- Deep Research Global

- Posts

- Wendy's - SWOT Analysis (2026)

Wendy's - SWOT Analysis (2026)

The fast-food industry continues to face unprecedented challenges as consumer preferences shift and economic pressures mount.

Wendy’s International, LLC, the iconic square-burger chain founded by Dave Thomas in 1969, stands at a critical juncture. With Project Fresh turnaround strategy launched in October 2025 and ambitious plans for 2026, the company is charting a new course to reclaim its competitive edge.

This comprehensive analysis examines Wendy’s strengths, weaknesses, opportunities, and threats as the brand navigates the increasingly competitive quick-service restaurant sector.

Table of Contents

Image source: wendys.com

Understanding Wendy’s Current Market Position

As of the third quarter of 2025, Wendy’s operates more than 7,000 restaurants across more than 30 international markets. The company’s global systemwide sales reached $3.5 billion in Q3 2025, though this represents a 2.6% decrease year-over-year. While the U.S. market experienced a 4.4% decline in systemwide sales, international operations demonstrated resilience with 8.6% growth across all regions.

The company recently announced a strategic shift through Project Fresh, a comprehensive turnaround plan focused on brand revitalization, system optimization, operational excellence, and capital reallocation. This initiative comes at a crucial time when Wendy’s faces declining same-store sales of 4.7% in the U.S. market compared to competitors like McDonald’s and Burger King.

Strengths: Built on a Foundation of Quality

Brand Heritage and Quality Positioning

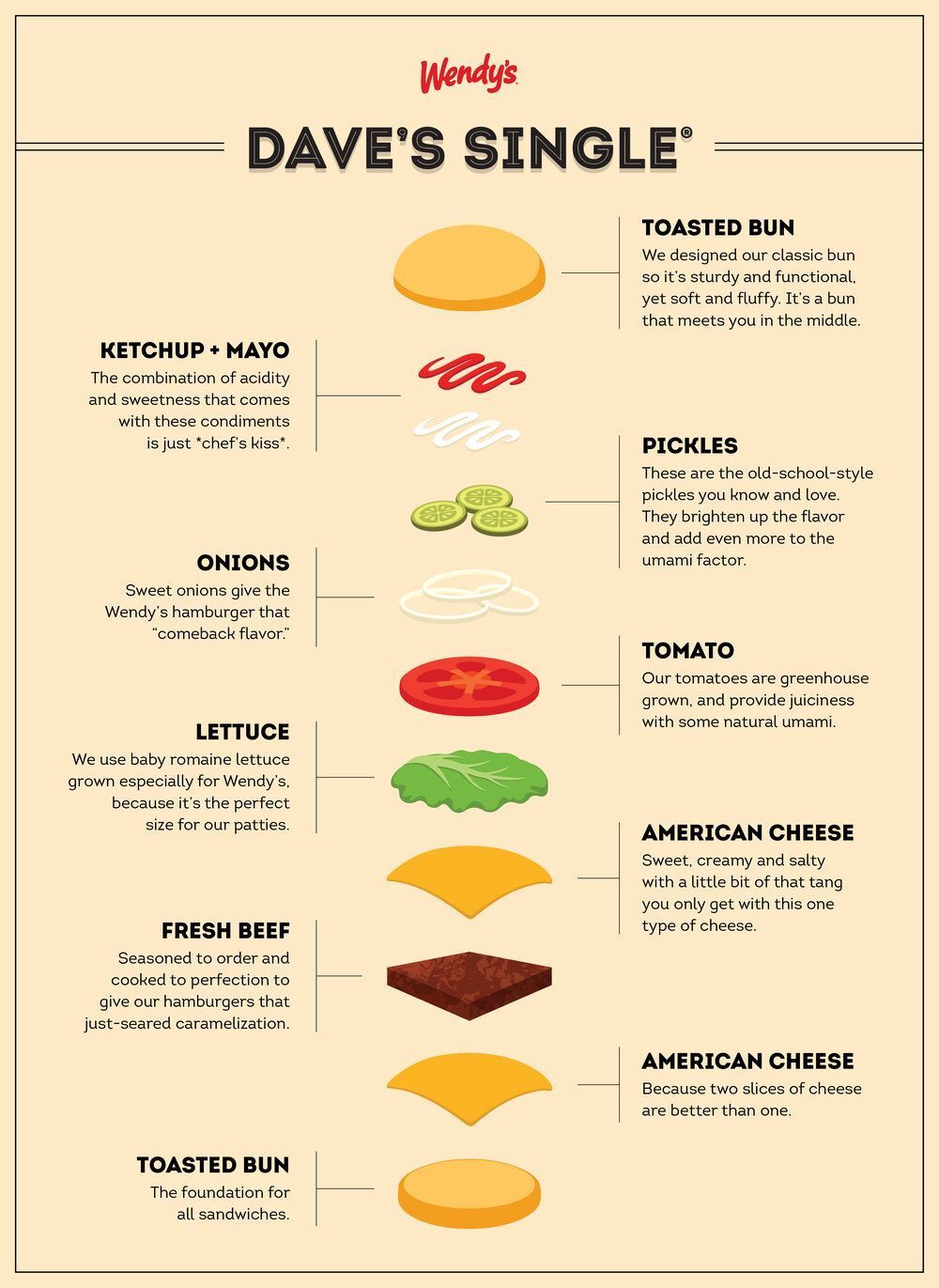

Wendy’s has maintained its commitment to “Quality is our Recipe” since its founding. The company’s dedication to fresh, never-frozen beef (available in the contiguous U.S., Alaska, Canada, and select international markets) remains a key differentiator in the fast-food industry. This quality-first approach has cultivated strong brand loyalty among consumers who value freshness and authenticity.

Image source: wendys.com

The brand’s signature square hamburgers, Frosty desserts, and fresh-prepared menu items have become iconic in American food culture. This distinctive brand identity provides Wendy’s with strong recognition and customer recall in a crowded marketplace.

International Growth Momentum

One of Wendy’s brightest spots is its international expansion trajectory. In the first half of 2025, Wendy’s opened 118 new restaurants globally, with particularly strong performance in international markets. The company has secured development agreements for 190 new restaurants across Italy and Armenia, demonstrating significant expansion potential beyond North America.

International systemwide sales grew 8.6% in Q3 2025, with same-restaurant sales growth of 3.0% in these markets. This international success provides a crucial growth engine as the company addresses challenges in its U.S. operations.

Company-Operated Restaurant Performance

Wendy’s company-operated restaurants have demonstrated superior execution compared to the overall system. During the third quarter of 2025, comparable sales at company-operated restaurants outperformed the system by 4%. This performance gap highlights the potential for operational improvements across the franchise network and validates the company’s operational excellence initiatives under Project Fresh.

Technology and Innovation Leadership

Wendy’s has positioned itself as a technology leader in the quick-service restaurant sector. The company’s FreshAI platform represents significant innovation in drive-thru automation. Developed in partnership with Google Cloud, FreshAI uses artificial intelligence to transform the drive-thru ordering experience with improved speed, accuracy, and consistency.

Image source: webkorps.com

By May 2025, Wendy’s deployed digital menu boards and FreshAI to over 500 restaurants, with plans for continued expansion. The company has also invested heavily in mobile app enhancements, self-service kiosks, and digital ordering platforms to meet evolving consumer preferences.

Strong Free Cash Flow Generation

Despite operational challenges, Wendy’s maintains robust financial fundamentals. The company generated adjusted EBITDA of $138.0 million in Q3 2025, representing a 2.1% increase year-over-year. The company also increased its free cash flow outlook by $35 million at the midpoint, demonstrating disciplined financial management and the ability to fund strategic initiatives while returning capital to shareholders through dividends and share repurchases.

Weaknesses: Challenges Requiring Strategic Response

Declining U.S. Market Performance

Wendy’s most significant weakness is the pronounced decline in U.S. same-restaurant sales, which fell 4.7% in Q3 2025. This underperformance relative to major competitors like McDonald’s and Burger King signals fundamental challenges in customer traffic and market share. The company’s decision to close up to 350 underperforming U.S. restaurants beginning in late 2025 and continuing through 2026 reflects the severity of these operational challenges.

U.S. systemwide sales decreased 4.4% in Q3 2025, with global systemwide sales down 2.6%. This declining trajectory requires urgent intervention through the Project Fresh turnaround strategy.

Limited Global Footprint Compared to Competitors

While Wendy’s international business shows strong growth, the company’s overall global presence remains limited compared to industry giants. With restaurants in approximately 30 markets versus McDonald’s presence in over 100 countries, Wendy’s lacks the geographic diversification of its largest competitors. This limited international footprint creates vulnerability to regional economic downturns and restricts revenue diversification opportunities.

Restaurant Margin Compression

U.S. company-operated restaurant margin declined to 13.1% in Q3 2025, down from 15.6% in the prior year. This 2.5 percentage point decrease resulted from commodity inflation, declining traffic, and labor rate inflation. While the company achieved some labor efficiencies and increased average check sizes, these gains were insufficient to offset cost pressures.

For the nine months ended September 28, 2025, U.S. company-operated restaurant margin was 14.7%, down from 15.8% in the prior year, indicating sustained pressure on profitability.

Franchise System Variability

Wendy’s predominantly franchised business model (representing approximately 95% of all locations) creates operational consistency challenges. The performance gap between company-operated restaurants (which outperformed by 4% in Q3 2025) and franchise locations highlights inconsistencies in execution, service quality, and customer experience across the system. Addressing this variability is central to the system optimization pillar of Project Fresh.

Marketing Effectiveness Concerns

Recognition that marketing efforts have not effectively reached target consumers led Wendy’s to retain Creed UnCo, led by former Taco Bell and Yum! Brands CEO Greg Creed, to transform marketing effectiveness. This acknowledgment of marketing shortcomings, combined with plans to simplify the marketing calendar and shift from broad promotions to more targeted efforts, suggests previous strategies have underdelivered in connecting with consumers.

Opportunities: Pathways to Future Growth

International Expansion Acceleration

International markets represent Wendy’s most significant growth opportunity. With 8.6% systemwide sales growth internationally and development agreements for 190 new restaurants across Italy and Armenia, the company is well-positioned for geographic expansion.

Latin America offers particular promise, with Wendy’s planning for more than 125 new restaurants across the region by 2028, using Mexico as a hub for growth. European expansion through the Italy agreement (up to 150 locations) represents entry into a large, affluent market with strong potential for the Wendy’s brand.

The company expects over 9% international net unit growth in 2026, significantly outpacing domestic expansion plans.

Digital Commerce and Technology Integration

The digital channel represents a $1.8 billion opportunity for Wendy’s. Continued investment in FreshAI, mobile app functionality, loyalty programs, and digital ordering platforms positions the company to capture growing digital sales. The deployment of digital menu boards and AI-powered ordering to over 500 restaurants in 2025 is just the beginning of this technological transformation.

Enhanced personalization through data analytics, improved mobile payment options, and seamless omnichannel experiences can drive customer engagement and increase transaction frequency and average order values.

Wendy’s successful launch of new chicken tenders in Q3 2025 demonstrates the potential for menu innovation to drive traffic and sales. Opportunities exist to expand breakfast offerings, develop plant-based alternatives, introduce limited-time offerings that leverage seasonal ingredients, and create premium menu tiers that command higher price points.

The company’s focus on optimizing labor and operating hours across dayparts suggests untapped potential in breakfast and late-night segments where Wendy’s has historically underperformed relative to some competitors.

Project Fresh Implementation

Project Fresh itself represents a comprehensive opportunity to transform Wendy’s operations. The four pillars (brand revitalization, system optimization, operational excellence, and capital reallocation) provide a roadmap for addressing current weaknesses while building on existing strengths.

Key initiatives include strengthening brand positioning to connect with next-generation customers, prioritizing AUV (Average Unit Volume) growth in the U.S., increasing investments in customer experience through hospitality and technology, and optimizing capital expenditures, including a reduction of approximately $20 million in Build to Suit program spending in 2025 with larger anticipated reductions in 2026.

Franchisee Partnership Enhancement

The “One Wendy’s” approach emphasizes stronger franchisee collaboration and support. By leveraging insights from top-performing company-operated restaurants and implementing returns-based approaches to franchisee investments, Wendy’s can improve system-wide performance, reduce operational variability, and increase franchisee profitability and satisfaction.

Threats: External Challenges and Competitive Pressures

Intense Fast-Food Industry Competition

Wendy’s faces aggressive competition from well-resourced rivals. McDonald’s maintains dominant market share with superior resources and global presence. Burger King continues to compete directly in the burger segment with promotional strategies and menu innovation. Fast-casual chains like Chipotle and Five Guys attract customers seeking higher-quality dining experiences.

The company’s 4.7% decline in U.S. same-store sales while competitors maintain steadier performance highlights the competitive pressure Wendy’s currently faces.

Image source: researchgate.net

Economic Pressures and Consumer Spending Patterns

Macroeconomic challenges significantly impact Wendy’s business. Inflation affects both consumer purchasing power and operational costs. Consumers are cutting back on dining out, particularly at fast-food establishments, as economic pressures mount. Rising commodity costs for beef, dairy, and other key ingredients compress margins.

Labor cost inflation continues to pressure profitability even as the company implements efficiency measures. Interest rate movements affect both consumer spending and the company’s debt servicing costs.

Changing Consumer Preferences

Long-term shifts in consumer preferences pose strategic challenges. Growing health consciousness drives demand for nutritious options that may not align with Wendy’s traditional menu strengths. Increasing interest in plant-based and alternative proteins requires menu adaptation.

Younger consumers (Gen Z and Millennials) prioritize sustainability, transparency, and social responsibility in ways that may require operational changes. Digital-first expectations among younger demographics demand continued technology investment.

Supply Chain Vulnerabilities

As an independent supply chain purchasing co-op model, Wendy’s faces potential disruptions in ingredient availability, transportation challenges, and supplier reliability issues. Any significant supply chain disruption could affect food quality, menu availability, and cost structure simultaneously.

Leadership Transition Uncertainty

Wendy’s is currently operating under interim CEO Ken Cook while the Board conducts a search for a permanent Chief Executive Officer, targeting completion by the end of 2025. Leadership transitions inherently create uncertainty about strategic direction, execution focus, and organizational stability during this critical turnaround period.

Strategic Implications for 2026 and Beyond

Immediate Priorities

For 2026, Wendy’s must successfully execute the Project Fresh turnaround strategy with measurable results in customer traffic, same-store sales, and restaurant margins. The company needs to complete the closure of underperforming U.S. restaurants while maintaining franchisee relationships and system morale.

Accelerating FreshAI deployment to more restaurants will be crucial for improving operational efficiency. Implementing enhanced marketing strategies developed with Creed UnCo should demonstrate improved consumer engagement and brand relevance.

The company must also complete the CEO transition and establish clear leadership direction for the next phase of growth.

Medium-Term Strategic Imperatives

Through 2026-2027, Wendy’s should achieve sustained improvement in U.S. comparable sales performance, demonstrating the effectiveness of operational excellence initiatives. Expanding international presence through the execution of development agreements in Italy, Armenia, and Latin America will diversify revenue streams.

The company must continue developing and scaling digital commerce capabilities to capture the full $1.8 billion opportunity. Improving restaurant-level economics through operational enhancements and AUV growth will strengthen the entire system.

Rebuilding brand momentum through effective marketing and customer experience improvements is essential for long-term competitiveness.

Long-Term Competitive Positioning

For sustained success beyond 2026, Wendy’s must establish clear differentiation in quality, freshness, and customer experience that justifies premium positioning. Building a more balanced portfolio of U.S. and international revenues will reduce geographic concentration risk.

Achieving operational excellence parity between company-operated and franchise restaurants should be a key metric. Developing robust innovation pipelines for menu, technology, and service delivery will maintain competitiveness.

Cultivating a organizational culture focused on accountability, customer-centricity, and continuous improvement will support sustainable performance.

Financial Outlook and Investor Considerations

For 2025, Wendy’s maintains guidance for global systemwide sales growth of negative 3% to 5%, adjusted EBITDA of $505 to $525 million, adjusted earnings per share of $0.82 to $0.89, and global net new unit growth of 2% to 3%. The company has improved its free cash flow outlook to $195 to $210 million (increased by $35 million at the midpoint) while reducing capital expenditures to $135 to $145 million (down from previous guidance of $165 to $175 million).

These adjustments reflect the strategic shift toward AUV growth over unit expansion in the U.S., with capital being reallocated to technology, marketing, and operational improvements rather than new restaurant development.

The company returned $40.7 million to shareholders through dividends and share repurchases in Q3 2025 and maintains its commitment to its regular quarterly dividend of $0.14 per share.

My Final Thoughts: A Brand at a Turning Point

Wendy’s International, LLC enters 2026 at a critical juncture. The company’s strong brand heritage, international growth momentum, technological innovation, and financial resources provide a solid foundation for recovery. However, significant challenges remain in reversing declining U.S. performance, competing effectively in an intense marketplace, and executing a comprehensive turnaround strategy.

Project Fresh represents a thoughtful, comprehensive approach to addressing Wendy’s challenges through brand revitalization, system optimization, operational excellence, and disciplined capital allocation. Success will require flawless execution across all four pillars, sustained commitment from leadership and franchisees, and patience as initiatives mature and deliver results.

The company’s international success demonstrates Wendy’s growth potential when properly positioned and executed. If the insights and operational excellence from these markets can be translated to the U.S. system, Wendy’s has the opportunity to restore its competitive position and create long-term value for franchisees, employees, and shareholders.

For investors, analysts, and industry observers, 2026 will be a pivotal year in determining whether Wendy’s can successfully execute its turnaround and reclaim its position as a thriving, growing quick-service restaurant brand. The combination of strategic clarity, operational focus, and adequate resources provides reason for cautious optimism, though tangible results in traffic, sales, and margins will ultimately validate the Project Fresh approach.

As consumer preferences continue to evolve and competitive pressures intensify, Wendy’s ability to differentiate through quality, innovation, and customer experience while maintaining operational efficiency will determine its success in 2026 and beyond.

Reply