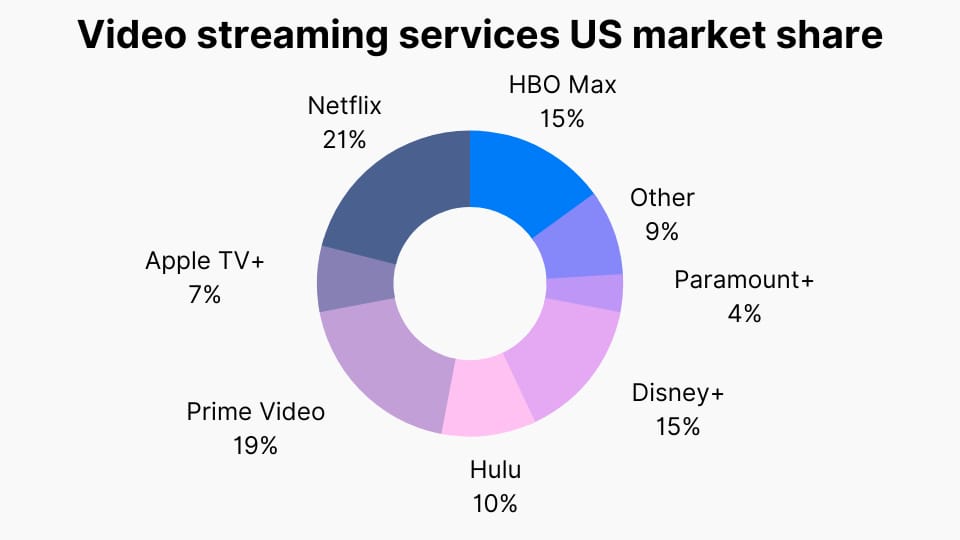

The competitive arena has intensified considerably, with Amazon Prime Video and Netflix in a two-horse race for market dominance. Amazon Prime Video commands 22% of the US market, while Netflix holds 21%, followed by Max at 13% and Disney+ at 12%. This tight competition underscores the importance of strategic decision-making for Netflix's continued success.

Strengths: The Foundation of Netflix's Market Leadership

Global Brand Recognition and Market Dominance

Netflix's most powerful strength lies in its unparalleled brand recognition and established market position. The company operates in over 190 countries, making it one of the most globally recognized entertainment brands. This worldwide presence provides Netflix with economies of scale that few competitors can match, allowing the company to spread content costs across a massive subscriber base.

The platform's 68.8% stock return over the past year and 14.84% revenue growth demonstrate strong investor confidence and operational excellence. Netflix has achieved a perfect Piotroski Score of 9, indicating exceptional financial health and robust operational performance.

Content Library and Original Programming Excellence

Netflix's content strategy remains a cornerstone of its competitive advantage. The company invested $16 billion on content in 2024, a $3 billion increase from 2023, and plans to spend $18 billion in 2025 with CFO Spencer Neumann stating they are "not anywhere near a ceiling" for content investment.

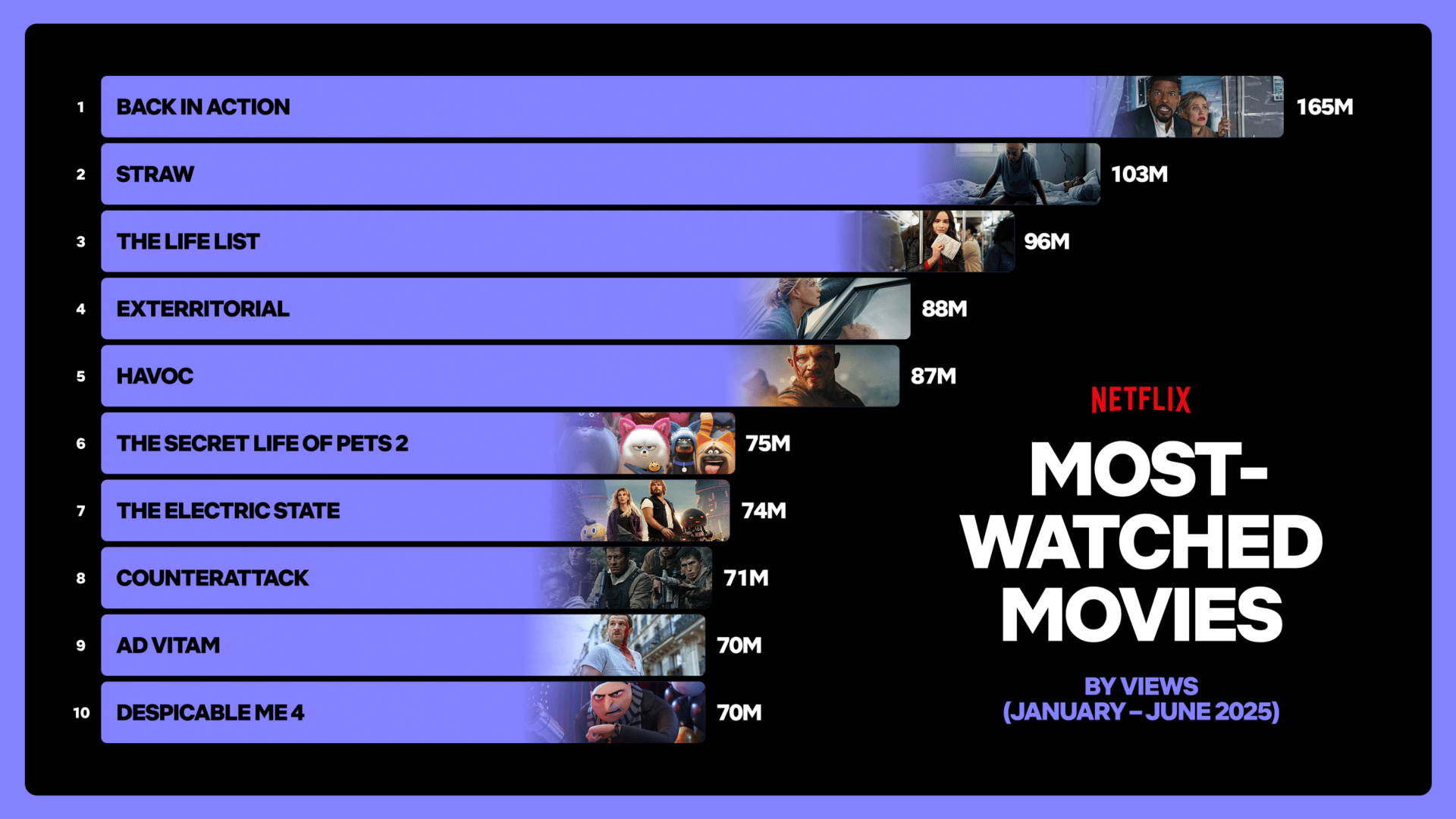

Popular original series including "Squid Game," "Wednesday," and "Stranger Things" have become cultural phenomena, driving subscriber engagement and reducing churn. The company's US library consists of 3,800 movies and 1,800 TV shows, providing extensive viewing options across diverse genres and demographics.

Advanced Technology Infrastructure and User Experience

Netflix's technological capabilities represent a significant competitive moat. The platform's sophisticated recommendation algorithm, which includes 1,300 recommendation clusters, personalizes the viewing experience for each user. This technology not only enhances user satisfaction but also reduces churn by helping subscribers discover content they'll enjoy.

The streaming infrastructure Netflix has built can handle massive concurrent viewership without degradation in quality, a technical achievement that requires substantial investment and expertise. This infrastructure reliability gives Netflix a significant advantage, particularly during high-demand periods when major content releases occur simultaneously.

Growing Advertising Revenue Stream

The introduction of the ad-supported tier has opened a lucrative new revenue channel. Netflix reported 94 million global monthly ad viewers in Q2 2025, with 55% of new sign-ups choosing the ad-supported plan. Ad revenue is projected to reach $1.3 billion in 2025, nearly doubling from $700 million in 2024.

This diversification away from pure subscription revenue provides Netflix with additional pricing flexibility and opens opportunities to serve price-sensitive market segments that might otherwise choose competitor services or piracy.

Strong Financial Performance and Operating Margins

Netflix's financial metrics demonstrate operational excellence. The company achieved a 29% operating margin in 2025, with projections suggesting continued margin expansion. The full-year 2025 revenue guidance stands between $44.8 billion to $45.2 billion, representing 15-16% year-over-year growth.

Earnings per share are expected to grow at a 20-25% CAGR over the next four years, driven by sustained revenue growth and consistent margin expansion. This financial strength provides Netflix with resources to invest in content, technology, and market expansion while returning value to shareholders.

Weaknesses: Internal Challenges Netflix Must Address

High Content Costs and Sustainability Concerns

While Netflix's content investment drives subscriber growth, the sustainability of current spending levels remains a concern. Some analysts have raised questions about the efficiency of Netflix's content spending relative to output and quality. With 90% of the US catalog projected to be original or exclusive content by 2026, the financial pressure to continuously produce hits intensifies.

The company must balance investment in high-quality programming with profitability requirements. As competition for top talent and compelling stories intensifies, production costs continue rising, potentially squeezing margins if subscription revenue growth slows.

Increasing Price Sensitivity Among Subscribers

Recent data reveals concerning trends in subscriber price sensitivity, particularly in mature markets. In the United States, churn intent increased to 42%, reflecting heightened concern about subscription costs. Surveys indicate that US subscribers show record-high sensitivity to price changes, with many indicating they would cancel over small price increases.

This price sensitivity limits Netflix's ability to raise prices as aggressively as in the past, potentially constraining revenue growth in its most lucrative markets. The challenge becomes particularly acute as household budgets face pressure from inflation and economic uncertainty.

Dependence on Subscription Growth for Valuation

Netflix's premium valuation with a P/E ratio of 52.3x reflects high market expectations for continued growth. However, as the streaming market matures in developed economies, maintaining subscriber growth rates becomes increasingly difficult.

The company stopped reporting quarterly subscriber numbers in early 2025, shifting focus to revenue and engagement metrics. While this change signals confidence in multiple revenue streams, it also highlights the challenge of sustaining subscriber growth at previous rates.

Limited Revenue Stream Diversification

Despite the addition of advertising revenue, Netflix remains heavily dependent on its streaming business. Unlike competitors such as Disney (theme parks, merchandise) or Amazon (e-commerce, cloud computing), Netflix lacks significant revenue diversification. This concentration increases vulnerability to disruptions in the streaming market or changes in consumer viewing preferences.

The company's gaming initiative remains nascent, with limited engagement compared to core streaming services. While Netflix is expanding gaming capabilities, including enabling games on TV screens, this revenue stream has not yet achieved meaningful scale.

Opportunities: Growth Avenues for 2026 and Beyond

Expansion of Live Events and Sports Programming

Live events represent a significant growth opportunity for Netflix. The company reported that 53% of US subscribers have watched live events on the platform, indicating strong interest in this content category. Co-CEO Ted Sarandos stated that Netflix's live broadcast strategy focuses on large, tentpole events.

Live sports and events could significantly reduce churn, as viewers return regularly for scheduled programming rather than binge-watching and canceling. This programming also commands premium advertising rates, enhancing the value of the ad-supported tier.

Advertising Business Maturation and Growth

The advertising opportunity extends well beyond current projections. As Netflix's ad tech platform matures and targeting capabilities improve, the company could command premium rates comparable to traditional television. With ad revenue expected to double in 2025, this revenue stream could eventually account for a significant portion of total revenue.

The ad-supported tier also serves as a retention tool. The AVOD tier has been successful in attracting new subscribers and retaining potential churners, particularly in price-sensitive markets. This dual benefit of new revenue and improved retention makes the advertising business strategically crucial.

International Market Expansion and Localization

International markets present substantial growth potential. The global entertainment market exceeds $650 billion (excluding China and Russia), and Netflix currently captures less than 10% of this market. The Europe, Middle East, and Africa region represents Netflix's largest subscriber base at 93.9 million, demonstrating the potential in these markets.

Netflix's strategy of producing localized content across multiple geographies has proven successful, with shows like "Squid Game" achieving global popularity. This approach allows Netflix to serve local tastes while occasionally producing breakout hits that resonate worldwide.

Gaming and Interactive Entertainment Evolution

While still emerging, gaming presents significant long-term potential. Netflix is expanding its gaming initiative beyond mobile to TV screens, broadening the accessible audience. The company announced plans to focus on multiplayer party games, creating social experiences that could enhance subscriber engagement.

Interactive entertainment bridges gaming and traditional content, offering unique experiences that competitors struggle to replicate. As technology evolves, Netflix's investment in this space could create a differentiated offering that drives subscriber acquisition and retention.

Strategic Partnerships and Content Licensing

Netflix has opportunities to form strategic partnerships that extend its reach without proportional cost increases. Partnerships with telecom providers, device manufacturers, and content creators could expand Netflix's subscriber base while sharing acquisition costs.

The company could also selectively license some of its successful original content to other platforms or for theatrical releases, generating incremental revenue without cannibalizing core streaming subscriptions. This approach would require careful strategy to maintain Netflix's value proposition while capitalizing on owned intellectual property.

Threats: External Challenges Facing Netflix

Intensifying Competition from Well-Funded Rivals

The streaming market has become increasingly crowded with well-capitalized competitors. Amazon Prime Video, Disney+, Max, Apple TV+, and others are all investing billions in content and technology. Amazon, in particular, leverages its e-commerce ecosystem to bundle Prime Video with other services, making direct comparison difficult.

Disney+ has accumulated 153.6 million subscribers, demonstrating the appeal of established franchise content. Warner Bros. Discovery's Max combines HBO's premium content with Discovery's extensive library, while Apple's deep pockets allow sustained investment despite lower subscriber numbers.

This competition drives content costs higher as studios bid against each other for top talent and compelling stories. It also fragments the market, potentially leading to subscriber fatigue as consumers face decisions about which services to maintain.

Economic Uncertainty and Discretionary Spending Pressures

Streaming subscriptions represent discretionary spending, making them vulnerable during economic downturns. Rising competition and price sensitivity could lead consumers to reduce the number of subscriptions they maintain, particularly if economic conditions deteriorate.

Inflation has squeezed household budgets, making consumers more selective about entertainment spending. Netflix's premium positioning in terms of both content quality and pricing could become a vulnerability if consumers shift toward lower-cost alternatives or free ad-supported services.

Content Licensing Challenges and Rising Production Costs

As media companies launch their own streaming services, they're reclaiming content previously licensed to Netflix. This forces Netflix to either pay significantly higher rates for licensing or invest more heavily in original production to fill content gaps.

Production costs continue escalating as competition for top talent intensifies. A-list actors, directors, and producers command premium rates, while visual effects and production values must meet or exceed theatrical standards to satisfy subscriber expectations.

Technological Disruptions and Cybersecurity Risks

Technological disruptions could threaten Netflix's business model. Advances in artificial intelligence might change content production economics, potentially favoring companies with different capabilities. Virtual and augmented reality could create new entertainment paradigms that require substantial investment to address.

Cybersecurity risks pose ongoing threats. Data breaches could compromise subscriber information, eroding trust and potentially triggering regulatory penalties. Content piracy, while partially addressed by the password-sharing crackdown, remains a persistent challenge that requires ongoing investment in security measures.

Regulatory Pressures and Content Restrictions

Netflix faces varying regulatory environments across its global footprint. Different countries impose distinct content restrictions, taxation policies, and data localization requirements that increase operational complexity and costs.

European regulators have implemented requirements for local content quotas and investment in regional production. Some countries impose taxes specifically on streaming services or limit foreign content availability. These regulations could constrain Netflix's operational flexibility and profitability in certain markets.

Strategic Implications and Future Outlook

Balancing Growth and Profitability

Netflix's challenge through 2026 involves balancing subscriber growth with profitability improvement. The company has demonstrated that it can achieve both, with operating margins reaching 29% while continuing to grow revenue at double-digit rates. However, maintaining this balance becomes more difficult as mature markets saturate.

The advertising business provides a crucial tool for this balancing act, enabling Netflix to serve price-sensitive consumers while generating incremental revenue. The company's success in growing this business to 91 million monthly active users by Q1 2025 demonstrates effective execution.

Content Strategy Evolution

Netflix must continue evolving its content strategy to maintain competitive advantage. The current approach of investing in localized content while maintaining global appeal has proven successful. Hits like "Squid Game" demonstrate how regional content can achieve worldwide popularity when quality and storytelling resonate universally.

The company's focus on tentpole events and major releases including the final season of "Stranger Things" aims to create cultural moments that drive subscriber acquisition and reduce churn. This blockbuster strategy complements the steady stream of varied content that serves diverse subscriber interests.

Technology and Innovation Focus

Continued investment in technology remains essential for Netflix's competitive position. The recommendation algorithm, streaming infrastructure, and production tools all require ongoing enhancement to maintain advantages over competitors. AI and machine learning capabilities can improve content production efficiency, enhance personalization, and reduce costs.

The expansion into gaming and interactive content represents a long-term technology bet that could differentiate Netflix's offering. While these initiatives haven't yet achieved meaningful scale, they position the company for potential shifts in how audiences consume entertainment.

Financial Outlook and Investor Considerations

Analyst price targets for Netflix vary considerably, ranging from Citi's $1,020 to Morgan Stanley's $1,500, reflecting different assumptions about growth sustainability and competitive dynamics. The consensus expectation points to continued revenue growth in the mid-teens percentage range through 2026, with earnings growing faster as operating leverage improves.

The company's valuation reflects high expectations, with the stock trading above InvestingPro's fair value estimate. This premium valuation means Netflix must continue executing well to justify current prices, leaving limited room for disappointment.

Netflix's Path Through 2026

Netflix's SWOT analysis reveals a company with formidable strengths and meaningful growth opportunities, but also facing significant challenges from competition, market saturation, and economic pressures. The streaming giant's ability to maintain its market leadership position through 2026 depends on successful execution across multiple strategic priorities.

The company's strengths in brand recognition, content production, technology infrastructure, and financial resources provide a solid foundation for continued success. The advertising business and live events represent major growth opportunities that could offset slowing subscriber growth in mature markets.

However, Netflix cannot afford complacency. Intensifying competition, rising content costs, and price-sensitive consumers require continuous innovation and strategic agility. The company's track record suggests management understands these challenges and has demonstrated ability to adapt business models when necessary.

For investors, industry observers, and consumers, Netflix's journey through 2026 will provide valuable lessons about sustainable competitive advantage in rapidly evolving digital markets. The company's success or struggles will help define the future of entertainment consumption for years to come.

Reply