- Deep Research Global

- Posts

- Nvidia - Company Analysis and Outlook Report (2026)

Nvidia - Company Analysis and Outlook Report (2026)

Executive TL;DR

Revenue Powerhouse: Nvidia $NVDA ( ▲ 1.02% ) reported record Q3 FY2026 revenue of $57 billion, up 62% year-over-year, with Data Center segment contributing 90% of total revenue at $51.2 billion.

Dominant Market Position: Commands approximately 90-92% market share in AI accelerator chips with substantial competitive moats through CUDA software ecosystem and high switching costs.

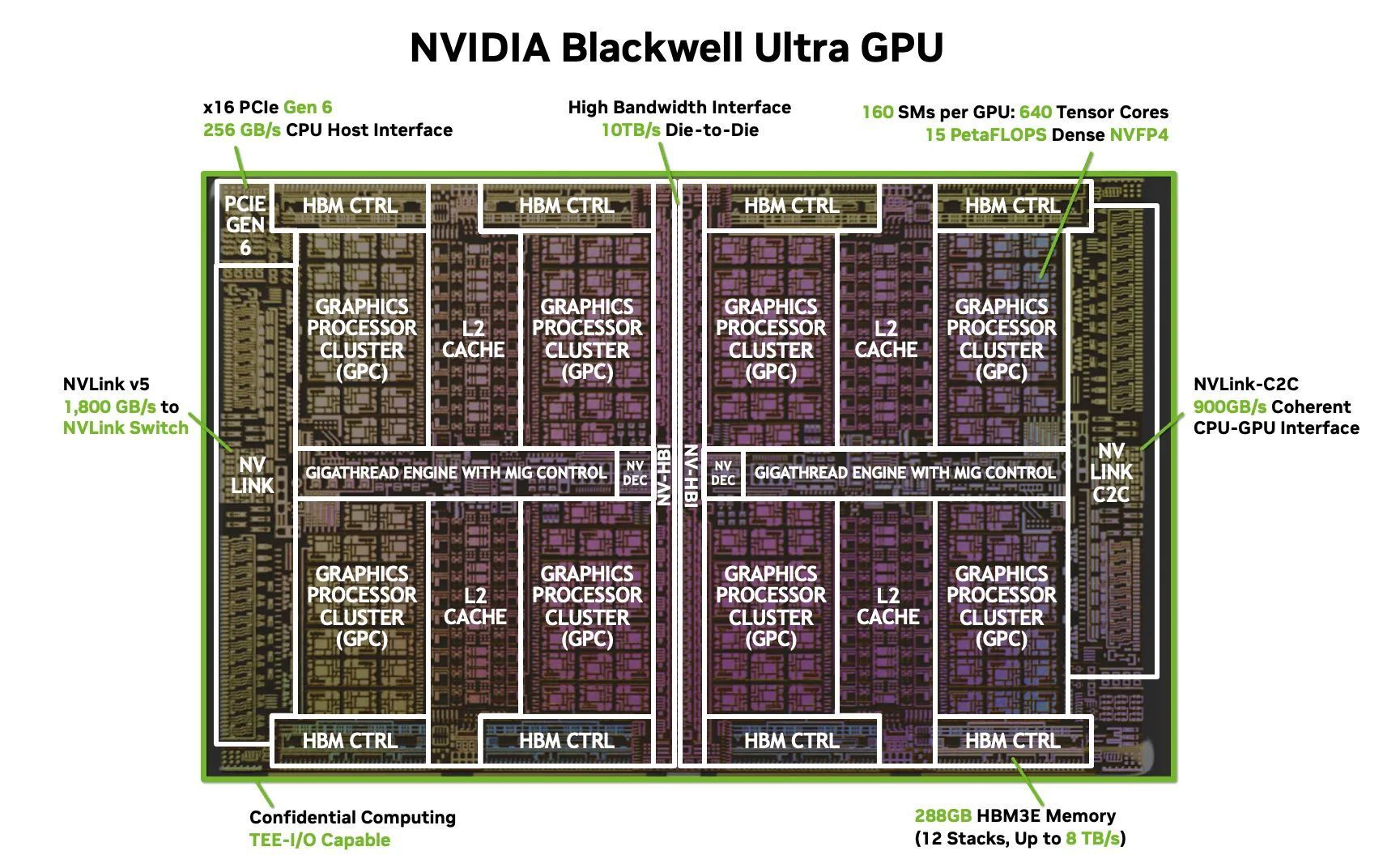

Blackwell Momentum: New Blackwell architecture GPUs are completely sold out through mid-2026, with projected Q4 FY2026 revenue of $65 billion, signaling continued exponential growth.

Valuation Compression: Forward P/E ratio of approximately 25x represents significant compression from historical levels, despite earnings growth accelerating at 60%+ annually through fiscal 2027.

Also Read:

Table of Contents

Introduction

Nvidia Corporation has transformed from a gaming GPU manufacturer into an indispensable infrastructure provider for the artificial intelligence revolution.

As of January 2026, the company stands at approximately $4.5 trillion in market capitalization. Its fiscal 2026 third-quarter results demonstrate why investors continue to view Nvidia as the primary beneficiary of what CEO Jensen Huang describes as the “AI factory” era.

Image source: commons.wikimedia.org

Key Facts: Business Overview

Corporate Foundation

Founded in 1993 and headquartered in Santa Clara, California, Nvidia trades on NASDAQ under ticker symbol NVDA. The company pioneered the Graphics Processing Unit (GPU) in 1999 and has since evolved into the dominant force in accelerated computing and artificial intelligence infrastructure.

Revenue Scale and Growth

Last Twelve Months (LTM) Revenue: Approximately $147.8 billion for the nine months ended October 26, 2025, with fiscal 2026 projected to exceed $203 billion.

Recent Performance Trajectory:

Fiscal Year | Revenue Growth Rate |

|---|---|

FY2021 | +53% |

FY2022 | +61% |

FY2023 | Flat (0%) |

FY2024 | +126% |

FY2025 | +114% |

FY2026 (Projected) | +63% |

The company’s fiscal 2026 Q3 results showed revenue of $57.0 billion, up 22% sequentially and 62% year-over-year.

Business Segments and Product Lines

Data Center (90% of revenue)

This segment generates $51.2 billion quarterly and encompasses GPU compute platforms for training and inference, networking solutions through Spectrum-X Ethernet, and the DGX systems portfolio. The Hopper H100/H200 architecture currently dominates deployments, while the Blackwell architecture (B200, GB200) entered full production in late 2025.

Gaming (8% of revenue)

Revenue of $4.3 billion quarterly comes from GeForce GPUs for gaming PCs and laptops. The segment recently launched the GeForce RTX 50 series featuring Blackwell architecture at CES 2026.

Professional Visualization (1.3% of revenue)

This $760 million quarterly segment provides RTX workstation GPUs for creators, designers, and engineers, plus Omniverse platform for collaborative 3D workflows.

Automotive and Robotics (1% of revenue)

Generating $592 million quarterly, this segment delivers the DRIVE platform for autonomous vehicles and robotics applications. Recent partnerships include Uber’s level 4 autonomous vehicle initiative targeting 100,000 vehicles starting in 2027.

Key Revenue Drivers

Demand for AI Training Infrastructure: Hyperscalers (Microsoft, Amazon, Meta, Google) are deploying massive GPU clusters for training foundation models. Training runs for frontier models now utilize tens of thousands of GPUs simultaneously.

Inference Expansion: As AI models move from training to production deployment, inference workloads are growing exponentially. Nvidia’s Blackwell architecture delivers 10x throughput per megawatt compared to previous generations for inference tasks.

Cloud Service Provider Buildout: Major CSPs are constructing “AI factories” to provide GPU-as-a-Service. Strategic partnerships announced in Q3 FY2026 include at least 10 gigawatts of Nvidia systems for OpenAI and similar deployments with Microsoft, Oracle, and xAI.

Enterprise AI Adoption: Corporations across industries are building private AI infrastructure. Nvidia reported accelerating demand from enterprises deploying RAG (Retrieval Augmented Generation) systems, AI agents, and custom models.

Sovereign AI Initiatives: Countries including South Korea (250,000+ GPUs), UK (£2 billion investment), and Germany are building national AI infrastructure.

Competitive Analysis and Moat Assessment

Porter’s Five Forces Analysis

Threat of New Entrants: Low to Moderate

Barriers to Entry:

- Capital Requirements: $10-20 billion for fab partnerships and R&D

- Technical Complexity: 15+ years to build competitive GPU architecture

- Software Ecosystem: CUDA has 2 million registered developers

- Time to Market: 3-5 year design cycles for competitive products

Entry barriers remain formidable. However, well-funded competitors (AMD, Intel, custom silicon from hyperscalers) are making gradual progress.

Bargaining Power of Suppliers: Moderate

Nvidia depends on TSMC for manufacturing, creating concentration risk. The company celebrated its first Blackwell wafer produced in Arizona, partially mitigating geographic concentration.

For critical components like HBM (High Bandwidth Memory), Nvidia sources from SK Hynix, Micron, and Samsung, maintaining supplier diversification.

Bargaining Power of Buyers: Moderate to High

Customer concentration represents a material risk. Two customers accounted for 39% of Q2 FY2026 revenue, with four customers contributing 61% of total revenue.

Major buyers (Microsoft, Amazon, Meta, Google) are simultaneously developing custom AI chips. However, switching costs remain substantial due to CUDA software lock-in.

Threat of Substitutes: Moderate and Rising

Alternative solutions include AMD MI300 series, Google TPUs, Amazon Trainium/Inferentia, Microsoft Maia, and Meta MTIA chips.

While these substitutes are gaining traction for specific workloads, Nvidia maintains performance leadership and ecosystem advantages. The company’s full-stack approach (hardware, software, networking) creates defensibility.

Competitive Rivalry: Intense and Accelerating

Competitor | Market Position | Key Strengths |

|---|---|---|

AMD | 5-8% AI chip share | MI300X competitive on inference, lower pricing |

Intel | <1% AI chip share | Manufacturing capabilities, Gaudi 3 improving |

Custom Silicon (Hyperscalers) | 10-15% internal workloads | Cost optimization for specific use cases |

Emerging Players (Groq, Cerebras) | <1% collectively | Novel architectures for specific applications |

Despite intensifying competition, Nvidia maintained 92% discrete GPU market share in Q3 2025.

AI Accelerator Market: Nvidia commands approximately 90% share of the AI chip market. This dominance stems from performance leadership, software ecosystem maturity, and first-mover advantages.

Data Center GPU Market: Nvidia’s Data Center revenue of $51.2 billion quarterly dwarfs competitors. AMD’s Data Center GPU revenue runs approximately $2-3 billion quarterly, while Intel’s accelerator business remains under $1 billion quarterly.

Switching Costs and Competitive Moat

CUDA Software Ecosystem

Nvidia’s most durable competitive advantage lies in its CUDA platform, introduced in 2006. CUDA enables developers to program GPUs using C++ syntax, creating a massive installed base of optimized code.

CUDA Ecosystem Metrics:

- 2+ million registered developers

- 3,500+ GPU-accelerated applications

- 600+ CUDA-optimized libraries

- 15+ years of accumulated software IP

Migrating AI workloads from CUDA to alternative platforms (ROCm for AMD, OneAPI for Intel, proprietary frameworks for custom chips) requires substantial engineering investment. Estimates suggest 6-12 months and significant engineering resources to port complex AI applications.

Full-Stack Integration

Beyond GPUs, Nvidia provides networking (NVLink, InfiniBand, Spectrum-X Ethernet), software frameworks (TensorRT, Triton Inference Server, NeMo), and system designs (DGX, HGX). This comprehensive approach creates vendor lock-in effects that competitors struggle to replicate.

Performance Leadership

Blackwell architecture achieved highest scores in MLPerf benchmarks for both training and inference workloads. Sustained performance advantages justify premium pricing and reinforce ecosystem stickiness.

Network Effects

As more developers build on CUDA, more tools and libraries emerge, attracting additional developers. This classic network effect compounds Nvidia’s competitive position.

Financial Deep Dive

Historical Revenue and Profitability Trends

Revenue Progression (Fiscal Years)

Metric | FY2021 | FY2022 | FY2023 | FY2024 | FY2025 | FY2026E |

|---|---|---|---|---|---|---|

Revenue ($B) | $16.7 | $26.9 | $27.0 | $60.9 | $130.5 | $203.0 |

YoY Growth | 53% | 61% | 0% | 126% | 114% | 63% |

The fiscal 2023 flat performance reflected cryptocurrency market collapse and gaming GPU inventory corrections. The subsequent explosion beginning in fiscal 2024 directly correlates with ChatGPT’s launch (November 2022) and the ensuing AI infrastructure buildout.

Margin Analysis

Gross Margin Evolution

Nvidia’s gross margins demonstrate exceptional profitability:

Period | GAAP Gross Margin | Non-GAAP Gross Margin |

|---|---|---|

Q3 FY2024 | 74.6% | 75.0% |

Q4 FY2025 | 73.0% | 73.5% |

Q1 FY2026 | 78.4% | 79.0% |

Q2 FY2026 | 75.1% | 75.5% |

Q3 FY2026 | 73.4% | 73.6% |

Gross margins peaked in Q1 FY2026 at 78%+ as Hopper production ramped with optimized costs. Subsequent compression to 73-74% reflects Blackwell architecture introduction (new products typically carry higher initial costs) and product mix shifts.

Management guided Q4 FY2026 gross margins to 74.8% GAAP / 75.0% non-GAAP, suggesting margin stabilization as Blackwell production scales.

Operating Margin Excellence

Nvidia’s operating margins have expanded dramatically:

Q3 FY2026: 63.2% operating margin ($36.0B operating income on $57.0B revenue)

Q3 FY2025: 62.3% operating margin

Full FY2025: 61.6% average operating margin

These margins rival software companies despite Nvidia’s hardware-intensive business model. Scale advantages, pricing power from limited competition, and operational leverage drive this performance.

Free Cash Flow Analysis

FCF Generation Trajectory

Nvidia’s free cash flow has mushroomed alongside revenue:

Period | Operating Cash Flow | Capital Expenditures | Free Cash Flow |

|---|---|---|---|

FY2023 | $5.6B | ~$1.0B | ~$4.6B |

FY2024 | $28.1B | ~$1.3B | ~$26.8B |

FY2025 | $60.9B | ~$4.0B | ~$56.9B |

FY2026E | $96.5B | ~$5.5B | ~$91.0B |

For the nine months ended October 26, 2025, operating cash flow reached $47.5 billion. The trailing twelve months (TTM) free cash flow as of Q3 FY2026 stood at approximately $77.3 billion.

FCF Conversion Metrics

Nvidia demonstrates exceptional cash conversion:

FCF Margin = FCF / Revenue

Q3 FY2026 TTM: $77.3B / ~$150B = 51.5%

FCF to Net Income Ratio

FY2025: $56.9B / $61.0B = 93%

This near-perfect conversion of earnings to cash reflects minimal working capital requirements and moderate capital intensity. The company operates asset-light (fabless semiconductor model), outsourcing manufacturing to TSMC while focusing capital on R&D.

Capital Allocation

With such prodigious cash generation, Nvidia pursues multiple capital allocation strategies:

Share Repurchases: $37.0 billion returned to shareholders in first nine months of FY2026, with $62.2 billion remaining under authorization

Dividends: Nominal $0.01 per share quarterly dividend (symbolic given company’s growth stage)

Strategic Investments: Announced $10 billion investment in Anthropic (November 2025)

R&D Investment: $12.985 billion for nine months FY2026, representing 8.8% of revenue

Balance Sheet Strength

Asset Position (as of October 26, 2025)

Total Assets: $161.1 billion

Cash and Marketable Securities: $60.6 billion

Current Assets: $116.5 billion

Property and Equipment: $9.8 billion

Liability Structure

Total Current Liabilities: $26.1 billion

Short-term Debt: $1.0 billion

Long-term Debt: $9.7 billion

Total Debt: $10.7 billion

Financial Ratios

Current Ratio: 4.47x ($116.5B / $26.1B)

Net Cash Position: $49.9B ($60.6B cash - $10.7B debt)

Debt-to-Equity: <10% (minimal leverage)

Nvidia’s fortress balance sheet provides flexibility for strategic investments, protects against cyclical downturns, and supports aggressive R&D spending.

Image source: developer.nvidia.com

Valuation Analysis

DCF (Discounted Cash Flow) Methodology

Multiple DCF models yield intrinsic value estimates ranging from $146 to $252 per share, depending on assumptions.

Base Case DCF Assumptions

Revenue Projections:

- FY2026: $203B (consensus)

- FY2027: $272B (+34% growth)

- FY2028-2030: Decelerating to 20-25% annually

FCF Margin: 45-50% (conservative vs. current 51%+)

Discount Rate (WACC): 10-12%

Terminal Growth Rate: 4-5%

Using these parameters, a DCF valuation suggests intrinsic value of approximately $220-250 per share, implying modest upside to current prices near $189 (as of January 2026).

Bull Case DCF

Assuming sustained 30%+ revenue growth through FY2028, FCF margins expanding to 55%, and terminal growth of 6%, intrinsic value could reach $350-400 per share.

Bear Case DCF

If AI spending normalizes sharply, revenue growth decelerates to 15% post-FY2027, and margins compress to 40% due to competition, intrinsic value falls to $140-180 per share range.

Comparable Company Valuation

Forward Valuation Multiples

Company | Forward P/E | EV/Revenue | EV/EBITDA |

|---|---|---|---|

Nvidia | 24.7x | 18.5x | 29.3x |

AMD | 33.0x | 6.2x | 22.4x |

Intel | 61.0x | 1.8x | 14.2x |

Broadcom | 28.5x | 12.4x | 25.1x |

Qualcomm | 18.2x | 4.1x | 12.8x |

Nvidia’s forward P/E ratio of 24.7x appears reasonable given projected earnings growth of 60%+ in FY2026 and 40%+ in FY2027. The PEG ratio (P/E to Growth) of approximately 0.4x suggests significant undervaluation relative to growth rates.

Historical Valuation Context

Nvidia’s P/E ratio has compressed dramatically:

January 2022 peak: 80x forward P/E

Current (January 2026): 24.7x forward P/E

5-year average: ~45x

This compression occurred despite earnings exploding 400%+ over the period. The market appears to price significant deceleration concerns.

Sensitivity Analysis

Revenue Sensitivity Table (Intrinsic Value per Share)

Revenue CAGR (FY26-30) | WACC 10% | WACC 12% | WACC 14% |

|---|---|---|---|

20% | $195 | $165 | $142 |

25% | $248 | $210 | $180 |

30% | $312 | $265 | $227 |

35% | $389 | $330 | $283 |

Margin Sensitivity Table (Intrinsic Value per Share)

FCF Margin | Terminal Growth 3% | Terminal Growth 5% | Terminal Growth 7% |

|---|---|---|---|

40% | $172 | $208 | $258 |

45% | $195 | $236 | $294 |

50% | $218 | $264 | $330 |

55% | $241 | $292 | $366 |

These tables demonstrate that valuation hinges primarily on revenue growth sustainability and margin preservation. Bulls argue AI infrastructure spending will compound for years. Bears warn of demand normalization and competitive margin pressure.

Catalysts and Timeline

Near-Term Catalysts (Q1-Q2 2026)

Blackwell Revenue Ramp (Probability: 95%, Timeline: Ongoing)

The Blackwell architecture (B200, GB200) entered full production in Q3 FY2026. Management stated “Blackwell sales are off the charts” with complete sellout through mid-2026.

Revenue impact: Q4 FY2026 guidance of $65 billion (up 27% sequentially) reflects initial Blackwell contribution. Expect $70-75 billion quarterly run rate by Q2 FY2027.

China Market Resolution (Probability: 40%, Timeline: Q1-Q2 2026)

The Trump administration allowed H200 chip exports to approved Chinese customers in December 2025. Full implementation could add $2-4 billion quarterly revenue.

However, bipartisan legislation seeks to restrict these exports, creating uncertainty. Monitor H1 2026 political developments.

Medium-Term Catalysts (2026-2027)

Enterprise AI Adoption Wave (Probability: 80%, Timeline: Throughout 2026)

While hyperscalers dominate current demand, enterprise customers represent untapped opportunity. Nvidia’s partnership with Palantir Technologies aims to accelerate enterprise deployments.

Potential impact: Enterprise could contribute 20-30% of Data Center revenue by late 2027, diversifying customer concentration.

Sovereign AI Buildouts (Probability: 75%, Timeline: 2026-2027)

National AI initiatives in South Korea (250,000 GPUs), UK (£2B investment), Germany (Industrial AI Cloud), and Japan provide multi-year revenue visibility.

Estimated impact: $10-15 billion incremental annual revenue from sovereign AI contracts.

Automotive and Robotics Inflection (Probability: 60%, Timeline: Late 2026-2027)

The Uber partnership (100,000 autonomous vehicles starting 2027) and DRIVE AGX Hyperion 10 platform launch could accelerate automotive revenue.

Current automotive revenue: $592 million quarterly. Potential 2027 run rate: $1.5-2.0 billion quarterly if Uber deployment proceeds and other OEMs follow.

Long-Term Catalysts (2027-2028)

Rubin Architecture Launch (Probability: 85%, Timeline: Late 2026)

Next-generation Rubin platform expected in late 2026 will utilize TSMC 3nm process and HBM4 memory. The Rubin CPX variant targets massive-context inference workloads.

Continued architectural leadership sustains pricing power and market share.

AI-Driven Industrial Transformation (Probability: 70%, Timeline: 2027-2030)

Physical AI applications in manufacturing, robotics, and logistics could expand total addressable market significantly. Partnerships with Foxconn, Caterpillar, Toyota position Nvidia for industrial AI wave.

Market opportunity: Physical AI could represent $50-100 billion annual market by 2030.

Key Risks with Probability Assessment

High Probability Risks (>50% chance of material impact)

Customer Concentration Risk (Probability: 65%)

Four customers account for 61% of revenue, with two customers contributing 39%. If Microsoft, Amazon, or Meta substantially reduce GPU purchases due to custom silicon success, revenue could decline 10-20% within 2-3 quarters.

Scenario Analysis:

Bear Case: Major customer reduces orders 50% → $8-10B quarterly revenue impact

Base Case: Gradual customer diversification as enterprise adoption grows

Bull Case: Customer growth rates offset any single-customer reduction

Competitive Threats Intensifying (Probability: 60%)

AMD’s MI300X gains traction for inference workloads. Google aggressively markets TPUs. Custom silicon from hyperscalers capture 10-15% of their internal workloads.

Impact Timeline:

2026: Nvidia maintains 85%+ market share

2027: Share erodes to 75-80% as alternatives mature

2028: Stabilizes at 70-75% with performance leadership and ecosystem lock-in

Revenue: 5-10 percentage point market share loss could reduce growth rates by 10-15 percentage points annually.

Medium Probability Risks (25-50% chance)

AI Spending Slowdown (Probability: 40%)

If AI applications fail to monetize, cloud providers and enterprises could curtail infrastructure investments. This “AI winter” scenario would devastate near-term growth.

Warning Signals to Monitor:

Cloud provider capex reductions

Model training efficiency breakthroughs reducing GPU requirements

Regulatory constraints on AI development

Financial Impact: Revenue growth could decelerate to 10-20% annually vs. 40-60% currently projected.

Geopolitical Risks (Probability: 35%)

US-China tensions over semiconductor exports create ongoing uncertainty. Further export restrictions could eliminate $5-8 billion annual revenue from China-related sales.

Taiwan-specific risks (TSMC concentration): 90%+ of Nvidia’s chips manufactured in Taiwan. Any cross-strait conflict would devastate production. Arizona fab production provides partial mitigation but limited near-term capacity.

Margin Compression (Probability: 45%)

As competition intensifies, Nvidia may face pricing pressure. Historical precedent: gross margins compressed from 64% (FY2022) to 56% (FY2023) during gaming GPU oversupply.

Scenario:

Current: 73-75% gross margins

2027 bear case: 65-68% gross margins (8-10 point compression)

Revenue impact: Assuming $250B revenue, 8-point margin drop = $20B gross profit reduction

Lower Probability but High Impact Risks (<25% chance)

Technological Disruption (Probability: 20%)

Novel AI architectures (neuromorphic computing, optical computing, quantum-inspired approaches) could obsolete GPU-based training. Companies like Groq and Cerebras pursue alternative paradigms.

Timeframe: Any such disruption likely 5-10+ years away given current GPU performance trajectory and ecosystem entrenchment.

Regulatory Intervention (Probability: 15%)

Antitrust scrutiny given market dominance. EU or US regulators could mandate ecosystem openness or impose operational restrictions.

Precedent: Similar scrutiny faced by Microsoft (browser bundling), Intel (compiler optimizations), Google (search dominance).

TSMC Dependency Materialization (Probability: 10% in next 2 years)

Natural disaster, geopolitical event, or technical issues at TSMC could halt production. This tail risk carries catastrophic consequences despite low probability.

Mitigation: Samsung and Intel foundry relationships provide alternatives, but capacity and technical compatibility challenges exist.

SWOT Analysis

Strengths

Unparalleled Market Position

90%+ market share in AI accelerators translates to pricing power and economies of scale. First-mover advantages in GPU computing created 15+ year head start over competitors.

CUDA Software Moat

2 million developers and 3,500+ optimized applications create formidable switching costs. No competitor has successfully replicated this ecosystem depth.

Full-Stack Integration

Vertical integration across chips, networking, software frameworks, and system designs provides comprehensive solutions that maximize performance and customer lock-in.

Financial Fortress

$60.6 billion cash position, minimal debt, and $77 billion annual free cash flow enable aggressive R&D, strategic acquisitions, and shareholder returns.

Innovation Velocity

Consistent 1.5-2 year product cadence (Ampere → Hopper → Blackwell → Rubin) maintains performance leadership. R&D spending of 9% of revenue funds next-generation breakthroughs.

Hyperscaler Partnerships

Deep integration with Microsoft, Amazon, Google, Meta ensures Nvidia participates in exponential AI infrastructure growth.

Weaknesses

Customer Concentration

61% revenue from four customers creates existential risk if any major customer substantially reduces purchases or successfully transitions to custom silicon.

Manufacturing Dependency

90%+ reliance on TSMC introduces geopolitical risk, natural disaster exposure, and limited supply chain flexibility.

Limited Software Revenue

Despite software moat, Nvidia monetizes primarily through hardware sales. Software and services represent <5% of revenue, missing recurring revenue opportunities.

Price Sensitivity

Average selling prices of $25,000-40,000 per GPU make purchases highly discretionary. Economic downturn or AI spending normalization would immediately impact demand.

Gaming Revenue Volatility

Gaming segment demonstrated susceptibility to crypto boom-bust cycles and consumer spending fluctuations, contributing to FY2023 flat revenue performance.

Opportunities

Enterprise AI Expansion

Fortune 500 companies represent massive untapped market. Current enterprise penetration estimated at <20% of potential addressable market.

Edge AI and Automotive

Autonomous vehicles, robotics, and edge computing could expand TAM by $50-100 billion annually over next 5 years.

Inference Market Growth

As AI models move from training to production deployment, inference workloads growing faster than training. Inference could exceed training revenue by 2027-2028.

Sovereign AI Initiatives

National AI infrastructure investments provide government-backed, multi-year revenue contracts with limited price sensitivity.

Software and Services Monetization

NVIDIA AI Enterprise software, DGX Cloud, and professional services represent underpenetrated revenue streams with higher margins and recurring characteristics.

Vertical Market Expansion

Healthcare AI, financial services, telecommunications, and scientific computing offer industry-specific solutions opportunities.

Threats

Custom Silicon Competition

Every major hyperscaler developing proprietary AI chips threatens Nvidia’s dominant position. If custom chips capture 30-40% of internal workloads, Nvidia could lose $15-25 billion annual revenue.

Geopolitical Instability

US-China tensions, Taiwan conflict risk, and semiconductor export restrictions create regulatory uncertainty and potential supply chain disruption.

AI Bubble Concerns

If AI applications fail to deliver ROI, resulting investment pullback would devastate demand. Historical precedent: dot-com bubble, crypto bubble.

Open Source Alternatives

Projects attempting to democratize AI hardware (OpenCL, SYCL) or create CUDA alternatives could erode software moat over time.

Economic Recession

AI infrastructure represents discretionary spending vulnerable to economic downturns. 2023 demonstrated revenue can go flat or negative in adverse conditions.

Regulatory Constraints

Antitrust action, export controls tightening, or AI development regulations could limit growth or operating flexibility.

PESTEL Analysis

Political Factors

US-China Technology Competition

Semiconductor export controls represent primary political risk. Current regulations restrict cutting-edge AI chips to China, limiting $5-8 billion annual revenue opportunity. H200 export approval in December 2025 provides partial relief, but congressional opposition threatens reversal.

Government AI Infrastructure Spending

Positive catalyst: Multiple governments prioritizing AI as strategic imperative. US CHIPS Act, EU AI initiatives, and Asian sovereign AI programs create government-backed demand.

Antitrust Scrutiny

Nvidia’s market dominance attracts regulatory attention. While no formal investigations announced, EU and US antitrust authorities monitor dominant tech platforms increasingly aggressively.

Economic Factors

Interest Rate Environment

Current higher interest rates pressure tech valuations but haven’t materially impacted AI infrastructure spending. Cloud providers and enterprises view AI investments as strategic necessities rather than discretionary spending.

Global GDP Growth

AI infrastructure spending demonstrates low correlation to GDP growth, driven more by technological adoption curves. However, severe recession could force spending rationalization.

Capital Availability

Abundant venture capital and corporate cash reserves fund AI startup ecosystem, creating downstream GPU demand. Any credit market tightening could reduce startup customer segment.

AI Adoption Acceleration

Societal acceptance and excitement around AI applications (ChatGPT, Midjourney, etc.) drives commercial and consumer demand. Continued positive AI narratives support infrastructure investment.

Workforce Transformation

Organizations investing in AI to augment or replace human workers creates sustained demand. Counter-narrative: AI job displacement concerns could spur regulatory constraints.

Developer Community Growth

2 million CUDA developers represent powerful grassroots support. Active developer community drives innovation and ecosystem expansion.

Technological Factors

Moore’s Law Continuation

TSMC roadmap projecting 3nm (2026), 2nm (2027), and beyond enables continued performance scaling. Nvidia leverages leading-edge nodes faster than competitors.

Architectural Innovation

Blackwell’s 10x inference performance improvement demonstrates sustained innovation. Rubin architecture maintains 2-year cadence roadmap.

Software Stack Evolution

Continuous CUDA enhancements, new frameworks (TensorRT-LLM), and expanded libraries maintain software moat relevance despite 18+ year platform maturity.

Competitive Technology Development

AMD, Intel, and custom silicon advancing technically. However, Nvidia maintains 2-3 generation performance lead in most workloads.

Environmental Factors

Energy Consumption Concerns

Data centers consume 1-2% of global electricity, with AI accelerating this growth. Nvidia addresses through energy efficiency improvements (Blackwell delivers 10x performance per watt vs. previous generations).

Regulatory Pressure on Data Centers

EU and California implementing energy efficiency standards for data centers. Nvidia’s efficiency leadership positions company favorably vs. less-efficient alternatives.

Sustainability Initiatives

Corporate ESG commitments drive demand for energy-efficient AI infrastructure. Nvidia markets GPUs’ superior performance-per-watt as sustainability advantage.

Legal Factors

Intellectual Property Protection

Extensive patent portfolio (11,000+ patents) protects innovations. However, patent wars with competitors create legal expenses and potential licensing requirements.

Export Control Compliance

Complex regulatory regime around advanced chip exports requires sophisticated compliance infrastructure. Violations carry severe penalties.

Product Liability and Safety

As autonomous vehicle deployments scale, potential liability for AI system failures creates risk. Nvidia maintains substantial insurance and contractual liability limitations.

Analyst Price Targets Compilation

As of January 2026, Wall Street maintains bullish stance on Nvidia:

Consensus Metrics

Average 12-Month Price Target: $253-263

Number of Analysts Covering: 54

Consensus Rating: Strong Buy (85% Buy, 12% Hold, 3% Sell)

Individual Analyst Targets (Selected Recent Calls):

Highest Target: $352 (represents 86% upside)

Median Target: $260

Lowest Target: $140 (bearish outlier)

Notable Recent Updates:

Citi: Raised target to $250 (December 2025), citing Blackwell momentum

Morgan Stanley: $235 target, forecasting continued AI surge

Bank of America: $258 target following H200 export approval

Goldman Sachs: $275 target (top-tier among bulge brackets)

2026-2030 Extended Forecasts:

Year | Bullish Estimate | Average Estimate | Bearish Estimate |

|---|---|---|---|

2026 | $308 | $207 | $170 |

2027 | $567 | $442 | $285 |

2028 | $629 | $537 | $396 |

These projections assume continued AI infrastructure buildout, sustained market share, and margin stability.

Key Variables Driving Target Ranges:

Blackwell revenue ramp velocity

Competitive dynamics and market share evolution

Gross margin trajectory (70-75% range)

AI spending sustainability

China market access

Analyst consensus implies approximately 33-40% upside from January 2026 levels, reflecting optimism about continued growth despite current elevated valuation multiples.

SEC Filings and Financial Documents

10-K Annual Reports:

Fiscal 2025 10-K (filed February 26, 2025)

Available at: https://investor.nvidia.com/financial-info/sec-filings/default.aspx

10-Q Quarterly Reports:

Q3 FY2026 10-Q (filed November 2025)

Q2 FY2026 10-Q (filed August 2025)

8-K Current Reports: Earnings releases and material event disclosures available at SEC EDGAR database (CIK: 0001045810)

Earnings Materials

Press Releases and Transcripts:

Q3 FY2026 Earnings Release (November 19, 2025)

CFO Commentary (quarterly updates)

Earnings call transcripts: Available via investor relations website

Investor Presentations: Quarterly results presentations accessible at https://investor.nvidia.com/financial-info/quarterly-results/

Company Resources

Official Channels:

Investor Relations: https://investor.nvidia.com

News Room: https://nvidianews.nvidia.com

Technical Blog: https://blogs.nvidia.com

Developer Resources: https://developer.nvidia.com

My Final Thoughts

Nvidia stands at a unique moment in corporate history, having transformed from a gaming peripheral supplier into the foundational infrastructure provider for artificial intelligence. The company’s fiscal 2026 performance validates that AI represents a genuine technological revolution rather than speculative hype.

The Investment Proposition Crystallizes Around Three Core Questions:

First, can Nvidia sustain 40-50%+ revenue growth through fiscal 2027-2028? The Blackwell sellout and expanding customer base beyond hyperscalers suggest affirmative answers. However, deceleration appears inevitable as revenue base exceeds $200 billion. The critical question: does growth stabilize at 20-25% (attractive) or 10-15% (problematic given current valuation)?

Second, will competitive threats erode Nvidia’s market dominance meaningfully? Custom silicon from hyperscalers and AMD’s improving offerings pose real challenges. Yet the CUDA ecosystem moat appears deeper than many appreciate. Developers aren’t simply locked in by switching costs but by accumulated expertise, optimized libraries, and production-tested code representing billions in sunk investment.

Third, what multiple should investors assign to a hardware company growing like software? Current forward P/E of 25x appears reasonable for 50%+ earnings growth, yet historical hardware businesses rarely sustain premium multiples. Nvidia’s software ecosystem and recurring revenue potential through DGX Cloud and AI Enterprise justify some premium, but compression risk exists.

For Long-Term Investors:

The risk-reward at current levels favors patient capital. While near-term upside may be limited by elevated expectations, the 3-5 year outlook remains compelling. Key indicators to monitor: gross margin stability (stay above 70%), customer concentration trends (diversification critical), and competitive win rates in enterprise segment.

Position sizing should account for inherent volatility. Nvidia’s business model carries higher cyclicality than software peers despite comparable growth rates.

The Secular Thesis Endures:

AI computation requirements grow exponentially with model scale. Each generation of foundation models demands 5-10x more training compute. Inference workloads compound as AI applications proliferate. This computational demand curve supports multi-year growth visibility.

Nvidia’s combination of hardware performance leadership, software ecosystem depth, and full-stack integration creates competitive advantages that won’t erode quickly. The company resembles Microsoft in the 1990s or Google in the 2000s at the center of transformative technological shifts.

However, overconcentration risk warrants prudence. Nvidia should represent a core position in technology-focused portfolios but tempered by diversification across AI beneficiaries (cloud platforms, AI application companies, semiconductor equipment firms).

The company’s $4.5 trillion valuation already prices substantial success. Extraordinary returns from current levels require not just meeting but exceeding already-elevated expectations. That bar gets harder to clear as scale increases.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.

Reply