- Deep Research Global

- Posts

- Pfizer - SWOT Analysis (2026)

Pfizer - SWOT Analysis (2026)

The pharmaceutical industry stands at a crossroads of innovation and challenge, where companies must navigate patent expirations, emerging technologies, and shifting market dynamics. Pfizer Inc., one of the world’s largest pharmaceutical companies, exemplifies this delicate balance.

As we look toward 2026 and beyond, understanding Pfizer’s strategic position through a comprehensive SWOT analysis becomes essential.

Table of Contents

Image source: The Business Journals

Company Overview: Pfizer’s Current Position

Pfizer has established itself as a pharmaceutical powerhouse with a global footprint spanning approximately 200 countries. The company’s recent performance demonstrates both resilience and strategic evolution. In the third quarter of 2025, Pfizer achieved solid financial results with revenues totaling $16.7 billion, representing a 7% operational decline year-over-year, primarily driven by reduced COVID-19 product sales. However, this decline masks underlying strength in the company’s core business operations.

For the full year 2024, Pfizer reported total revenues of $63.6 billion, reflecting 7% operational growth year-over-year. The company has demonstrated disciplined operational execution while achieving pivotal strategic milestones, leading management to raise and narrow its full-year 2025 adjusted earnings per share guidance. This confidence stems from improved productivity, enhanced commercial excellence, and a strengthened research and development pipeline (Pfizer Q3 2025 Earnings).

The company’s commitment to innovation remains unwavering. In the first nine months of 2025, Pfizer invested $7.2 billion in internal R&D while returning $7.3 billion to shareholders through quarterly dividends. This dual focus on innovation and shareholder value reflects a mature company balancing growth imperatives with financial discipline.

Strengths: Building on a Solid Foundation

Unparalleled Drug Development Pipeline

Pfizer’s drug pipeline stands as one of the most robust in the pharmaceutical industry. With 271 drugs currently in development, the company leads its closest competitors, including Roche (261), Novartis (254), AstraZeneca (241), and Sanofi (233). This extensive pipeline provides multiple opportunities for future revenue growth and helps mitigate the risk of individual drug failures.

The pipeline spans diverse therapeutic areas, with particularly strong representation in oncology, vaccines, and rare diseases. As of November 2025, the company continues to advance promising candidates through various development stages, from early-phase trials to late-stage programs awaiting regulatory approval (Pfizer Pipeline).

Image source: News-Medical

Oncology Leadership and Strategic Focus

Oncology represents a cornerstone of Pfizer’s growth strategy. The company has set an ambitious goal to deliver eight blockbuster cancer drugs by 2030, with oncology sales already comprising more than 25% of total revenues. In the first half of 2025, oncology revenues grew 9%, driven by drugs like PADCEV, XTANDI, and products from the Seagen acquisition.

Recent pivotal results underscore the strength of this portfolio. PADCEV combined with pembrolizumab demonstrated significant survival improvements for certain bladder cancer patients when given before and after surgery. The combination of BRAFTOVI and MEKTOVI showed updated positive results for metastatic non-small cell lung cancer patients with BRAF V600E mutations. XTANDI demonstrated unprecedented overall survival improvements in non-metastatic hormone-sensitive prostate cancer patients with biochemical recurrence.

These clinical successes validate Pfizer’s oncology-focused strategy and position the company to capture significant market share in the rapidly growing cancer therapeutics market.

Global Infrastructure and Market Presence

Pfizer’s global presence provides significant competitive advantages. Operating in approximately 200 countries, the company maintains established distribution networks, regulatory relationships, and market access capabilities that would take competitors years to replicate. This geographic diversification also provides revenue stability, as economic or regulatory challenges in one region can be offset by performance in others.

The company’s manufacturing capabilities span multiple continents, providing supply chain resilience and the ability to respond quickly to regional demand fluctuations. This infrastructure proved invaluable during the COVID-19 pandemic and continues to support the company’s commercial operations.

Financial Strength and Capital Allocation Discipline

Despite recent headwinds from declining COVID-19 product sales, Pfizer maintains a strong balance sheet and generates substantial cash flow. This financial strength enables the company to pursue strategic acquisitions, invest in R&D, and return capital to shareholders simultaneously. The company’s acquisition of Seagen for $43 billion in 2023 and the proposed Metsera acquisition for over $10 billion demonstrate management’s willingness to deploy capital for strategic growth.

The company’s dividend policy provides income-oriented investors with reliable returns while the business undergoes transformation. This financial discipline helps maintain investor confidence during periods of operational transition.

Weaknesses: Challenges to Address

The Looming Patent Cliff

The most significant challenge facing Pfizer is the impending patent cliff between 2026 and 2028, which threatens $17-18 billion in annual revenues from key drugs. This “super cliff” will impact several blockbuster medications that currently drive substantial portions of the company’s income.

Image source: Boston Consulting Group

Eliquis, the anticoagulant that generated $7.4 billion in 2024 sales, faces patent expiration in 2028. This drug represents one of Pfizer’s most significant revenue sources, and generic competition will dramatically erode its contribution. Ibrance, a breast cancer treatment, loses patent protection in 2027, as does Xtandi, a prostate cancer therapy. Prevnar 13, the pneumococcal vaccine, faces generic competition starting in 2026.

Industry analysts estimate that more than $236 billion in pharmaceutical sales across the industry will be affected by patent expirations through 2028, with Pfizer facing disproportionate exposure (Parola Analytics). The company must successfully launch new products and grow existing non-blockbuster drugs significantly to offset these losses.

Revenue Concentration and Dependency

While diversification across therapeutic areas provides some protection, Pfizer remains heavily dependent on a relatively small number of blockbuster drugs for the majority of its revenues. This concentration creates vulnerability when any individual product faces challenges, whether from patent expiration, safety concerns, or competitive pressure.

The decline in COVID-19 product revenues illustrates this challenge. While the pandemic generated windfall profits for Pfizer, the rapid decline in COVID-19 vaccine and treatment sales has created a significant revenue gap that the company must fill through other products.

Operational Challenges and Cost Structure

Like many large pharmaceutical companies, Pfizer faces ongoing pressure to improve operational efficiency. The company has implemented cost-reduction programs, but the complexity of a global organization with diverse therapeutic focuses creates inherent inefficiencies. Research and development productivity, while improving, must accelerate to generate sufficient new products to replace those losing patent protection.

The company’s administrative expenses and sales force costs also represent areas where competitors may have advantages, particularly smaller biotechnology companies with leaner structures and more focused product portfolios.

Integration Risks from Acquisitions

Pfizer’s growth strategy relies partially on acquisitions, including the recent Seagen purchase and proposed Metsera acquisition. Integrating acquired companies presents multiple challenges, including cultural alignment, system integration, retention of key talent, and realization of anticipated synergies. Historical evidence suggests that many pharmaceutical acquisitions fail to deliver expected value, creating execution risk for Pfizer’s strategy.

The Metsera acquisition, valued at over $10 billion, came after a bidding war with Novo Nordisk, potentially indicating that Pfizer paid a premium price. The acquired company’s lead asset, a once-monthly obesity treatment, remains in development with uncertain regulatory and commercial outcomes.

Opportunities: Pathways for Growth

Oncology Market Expansion

The global oncology market continues to expand rapidly, driven by aging populations, improved diagnostic capabilities, and rising cancer incidence rates. Pfizer’s strong oncology portfolio and pipeline position the company to capture significant market share in this growing segment.

The company’s goal to have eight blockbuster cancer drugs by 2030 represents a clear strategic vision. With oncology revenues already growing 9% in the first half of 2025, the trajectory supports optimism about this growth driver. Novel mechanisms of action, combination therapies, and expansion into earlier treatment lines all provide opportunities to maximize the value of existing assets while new products progress through development.

Obesity and Metabolic Disease Market Entry

The proposed Metsera acquisition represents Pfizer’s strategic entry into the rapidly expanding obesity treatment market. This market has attracted enormous attention following the success of GLP-1 agonists from competitors, with analysts projecting the obesity drug market could reach $100 billion annually by 2030.

Metsera’s once-monthly treatment, if successfully developed and approved, could offer dosing convenience advantages over existing weekly injections. This differentiation, combined with Pfizer’s commercial capabilities, could generate substantial revenues. The obesity market also presents opportunities beyond weight loss, including treatments for related metabolic conditions like type 2 diabetes, cardiovascular disease, and non-alcoholic fatty liver disease.

Emerging Markets Expansion

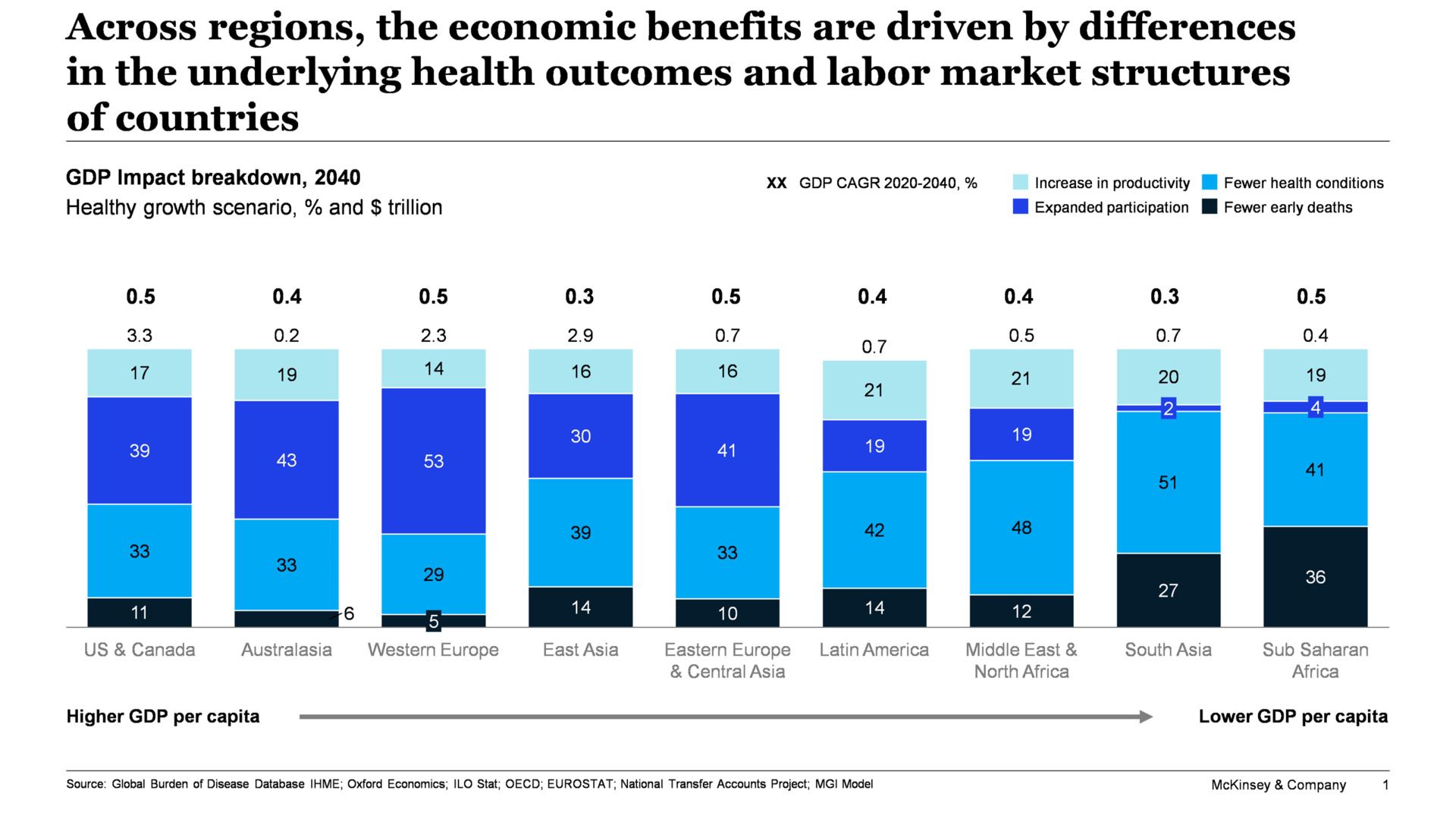

Image source: Brookings Institution

Emerging markets, often called “pharmerging” markets, represent one of the fastest-growing segments of the global pharmaceutical industry. IQVIA forecasts compound annual growth of 5-8% at invoice price levels in these markets through 2026, potentially reaching a CAGR of 9.7%, making it the fastest-growing pharmaceutical region globally.

Countries like China, India, Brazil, and others in Southeast Asia and Latin America are experiencing rising middle classes, improved healthcare infrastructure, and increasing government healthcare spending. These markets present opportunities for Pfizer to expand its geographic footprint, launch existing products in new territories, and develop region-specific formulations or pricing strategies.

Pfizer’s existing global infrastructure provides a foundation for emerging market expansion, though success requires understanding local regulatory environments, pricing dynamics, and competitive landscapes that differ significantly from developed markets.

Vaccine Portfolio Expansion

Beyond COVID-19 vaccines, Pfizer continues to invest in its vaccine franchise. The company plans to launch Phase 3 trials for its 25-valent pneumococcal vaccine in 2026, representing a significant advancement over existing pneumococcal vaccines. This expansion of the valency (number of bacterial strains covered) could provide competitive advantages and drive growth in the pneumococcal vaccine market.

Pfizer’s partnership with BioNTech on mRNA technology also creates opportunities for novel vaccines against infectious diseases, cancer, and other conditions. The mRNA platform’s flexibility and rapid development timelines could accelerate vaccine innovation and generate new revenue streams.

Strategic Partnerships and Collaborations

The pharmaceutical industry increasingly relies on partnerships between large companies and innovative biotechnology firms. Pfizer has demonstrated willingness to engage in various partnership models, including research collaborations, licensing agreements, and joint ventures. These partnerships provide access to novel technologies, mechanisms of action, and therapeutic approaches that complement internal research efforts.

Partnerships can accelerate development timelines, share financial risk, and provide expertise in specialized areas where Pfizer may lack internal capabilities. The company’s financial strength and commercial infrastructure make it an attractive partner for smaller companies seeking to advance promising assets.

Threats: External Challenges and Risks

Intense Competitive Pressure

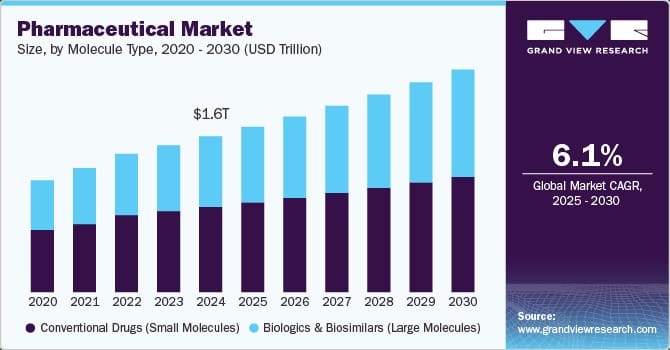

Image source: Grand View Research

The pharmaceutical industry remains intensely competitive, with major players including Johnson & Johnson, Roche Holding AG, Merck & Co., Novartis AG, GlaxoSmithKline, and AstraZeneca all competing across multiple therapeutic areas. Each competitor possesses significant resources, robust pipelines, and global commercial capabilities.

Competition extends beyond traditional pharmaceutical companies. Biotechnology firms, often more nimble and focused, continue to advance innovative therapies that challenge established treatments. The success of companies like Moderna in mRNA technology and numerous biotech firms in cell and gene therapy demonstrates that innovation can come from unexpected sources.

In specific therapeutic areas like oncology and obesity, competition intensifies further. The bidding war with Novo Nordisk over Metsera illustrates how competitive dynamics can drive acquisition prices higher and reduce potential returns. Novo Nordisk, Eli Lilly, and others racing to dominate the obesity market will compete aggressively for market share, potentially leading to pricing pressure and increased marketing expenses.

Regulatory and Pricing Pressures

Pharmaceutical companies face increasing scrutiny from regulators, payers, and the public regarding drug pricing. Governments worldwide are implementing policies to control healthcare costs, often targeting pharmaceutical spending. Medicare negotiation provisions in the United States, reference pricing in Europe, and aggressive generic substitution policies all pressure pharmaceutical revenues and margins.

Regulatory approval timelines and requirements continue to evolve, creating uncertainty for pipeline programs. Stricter safety requirements, larger clinical trial mandates, and post-approval monitoring obligations increase development costs and extend timelines. While these regulations aim to protect patients, they also increase the financial burden of drug development and reduce the effective patent life of approved products.

Generic and Biosimilar Competition

Beyond the immediate patent cliff, Pfizer faces ongoing pressure from generic and biosimilar manufacturers. As patents expire, generic manufacturers quickly introduce lower-priced alternatives that capture the majority of market share within months. Biosimilars, while facing higher barriers to entry than traditional generics, increasingly threaten biologic drug revenues.

The competition for generic versions of drugs like Eliquis and others begins long before patent expiration, with generic manufacturers conducting studies and preparing regulatory submissions to launch immediately upon patent expiry. This creates a sharp revenue cliff rather than a gradual decline, making it difficult for companies to smooth the transition.

Clinical Trial Failures and Development Setbacks

Despite having 271 compounds in development, the majority of these candidates will ultimately fail. Pharmaceutical development involves substantial attrition, with most compounds in early development never reaching approval. Even late-stage programs can fail due to efficacy or safety issues, representing significant financial losses and strategic setbacks.

Recent examples in the industry show that even well-capitalized companies with experienced development teams experience high-profile failures. Each failure not only represents lost investment but also creates a gap in future revenue projections that must be filled by other programs.

Economic and Geopolitical Uncertainty

Global economic conditions affect pharmaceutical sales, particularly in markets without comprehensive health insurance coverage. Economic downturns can delay elective procedures, reduce diagnostic testing, and cause patients to forgo or delay treatments. While pharmaceutical spending often proves relatively recession-resistant, it is not immune to economic pressures.

Geopolitical tensions, trade disputes, and supply chain disruptions create additional uncertainty. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, and companies continue working to build resilience. However, dependence on specific regions for raw materials, manufacturing, or sales creates exposure to political and economic instability.

Technological Disruption and Paradigm Shifts

Emerging technologies like artificial intelligence in drug discovery, gene editing, cell therapies, and personalized medicine could disrupt traditional pharmaceutical business models. Companies that successfully leverage these technologies may gain significant competitive advantages, while those that lag could find their approaches obsolete.

The shift toward precision medicine and biomarker-driven therapies creates challenges for companies with products designed for broad populations. As medicine becomes more targeted, markets for individual drugs may shrink, requiring different commercial strategies and potentially reducing peak sales projections.

Pfizer stands at a critical juncture as it approaches 2026 and beyond. The company possesses significant strengths, including a world-leading drug pipeline, strong oncology franchises, global infrastructure, and financial resources. However, the patent cliff threatens to erase billions in annual revenues, requiring successful execution across multiple fronts simultaneously.

The company’s strategy appears sound: invest heavily in R&D to generate new products, pursue strategic acquisitions to fill pipeline gaps and enter new markets, optimize operations to improve efficiency, and return capital to shareholders while maintaining growth investments. Success depends on execution quality and some degree of luck, as drug development inherently involves substantial uncertainty.

The oncology focus provides a clear strategic anchor, with the cancer therapeutics market offering substantial growth potential. The proposed entry into obesity treatments, while expensive and competitive, positions Pfizer in another high-growth market. Expansion in emerging markets and continued innovation in vaccines diversify revenue sources and reduce dependence on any single product or geography.

For investors, Pfizer presents a complex risk-reward profile. The dividend yield provides income while waiting for pipeline products to mature, but the patent cliff creates near-term revenue challenges. Long-term investors with confidence in management’s execution capabilities may find current valuations attractive, while those concerned about execution risk may prefer to wait for evidence of successful new product launches.

For the pharmaceutical industry, Pfizer’s experience over the coming years will provide valuable lessons. How the company navigates the patent cliff, integrates acquisitions, and commercializes pipeline products will influence strategic thinking across the sector. Success would validate the “blockbuster drug” model and demonstrate that large pharmaceutical companies can successfully renew their product portfolios. Significant struggles might accelerate industry trends toward more focused companies and different business models.

The transformation underway at Pfizer reflects broader pharmaceutical industry dynamics: the tension between the value of scale and the agility of focus, the challenge of replacing mature products with innovative new therapies, and the difficulty of predicting which scientific approaches will generate the next generation of breakthrough medicines. As we move through 2026 and beyond, Pfizer’s journey will offer insights into how established pharmaceutical leaders adapt to an industry undergoing fundamental change.

Reply