- Deep Research Global

- Posts

- What a Federal Reserve Rate Cut Means for Your Finances?

What a Federal Reserve Rate Cut Means for Your Finances?

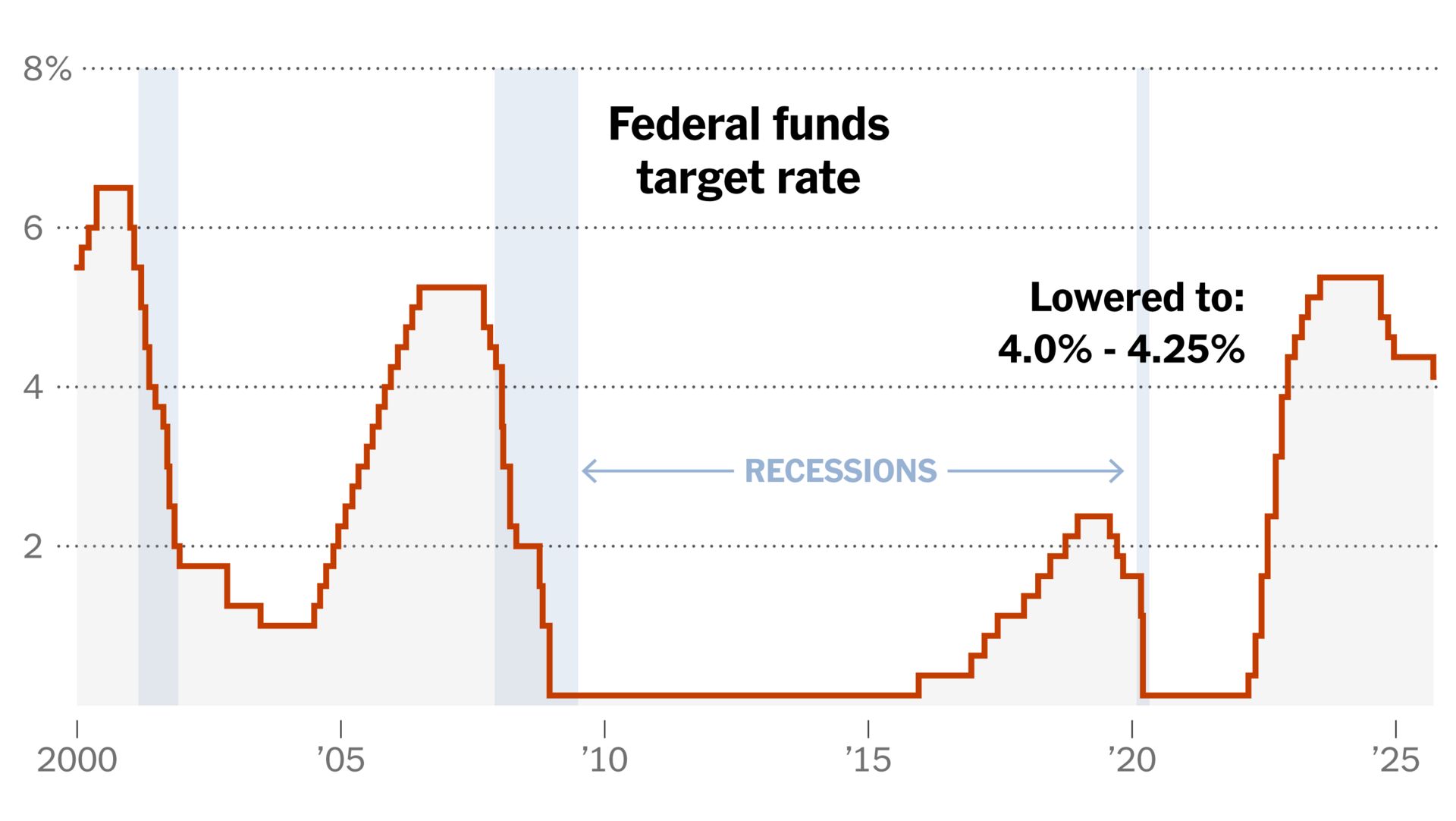

The Federal Reserve made headlines on October 29, 2025, by cutting interest rates for the second time this year, reducing the benchmark federal funds rate by a quarter percentage point to a range of 3.75% to 4.00%.

This marks the lowest rate since the end of 2022 and represents a significant shift in monetary policy as the central bank responds to concerns about the labor market and economic uncertainty.

For millions of Americans managing mortgages, credit cards, student loans, and savings accounts, understanding how this rate cut affects their financial situation is crucial.

While the Fed's decision signals an attempt to support economic growth and job creation, the actual impact on your wallet may vary considerably depending on the type of financial product you're using.

Table of Contents

Understanding the Federal Funds Rate and Its Ripple Effects

The federal funds rate is the interest rate at which banks lend money to each other overnight. While consumers don't directly borrow at this rate, it serves as the foundation for nearly every other interest rate in the economy. When the Fed adjusts this benchmark, the effects ripple through the entire financial system.

According to Chair Jerome Powell's statement, the Fed is focused on achieving maximum employment while keeping inflation at its 2% target. However, Powell indicated that future rate cuts may not be guaranteed, suggesting the central bank will remain cautious as it monitors economic conditions.

The prime rate, which banks charge their most creditworthy customers, typically sits about 3 percentage points above the federal funds rate.

Many consumer financial products are directly tied to the prime rate, meaning changes to the Fed's benchmark can translate into real differences in what you pay or earn.

Credit Cards: Slow Relief for High-Interest Debt

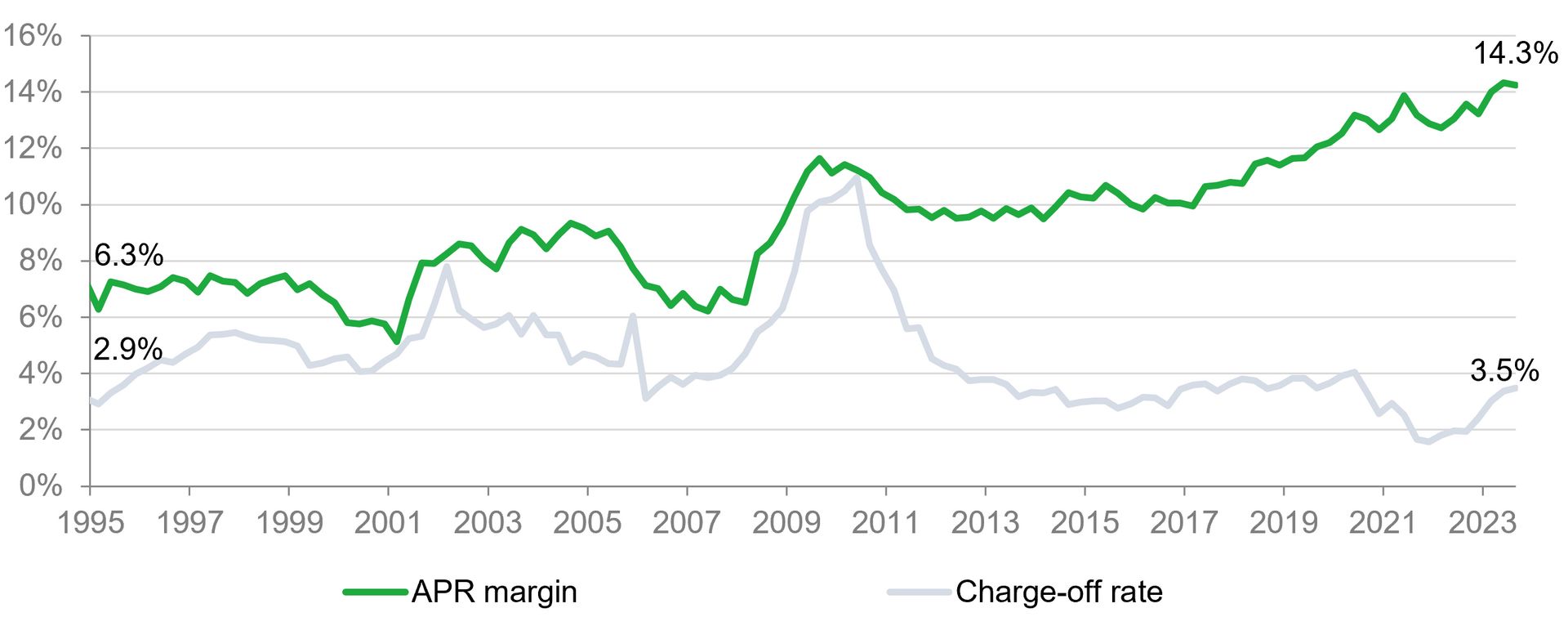

Credit card holders carrying balances may see some relief, but expectations should be tempered. As of October 2025, the average credit card APR stands at approximately 20.01%, according to Bankrate, remaining near historic highs despite the Fed's rate cutting cycle.

Since most credit cards have variable rates tied to the prime rate, cardholders should see their APRs adjust within one to two billing cycles after a Fed rate cut. However, the reduction may be modest. When the Fed cut rates by a full percentage point in the second half of 2024, CardRatings found that the average credit card rate fell by only 0.23% over the same period.

Stephen Kates, a financial analyst at Bankrate, put the savings into perspective: "A quarter-point rate cut is good, but it doesn't really change a lot for people carrying a balance on their credit card. We are talking about dollars per month."

To illustrate, consider someone with $7,000 in credit card debt at a 24.19% APR paying $250 monthly. A quarter-point rate reduction would save approximately $61 over the lifetime of the loan. While not insignificant, this modest relief underscores why aggressive debt repayment strategies remain essential for anyone carrying high-interest credit card balances.

With U.S. credit card debt reaching a record $1.21 trillion in the second quarter of 2025, an increase of $27 billion from the previous quarter, many Americans continue to struggle with high-cost debt.

Mortgages: Complex Relationship with Fed Policy

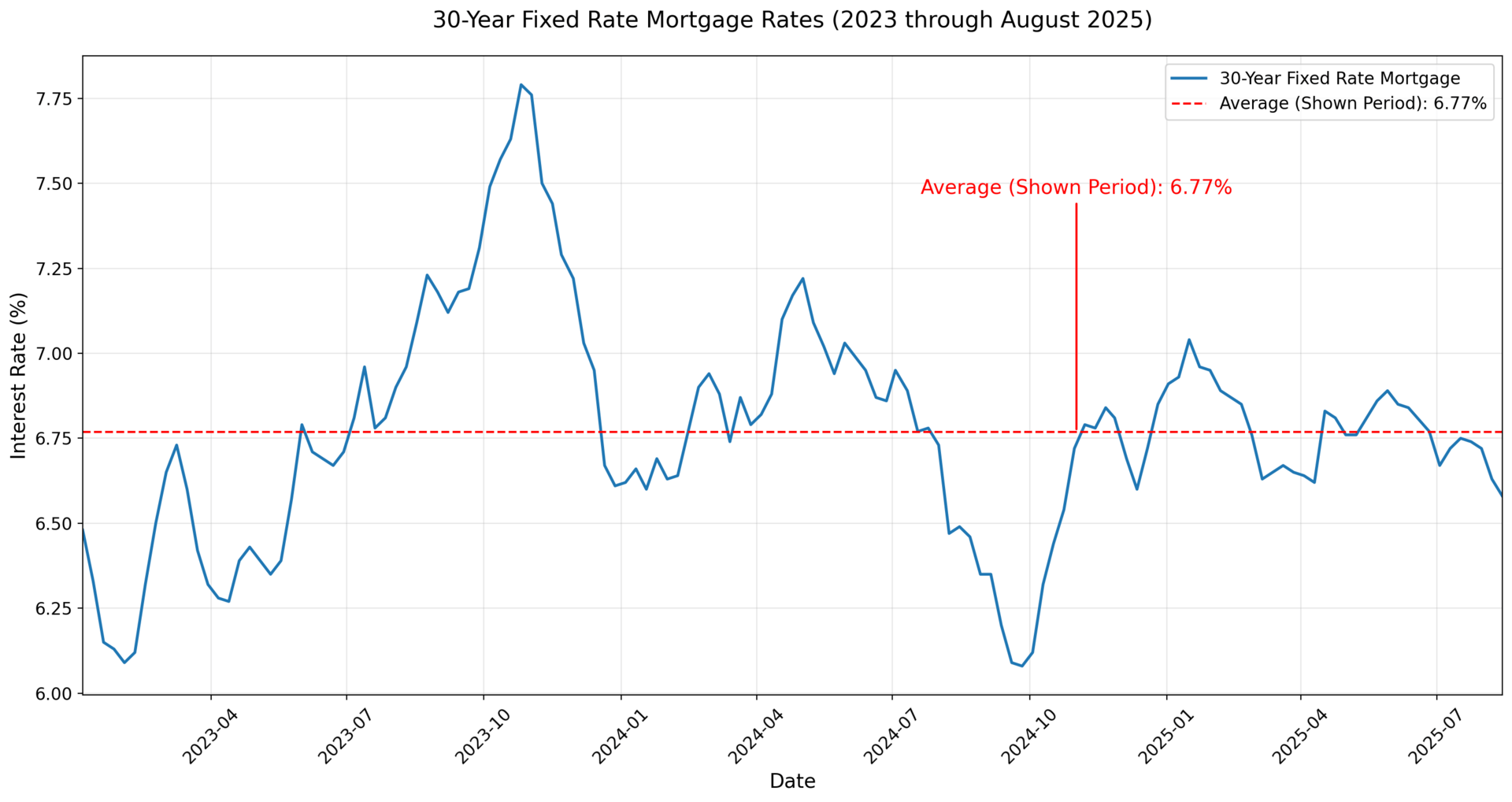

The relationship between Fed rate cuts and mortgage rates is more nuanced than many people realize. Unlike credit cards or home equity lines of credit, traditional 15-year and 30-year fixed-rate mortgages don't move in lockstep with the federal funds rate.

Fixed-rate mortgages are more closely tied to the yield on 10-year Treasury bonds, which responds to a variety of factors including inflation expectations, economic growth forecasts, and global investment demand. According to Freddie Mac, the average rate on a 30-year fixed-rate mortgage stood at 6.19% as of October 23, 2025, down from 6.54% a year earlier.

Sam Khater, Freddie Mac's chief economist, noted that "mortgage rates continued to trend down this week, hitting their lowest level in over a year," with rates dropping nearly a full percentage point from the start of 2025.

For prospective homebuyers, the indirect effects of Fed rate cuts could be meaningful. Michele Raneri, vice president at TransUnion, explained: "With another 25-basis-point reduction, a new home buyer securing a $350,000 mortgage at a 6.75% interest rate could potentially see their monthly payments fall by nearly $150." Over the lifetime of a 30-year mortgage, such savings can add up to tens of thousands of dollars.

However, current homeowners with existing fixed-rate mortgages won't see any immediate benefit unless they refinance. The refinancing decision depends on numerous factors including current equity, closing costs, how long you plan to stay in the home, and whether the new rate is significantly lower than your existing rate.

For those with adjustable-rate mortgages (ARMs) or home equity lines of credit (HELOCs), the impact is more direct. These variable-rate products typically adjust within two billing cycles after a Fed rate change, potentially providing more immediate relief for borrowers.

Auto Loans: Limited Immediate Impact

Auto loan rates, like mortgages, don't respond directly to Fed rate cuts. Instead, they generally track with the yield on five-year Treasury notes. As of September 2025, Edmunds reported that the average rate on new car loans was 7%, largely unchanged from a year earlier, while used car loan rates averaged 10.7%.

Since auto loans are typically fixed for the life of the loan, existing borrowers won't see any changes to their payments. However, potential car buyers could eventually benefit if borrowing costs decline further.

Joseph Yoon, Edmunds' consumer insights analyst, offered a measured perspective: "While another 25-basis-point rate cut may not drastically lower monthly payments, it could help lift consumer confidence. More importantly, it may signal that lenders and automakers are preparing to introduce additional financing incentives as we head into the holiday season."

For many shoppers who've been waiting for better deals, the combination of rate cuts and promotional financing offers from manufacturers could create more favorable buying opportunities in the coming months.

Student Loans: Fixed Rates Offer Stability

Federal student loan rates are set annually on July 1 based on the 10-year Treasury auction in May, meaning they won't change until mid-2026 regardless of what the Fed does. For the current academic year (July 1, 2025 through June 30, 2026), rates are:

Undergraduate loans: 6.39% (down from 6.53%)

Graduate and professional student loans: 7.94% (down from 8.08%)

PLUS loans (for graduate students and parents): 8.94% (down from 9.08%)

These rates are fixed for the life of the loan, providing predictability for borrowers.

Private student loans operate differently. Borrowers with variable-rate private loans may see their rates decrease in line with Fed cuts, potentially providing some relief. Those with fixed-rate private loans could consider refinancing to capture lower rates, though this decision requires careful consideration.

As higher education expert Mark Kantrowitz cautioned, refinancing federal loans into private loans means forgoing important benefits such as income-driven repayment plans, deferment and forbearance options, and potential loan forgiveness programs. This trade-off becomes especially relevant given that Trump's legislative agenda includes phasing out some federal repayment plans starting in 2028.

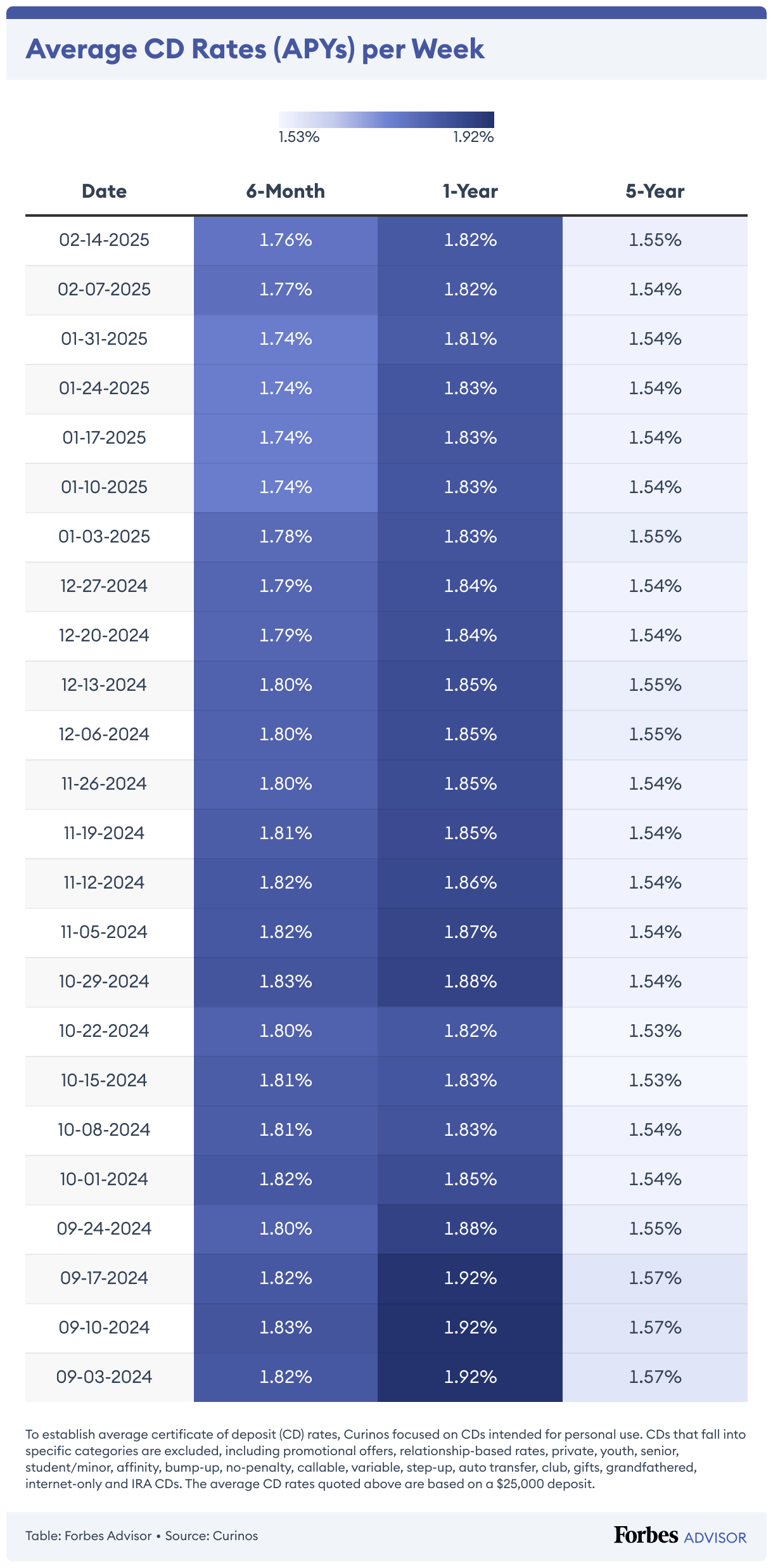

Savings Accounts and CDs: The Downside of Rate Cuts

While borrowers may celebrate lower rates, savers face a different reality. As the Fed cuts rates, banks quickly reduce the interest they pay on deposit accounts, diminishing the returns that savers have enjoyed over the past couple of years.

According to Bankrate, the national average savings account rate recently stood at just 0.62%. However, top-yielding online savings accounts and certificates of deposit still offer rates exceeding 4%, though these are declining as the Fed's rate-cutting cycle continues.

Matt Schulz of LendingTree emphasized the urgency for savers: "Yields on high-interest savings accounts and CDs are only going to keep dropping. It is likely time to act to lock in available high rates."

For those considering CDs, timing is important. Once you lock in a rate on a certificate of deposit, that rate remains fixed for the term of the CD, regardless of what happens to interest rates afterward. This makes current rates potentially attractive for those willing to commit funds for a specific period.

The yield on the Crane 100 Money Fund Index, which tracks the largest money-market funds, stood at 3.92% as of late October 2025, down from 5.13% at the end of June 2024. While still above the rate of inflation, this represents a significant decline in just a few months.

Investopedia reports that even after adjustments, many top high-yield accounts will still pay upper-3% rates, with many remaining above 4%, meaning it's still worthwhile to shop around for competitive rates.

Strategic Financial Moves in a Declining Rate Environment

Given the Fed's current stance, consumers can take several strategic actions to optimize their financial positions:

For Borrowers with High-Interest Debt

The most impactful move for those carrying credit card debt is to explore balance transfer cards or debt consolidation loans. Even with modest Fed rate cuts, the spread between credit card rates (averaging over 20%) and personal loan rates (typically in the single digits to low teens for qualified borrowers) can generate substantial savings.

Financial experts recommend consolidating high-interest debt before rates drop further, as personal loan rates tend to follow Fed cuts. However, consumers should carefully review terms, including balance transfer fees and the APR that will apply after introductory periods expire.

For Potential Homebuyers

Those considering purchasing a home should monitor mortgage rates closely and get preapproved with multiple lenders to compare offers. Even small differences in interest rates can translate into significant savings over the life of a 30-year mortgage.

Prospective buyers should obtain multiple quotes on the same day (since rates fluctuate daily) from a mix of mortgage brokers, banks, and credit unions. Compare not just the interest rate, but also discount points and lender fees. The annual percentage rate (APR) provides a more complete picture of total costs.

For Savers

With deposit rates declining, savers should act strategically:

Lock in current CD rates if you have funds you won't need for a specific period. Consider a CD ladder strategy, where you spread funds across CDs with different maturity dates to maintain some liquidity while capturing higher rates.

Shop around aggressively for high-yield savings accounts. Online banks typically offer rates far exceeding those of traditional brick-and-mortar institutions. According to recent data, the difference between the national average (0.62%) and top online savings accounts (4%+) represents hundreds of dollars in annual interest on even modest balances.

Consider I Bonds for inflation protection. While not directly related to Fed policy, Series I Savings Bonds adjust for inflation and currently offer attractive risk-free returns for those who can commit funds for at least one year.

For Investors

The Fed's rate policy affects investment markets in complex ways. Generally, lower rates can boost stock prices by making equities more attractive relative to bonds and by reducing borrowing costs for companies. However, if rate cuts signal serious economic concerns, market reactions can be unpredictable.

Diversification remains crucial, and many financial advisors suggest reviewing portfolio allocations as the interest rate environment shifts. Fixed-income investments may need rebalancing as bond yields change.

What's Next: Future Fed Policy and Economic Outlook

While the October 29 rate cut was widely anticipated, the Fed's future path remains uncertain. Chair Powell suggested that another rate cut in December is not guaranteed, indicating the central bank will take a cautious, data-dependent approach.

Several factors will influence future Fed decisions:

Labor Market Conditions: The Fed has expressed concern about employment trends, with recent layoffs at major companies adding uncertainty. A weakening job market could prompt additional rate cuts, while resilient employment might pause the cutting cycle.

Inflation Trajectory: The Fed's 2% inflation target remains paramount. If inflation proves stickier than anticipated, rate cuts may slow or stop. Conversely, if inflation continues moderating, additional cuts become more likely.

Economic Growth: Overall economic performance, including GDP growth, consumer spending, and business investment, will factor heavily into Fed deliberations.

Political Pressure: President Trump has repeatedly called for more aggressive rate cuts, creating an unusual dynamic. However, the Fed's independence allows it to make decisions based on economic conditions rather than political preferences.

The ongoing government shutdown has complicated the Fed's job by depriving officials of crucial economic data normally collected by federal workers. This uncertainty makes projecting the Fed's path more challenging than usual.

The Bottom Line

The Federal Reserve's October 2025 rate cut to a 3.75% to 4.00% range represents a meaningful shift in monetary policy, but its impact on individual finances varies widely depending on the specific financial products involved.

Credit card holders will see modest relief that shouldn't change fundamental debt repayment strategies. Mortgage rates have already declined significantly and may continue dropping, creating opportunities for buyers and refinancers. Auto loan rates remain elevated, though promotional financing may become more available. Student loan borrowers with federal loans won't see immediate changes, while those with variable-rate private loans may benefit. Savers face declining returns and should act quickly to lock in rates before they fall further.

As CNN financial analysts note, the key for consumers is to be proactive rather than reactive. Review your debts, savings, and overall financial situation to identify opportunities to benefit from the changing rate environment.

While nobody can predict exactly where rates will go from here, staying informed and taking strategic action based on your personal circumstances will help you maximize the benefits and minimize the drawbacks of the Fed's evolving monetary policy.

Reply