- Deep Research Global

- Posts

- Applied Materials - SWOT Analysis Report (2026)

Applied Materials - SWOT Analysis Report (2026)

Applied Materials $AMAT ( ▼ 5.57% ) stands as the world’s largest semiconductor equipment manufacturer, positioned at the nexus of technological transformation driving artificial intelligence, advanced computing, and next-generation electronics.

As the semiconductor industry prepares for unprecedented growth through 2026, understanding Applied Materials’ strategic position becomes essential for investors seeking to capitalize on the AI revolution and digital infrastructure expansion.

Our comprehensive SWOT analysis examines Applied Materials’ strategic position and threats as it navigates the global semiconductor equipment market.

Table of Contents

Company Overview: Foundation of Modern Electronics Manufacturing

Applied Materials operates at the critical intersection where materials science meets semiconductor innovation. Headquartered in Santa Clara, California, the company provides the manufacturing equipment, services, and software that enable the production of virtually every new chip and advanced display worldwide.

The company’s fiscal 2025 performance demonstrates remarkable resilience. Applied Materials reported record annual revenue of $28.37 billion, representing a 4 percent year-over-year increase, with non-GAAP earnings per share of $9.42, up 9 percent from the previous year.

This marks the company’s sixth consecutive year of growth, with revenue and earnings growing at annualized rates of approximately 12 percent and 20 percent respectively over this period.

Business Segment Performance

FISCAL 2025 REVENUE BREAKDOWN

Semiconductor Systems: $20.8 billion (73% of total revenue)

Applied Global Services: $6.4 billion (23% of total revenue)

Display and Other: $1.2 billion (4% of total revenue)

Total Annual Revenue: $28.4 billion

The company’s Semiconductor Systems segment serves three primary markets: foundry, logic, and other (67 percent), DRAM memory (26 percent), and flash memory (7 percent). Applied Global Services delivered record revenue with more than two-thirds generated from recurring subscriptions, providing critical revenue stability.

STRENGTHS: Competitive Moats Driving Market Leadership

Dominant Market Position and Technology Leadership

Applied Materials commands the largest share of the global semiconductor equipment market at 32.9 percent, significantly ahead of key competitors. This leadership position stems from decades of innovation and strategic positioning at critical technology inflections.

The company holds particularly strong positions in specific equipment categories:

Equipment Category | Market Share | Strategic Significance |

|---|---|---|

Deposition Equipment | 44% | Leading position in critical film formation |

Chemical Vapor Deposition | Dominant | Essential for advanced logic and memory |

Physical Vapor Deposition | Market Leader | Critical for metallization processes |

Ion Implantation | Strong Position | Key for transistor manufacturing |

Comprehensive Product Portfolio Across Critical Technologies

Applied Materials maintains the broadest portfolio of capabilities in the semiconductor equipment industry. The company’s product range spans the entire semiconductor manufacturing process, from wafer preparation through packaging, providing customers with integrated solutions that competitors struggle to match.

President and CEO Gary Dickerson emphasized this positioning during the fiscal 2025 earnings call: “We are well positioned at the highest value technology inflections in the fastest growing areas of the market, enabling us to extend our leadership in leading-edge logic, DRAM, and advanced packaging.”

Next-Generation Technology Innovations for AI Era

In October 2025, Applied Materials unveiled three groundbreaking systems specifically designed to accelerate AI chip performance:

Centura Xtera Epi System

This advanced epitaxy system enables production of Gate-All-Around transistors at 2-nanometer nodes and beyond. The technology creates void-free source-drain structures that deliver superior performance and power efficiency compared to previous-generation FinFET transistors.

VeritySEM E600 System

Incorporating cold field emission technology, this electron-beam metrology system increases nanoscale image resolution by up to 50 percent and imaging speed by up to 10 times. This capability proves essential for high-bandwidth memory production supporting AI applications.

Kinex Bonding System

The industry’s first integrated die-to-wafer hybrid bonding system uses direct copper-to-copper bonds, significantly improving chip performance and power consumption. This technology addresses critical bottlenecks in advanced packaging for AI processors and high-performance computing.

Research and Development Investment Driving Innovation

Applied Materials maintains aggressive R&D investment to sustain its technology leadership. In fiscal 2025, the company invested $3.6 billion in research, development, and engineering, representing 12.6 percent of revenue. This commitment exceeds many competitors’ R&D intensity ratios and supports continuous innovation across multiple technology platforms.

R&D INVESTMENT TRAJECTORY

Fiscal 2025: $3.57 billion (12.6% of revenue)

Fiscal 2024: $3.23 billion (11.9% of revenue)

Growth Rate: 10.5% year-over-year

The company operates advanced research facilities globally, including collaborative centers with leading research institutions. In June 2025, Applied Materials and CEA-Leti expanded their joint laboratory focused on device innovations for IoT, communications, automotive, power, and sensor markets.

Applied Global Services: Recurring Revenue Foundation

The Applied Global Services segment represents a strategic competitive advantage, generating $6.4 billion in fiscal 2025 revenue. More than two-thirds of AGS revenue comes from recurring subscriptions, providing predictable cash flows that buffer equipment sales volatility.

AGS performance metrics demonstrate strong momentum:

Metric | Fiscal 2025 Performance |

|---|---|

Total AGS Revenue | $6.4 billion (record) |

Year-over-Year Growth | 3% |

Recurring Revenue Growth | Double-digit percentage |

Operating Margin | 28.1% |

This subscription-based model creates customer dependency on Applied Materials’ service ecosystem, generating ongoing revenue long after initial equipment sales. As installed base grows, AGS revenue potential expands proportionally.

Strong Financial Performance and Capital Structure

Applied Materials maintains robust financial health with strong profitability metrics and efficient capital deployment. The company’s fiscal 2025 financial highlights include:

FISCAL 2025 FINANCIAL PERFORMANCE

Gross Margin (Non-GAAP): 48.8%

Operating Margin (Non-GAAP): 30.2%

Return on Equity: 34.8%

Free Cash Flow: $5.7 billion

Cash and Investments: $12.9 billion

The company’s gross margin expanded 120 basis points year-over-year to 48.8 percent, demonstrating pricing power and operational leverage. Operating margins of 30.2 percent exceed most equipment manufacturing peers, reflecting the value of Applied’s technology leadership.

Geographic Diversification and Global Manufacturing Footprint

Applied Materials serves customers across all major semiconductor manufacturing regions, providing geographic diversification that mitigates country-specific demand fluctuations. Fiscal 2025 revenue distribution demonstrates balanced global presence:

Region | Revenue | Percentage |

|---|---|---|

China | $8.5 billion | 30% |

Taiwan | $6.9 billion | 24% |

Korea | $5.6 billion | 20% |

United States | $3.1 billion | 11% |

Japan | $2.3 billion | 8% |

Others | $2.0 billion | 7% |

This geographic diversification provides resilience against regional economic downturns while positioning Applied Materials to serve customers wherever semiconductor manufacturing capacity expands.

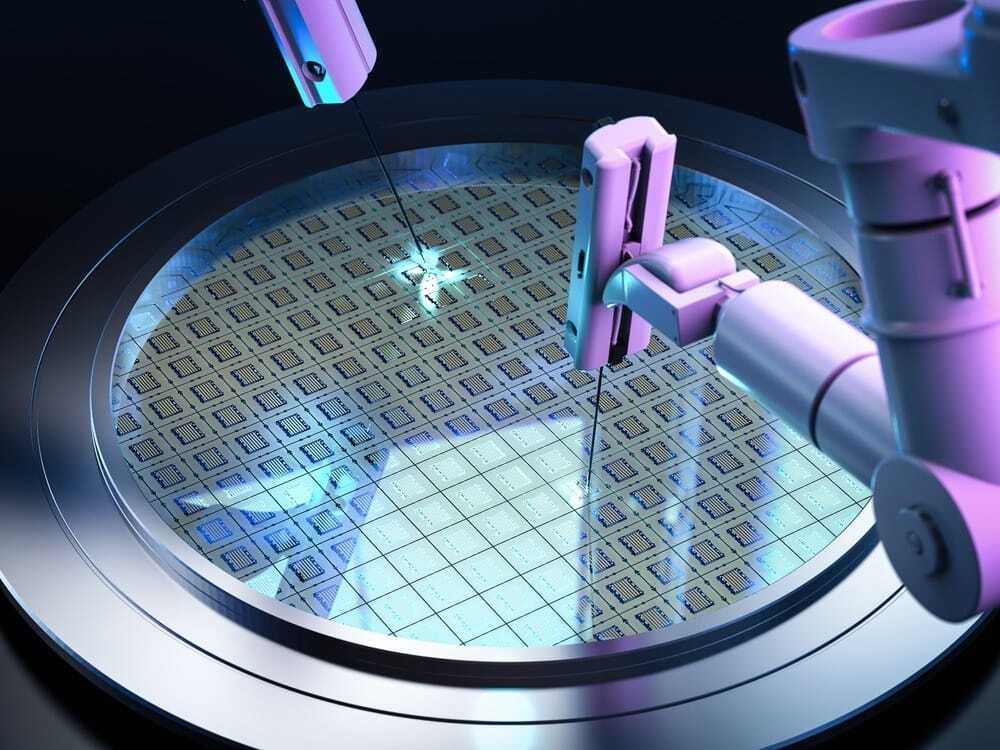

Image source: embedded.com

WEAKNESSES: Vulnerabilities and Strategic Challenges

Significant China Exposure Amid Geopolitical Tensions

China’s 30 percent revenue contribution in fiscal 2025 represents Applied Materials’ most significant strategic vulnerability. Escalating U.S. export restrictions on advanced semiconductor manufacturing equipment have progressively constrained the company’s accessible market in China.

Recent regulatory developments demonstrate this challenge’s magnitude. In October 2025, new export restrictions resulted in an expected $710 million revenue reduction, representing approximately 2.5 percent of annual revenue. China’s revenue share declined from 37 percent in fiscal 2024 to 30 percent in fiscal 2025, with further declines anticipated in 2026.

CHINA REVENUE TREND AND PROJECTIONS

Fiscal 2024: $10.1 billion (37% of revenue)

Fiscal 2025: $8.5 billion (30% of revenue)

Q4 FY2025: $2.0 billion (29% of revenue)

Fiscal 2026 Est: Lower absolute dollars and percentage

These restrictions create several compounding challenges. First, they reduce the addressable market size without providing alternative revenue sources. Second, they enable Chinese competitors to gain market share in segments where Applied Materials can no longer compete. Third, they introduce uncertainty that complicates long-term strategic planning and capacity investments.

Cyclical Industry Dynamics Creating Revenue Volatility

The semiconductor equipment industry exhibits pronounced cyclical characteristics tied to broader semiconductor demand cycles. These cycles, typically lasting 3-5 years, create significant revenue and earnings volatility that challenges predictable growth trajectories.

Applied Materials’ fiscal 2025 performance illustrates this cyclicality. While the company achieved record annual revenue, quarterly revenue declined 3 percent year-over-year in Q4, and the company experienced unfavorable market mix as fastest-growing segments favored competitors’ technologies.

Recent industry analysis suggests traditional semiconductor cycles may be evolving, potentially becoming less predictable as AI demand creates new demand patterns. This uncertainty complicates inventory management, capacity planning, and workforce optimization.

Despite overall market leadership, Applied Materials holds limited or no share in several high-growth equipment categories, constraining participation in the fastest-expanding market segments.

Most significantly, Applied Materials has minimal presence in extreme ultraviolet lithography, where ASML holds monopolistic control. In fiscal 2025, leading-edge foundry-logic investment concentrated heavily on advanced lithography equipment, a segment generating substantial capital equipment demand where Applied Materials cannot compete.

COMPETITIVE SHARE GAPS IN KEY SEGMENTS

EUV Lithography: 0% (ASML monopoly)

Advanced Immersion Litho: Limited

Certain Etch Applications: Lower than competitors

Specific Metrology Tools: Secondary position

This positioning limited Applied Materials’ growth in fiscal 2025 as lithography equipment captured disproportionate wafer fab equipment spending. While management characterizes strong lithography investment as a positive leading indicator for subsequent process equipment demand, the company captures revenue only when customers invest in complementary tools.

Dependence on Small Number of Major Customers

The semiconductor manufacturing industry’s concentrated structure creates customer concentration risk for equipment suppliers. A small number of leading-edge manufacturers account for disproportionate capital equipment spending, with companies like Taiwan Semiconductor Manufacturing Company, Samsung, and Intel representing substantial revenue portions.

This concentration creates several vulnerabilities:

Revenue Concentration Risk

A single customer’s decision to delay or cancel capacity expansion directly impacts Applied Materials’ quarterly results. Major customers possess significant negotiating leverage, potentially pressuring equipment pricing and payment terms.

Technology Direction Dependency

Applied Materials’ R&D priorities must align with major customers’ technology roadmaps. If the company misreads customer technology preferences, significant R&D investments may generate limited return.

Competitive Displacement Risk

Major customers actively manage supplier diversification to avoid dependence on single equipment providers. This strategy can result in Applied Materials losing tool-of-record positions to competitors, even when holding technical advantages.

Complex Global Operations Creating Execution Risk

Applied Materials operates an intricate global supply chain spanning multiple countries, incorporating thousands of suppliers, and supporting customers across diverse regulatory environments. This complexity introduces operational risks that can impact profitability and customer satisfaction.

The company’s global footprint requires managing:

Supply chain resilience across geographically dispersed suppliers

Compliance with export regulations across multiple jurisdictions

Quality control across international manufacturing facilities

Workforce management in regions with varying labor market dynamics

Currency exchange rate fluctuations impacting costs and pricing

OPPORTUNITIES: Growth Vectors Through 2026 and Beyond

AI Computing Revolution Driving Multi-Year Growth Cycle

Artificial intelligence represents the most significant growth opportunity for semiconductor equipment manufacturers in decades. AI computing’s voracious appetite for advanced semiconductors drives unprecedented investment in manufacturing capacity, with Applied Materials positioned to capture substantial share.

Recent SEMI forecasts project global semiconductor equipment sales reaching $145 billion in 2026 and $156 billion in 2027, representing growth of 9 percent and 7.6 percent, respectively. AI-driven demand accounts for a substantial portion of this growth, with data center build-outs requiring massive quantities of advanced logic and high-bandwidth memory chips.

SEMICONDUCTOR EQUIPMENT MARKET FORECAST

2025: $133 billion (13.7% growth)

2026: $145 billion (9.0% growth)

2027: $156 billion (7.6% growth)

Key Growth Drivers:

- AI processor manufacturing capacity

- High-bandwidth memory production

- Advanced packaging infrastructure

- Leading-edge logic node transitions

Applied Materials’ technology portfolio aligns precisely with AI chip manufacturing requirements. The company’s newly introduced Kinex hybrid bonding system addresses critical packaging bottlenecks for AI processors, while advanced deposition and metrology systems support high-bandwidth memory production.

CEO Gary Dickerson articulated this opportunity during the recent earnings call: “Based on our conversations with our customers and partners, we are preparing Applied’s operations and service organizations to be ready to support higher demand beginning in the second half of calendar 2026.”

Advanced Packaging Market Expansion

Advanced packaging represents one of semiconductor technology’s fastest-growing segments, with Applied Materials holding strong competitive positions. As traditional two-dimensional chip scaling approaches physical and economic limits, three-dimensional packaging technologies enable continued performance improvements through heterogeneous integration.

The advanced packaging equipment market demonstrates exceptional growth dynamics:

Technology | Growth Driver | Applied Materials Position |

|---|---|---|

Hybrid Bonding | AI processors, HBM | Industry-leading Kinex system |

Through-Silicon Via | 3D memory, sensors | Established market share |

Wafer-Level Packaging | Mobile, IoT devices | Comprehensive tool portfolio |

Chiplet Integration | Disaggregated designs | Enabling technologies |

Applied Materials estimates the advanced packaging equipment market will grow from approximately $5 billion in 2025 to over $10 billion by 2030, representing a compound annual growth rate exceeding 15 percent. The company’s integrated approach, combining deposition, metrology, and bonding capabilities, positions it to capture disproportionate share of this expansion.

Gate-All-Around Transistor Technology Transition

The semiconductor industry’s transition from FinFET to Gate-All-Around transistor architecture at 2-nanometer nodes and below creates substantial equipment demand aligned with Applied Materials’ core strengths. GAA transistors provide superior electrical control and power efficiency compared to FinFETs, but require fundamentally different manufacturing processes.

Applied Materials’ Centura Xtera Epi system specifically targets GAA transistor manufacturing, enabling void-free source-drain structures critical for optimal device performance. This technology advantage positions the company to capture significant share as leading-edge manufacturers transition to GAA architectures in 2026 and 2027.

Industry analysts project leading-edge logic equipment spending will increase substantially as GAA transitions from development to volume production. Taiwan Semiconductor Manufacturing Company, Samsung, and Intel have all announced GAA production timelines, with volume ramps expected to drive equipment purchases totaling billions of dollars annually.

High-Bandwidth Memory Market Growth

AI computing’s insatiable demand for memory bandwidth drives rapid expansion in high-bandwidth memory production capacity. HBM combines multiple memory dies in three-dimensional stacks, requiring specialized equipment for die preparation, hybrid bonding, and testing.

Recent market reports indicate memory manufacturers face unprecedented HBM demand, with production capacity constrained through 2026. This supply-demand imbalance drives aggressive capacity expansion by Samsung, SK Hynix, and Micron Technology, each investing billions in HBM manufacturing infrastructure.

Applied Materials supplies critical equipment across the HBM manufacturing process:

Advanced deposition systems for thin film formation

Electron-beam metrology for nanoscale inspection

Chemical mechanical planarization for wafer thinning

Hybrid bonding systems for die stacking

The company’s comprehensive HBM equipment portfolio positions it to benefit from multi-year capacity expansion, with HBM-related equipment revenue potentially reaching $2-3 billion annually by 2027.

Emerging Market Expansion and Fab Diversification

Global semiconductor manufacturing diversification creates expansion opportunities beyond traditional strongholds in Taiwan, Korea, and the United States. Countries including India, Japan, and various European nations pursue semiconductor manufacturing capacity to enhance supply chain resilience and technological sovereignty.

India Semiconductor Initiative

Applied Materials announced plans in 2025 to build a collaborative engineering center in Bangalore focused on semiconductor equipment development. This $400 million investment positions the company to support India’s emerging semiconductor manufacturing ecosystem while accessing engineering talent.

India’s semiconductor ambitions extend beyond design into manufacturing, with the government providing substantial incentives for fab construction. As Indian manufacturers select equipment suppliers, Applied Materials’ local presence provides competitive advantage.

Japan Fab Resurgence

Japan’s government actively supports domestic semiconductor manufacturing expansion through financial incentives and strategic partnerships. Companies like Rapidus pursue leading-edge manufacturing capabilities, creating equipment demand opportunities for Applied Materials.

European Semiconductor Strategy

The European Union’s strategy to double semiconductor production by 2030 drives fab construction across multiple countries. Applied Materials’ established European presence, including the expanded CEA-Leti collaboration, positions the company to benefit from this regional growth.

Service Business Expansion Through Installed Base Growth

Applied Global Services presents significant organic growth opportunity as the company’s equipment installed base expands. Each new system sale creates decades of potential service revenue through spare parts, upgrades, and maintenance contracts.

The AGS business model demonstrates attractive characteristics:

AGS BUSINESS MODEL ADVANTAGES

Recurring Revenue: 67% of AGS revenue from subscriptions

Higher Margins: Operating margins ~28% vs 32% for systems

Revenue Visibility: Multi-year service contracts predictability

Counter-Cyclical: Service demand continues during downcycles

Growth Trajectory: Double-digit core growth in fiscal 2025

As semiconductor manufacturers operate increasingly complex and expensive equipment, outsourced service becomes economically attractive. Applied Materials can leverage its original equipment manufacturer position to offer superior service capabilities compared to third-party providers.

CFO Brice Hill emphasized this opportunity: “In 2025, our core service business delivered another year of double-digit growth, with more than two-thirds of our service revenue generated from subscriptions.”

The company projects AGS revenue growing faster than equipment revenue over the next several years as installed base expansion, service contract penetration increase, and upgrade opportunities multiply.

Image source: azom.com

THREATS: External Risks and Competitive Pressures

Escalating U.S.-China Technology Tensions

Geopolitical friction between the United States and China represents Applied Materials’ most significant external threat. The U.S. government’s increasingly restrictive approach to advanced semiconductor technology exports creates multiple risk vectors that could substantially impact revenue and profitability.

Recent export control expansions demonstrate this threat’s evolving nature. In October 2025, new restrictions immediately reduced Applied Materials’ addressable China market by $710 million annually. Additional restrictions could further constrain the company’s ability to serve Chinese customers, potentially eliminating substantial revenue streams.

The geopolitical risk extends beyond direct export restrictions:

Retaliatory Actions

China has implemented export controls on rare earth materials critical for semiconductor manufacturing equipment. These restrictions could increase Applied Materials’ manufacturing costs or create supply disruptions.

Customer Diversification

Chinese chipmakers actively develop relationships with non-U.S. equipment suppliers to reduce dependence on American technology. Japanese and European competitors may gain market share in China at Applied Materials’ expense.

Technology Bifurcation

Persistent U.S.-China tensions could fracture global semiconductor technology standards, forcing equipment manufacturers to maintain separate product lines for different markets, increasing R&D and manufacturing costs.

Intensifying Competition from Global Equipment Manufacturers

Applied Materials faces sophisticated competition from well-capitalized rivals across multiple equipment categories. These competitors pursue aggressive technology development and customer relationships that threaten Applied Materials’ market positions.

Primary Competitors and Competitive Dynamics

Competitor | Market Position | Competitive Strengths | Threat Level |

|---|---|---|---|

Lam Research | 25% market share | Etch leadership, strong R&D | High |

ASML | EUV monopoly | Lithography dominance | Medium |

Tokyo Electron | 9% market share | Broad portfolio, Japan strength | Medium |

KLA Corporation | Metrology leader | Inspection technology | Medium |

Lam Research presents the most direct competitive threat, holding second position in overall market share at 25.1 percent. Lam’s leadership in etching equipment and aggressive R&D investment enable it to compete effectively in shared markets while defending category dominance.

Competition intensifies particularly in emerging technology areas where market positions remain fluid. Advanced packaging, Gate-All-Around transistors, and AI-specific manufacturing processes create opportunities for competitors to displace incumbents through technological differentiation.

Semiconductor Industry Cyclicality and Demand Volatility

Despite AI-driven growth optimism, semiconductor equipment demand remains fundamentally cyclical. Industry downturns, whether triggered by macroeconomic conditions, inventory corrections, or technology transitions, can rapidly reduce capital equipment spending.

Historical semiconductor cycles demonstrate this volatility’s potential severity. During previous downturns, equipment manufacturer revenues declined 30-50 percent over 12-18 month periods, with profitability deteriorating more sharply due to operating leverage.

Several factors could trigger near-term cyclical downturns:

Memory Market Overcapacity

Aggressive HBM capacity expansion could create oversupply by 2027-2028, leading to margin compression and reduced capital spending. Memory equipment represents significant portion of Applied Materials’ revenue, making the company vulnerable to memory market corrections.

AI Demand Uncertainty

While AI currently drives robust equipment demand, questions remain about AI adoption sustainability and return on investment for large-scale deployments. If AI demand disappoints, data center build-outs could decelerate, reducing semiconductor equipment requirements.

Macroeconomic Headwinds

Global economic slowdown, interest rate volatility, or geopolitical conflicts could reduce end-market demand for electronics, cascading into reduced semiconductor production and equipment spending.

Technology Disruption and Changing Manufacturing Paradigms

Fundamental shifts in semiconductor manufacturing technology could obsolete portions of Applied Materials’ product portfolio or create opportunities for new competitors. Several emerging technology trends present potential disruption risks:

Alternative Computing Architectures

Quantum computing, neuromorphic chips, and other non-traditional architectures could reduce demand for conventional silicon-based semiconductors, diminishing equipment market size.

Consolidated Manufacturing Processes

New manufacturing techniques that combine or eliminate process steps could reduce overall equipment unit requirements. Single-wafer processing or atomic-layer manufacturing technologies might displace multiple conventional tools.

Advanced Materials Beyond Silicon

Gallium nitride, silicon carbide, and other compound semiconductors require specialized manufacturing equipment different from silicon processing tools. If these materials capture significant market share, Applied Materials must develop new equipment lines or risk losing business to specialized competitors.

Customer Vertical Integration and In-House Development

Leading semiconductor manufacturers increasingly develop proprietary manufacturing equipment and processes to maintain competitive advantages. This vertical integration trend threatens equipment suppliers’ market access and revenue potential.

Intel, Samsung, and Taiwan Semiconductor Manufacturing Company all maintain substantial internal equipment development capabilities. These efforts focus on critical, differentiating process steps where commercial equipment may not provide sufficient performance or capacity.

Customer vertical integration creates multiple challenges:

Reduced addressable market as customers develop in-house solutions

Competitive intelligence leakage as customers understand equipment design principles

Pricing pressure as customers use internal development capabilities as negotiating leverage

Technology appropriation risk if customers incorporate Applied Materials’ innovations into proprietary tools

Regulatory Compliance and Export Control Complexity

Operating globally in a highly regulated industry exposes Applied Materials to compliance risks that could result in financial penalties, operational disruptions, or reputational damage. Export control regulations prove particularly complex and volatile.

The company operates under multiple regulatory frameworks:

U.S. Department of Commerce export regulations

International Traffic in Arms Regulations (ITAR)

Entity List restrictions on specific customers

Country-specific import and technology transfer regulations

Environmental and safety regulations across multiple jurisdictions

Regulatory violations can result in severe consequences. In 2023, media reports indicated Applied Materials faced U.S. criminal investigation for alleged shipments to restricted Chinese customers, highlighting compliance challenges’ seriousness.

As geopolitical tensions intensify, regulatory complexity increases. Applied Materials must navigate an increasingly intricate web of restrictions while maintaining customer relationships and protecting market positions.

Strategic Implications for Investors

Applied Materials’ SWOT analysis reveals a company with substantial competitive advantages operating in an attractive growth market, yet facing significant geopolitical and competitive challenges. For investors, several key considerations emerge from this analysis.

Balanced Risk-Reward Profile for Long-Term Investment

The company’s dominant market position, technology leadership, and exposure to secular AI-driven growth provide compelling long-term investment rationale. Applied Materials’ 32.9 percent market share, comprehensive product portfolio, and strong customer relationships create durable competitive moats that should generate attractive returns over multi-year periods.

Financial performance demonstrates this strength. Over fiscal years 2020-2025, Applied Materials grew revenue at a 12 percent annualized rate while expanding non-GAAP operating margins from 27.1 percent to 30.2 percent. This operating leverage, combined with aggressive share repurchases, generated 20 percent annualized earnings per share growth.

However, China exposure and regulatory uncertainty introduce volatility that investors must accept. The $710 million revenue reduction from recent export controls represents approximately 2.5 percent of annual revenue, with additional restrictions possible. This geopolitical overhang will likely persist throughout 2026 and beyond, creating uncertainty about China revenue trajectory.

Near-Term Catalysts and Risks for 2026

Applied Materials enters fiscal 2026 with mixed near-term outlook. Company guidance projects Q1 fiscal 2026 revenue of $6.85 billion, representing modest sequential growth but continued year-over-year decline. Management expects significant acceleration in the second half of calendar 2026 as AI-driven capacity expansion intensifies.

Positive Near-Term Catalysts:

GAA transistor volume production ramp at leading-edge manufacturers

High-bandwidth memory capacity expansion by Samsung, SK Hynix, and Micron

Advanced packaging equipment demand for AI processors

Service business growth from expanding installed base

New product introductions driving technology displacement cycles

Near-Term Headwinds:

Continued China revenue decline from export restrictions

Memory market volatility creating demand uncertainty

Customer digestion period following aggressive 2025 equipment purchases

Competitive pressure in specific tool categories

Macroeconomic uncertainty impacting customer spending

Valuation Considerations and Market Positioning

Compared to semiconductor equipment peers, Applied Materials trades at moderate valuation multiples reflecting both growth potential and risk factors. The company’s strong market position and superior financial performance justify premium valuations relative to smaller, less diversified competitors.

However, investors should recognize that equipment manufacturer valuations exhibit high correlation with semiconductor cycle positioning. During industry upswings, equipment stocks typically trade at elevated multiples that compress rapidly when demand weakens. Applied Materials’ valuation will likely follow this cyclical pattern regardless of company-specific performance.

Strategic Positioning for AI Infrastructure Build-Out

Applied Materials’ technology portfolio alignment with AI chip manufacturing requirements positions the company as a primary beneficiary of multi-year AI infrastructure investments. The company supplies equipment across the complete AI chip value chain, from logic processors to high-bandwidth memory to advanced packaging.

This comprehensive positioning contrasts with more focused competitors serving narrower market segments. As AI computing requirements evolve, Applied Materials’ broad capabilities provide flexibility to capitalize on emerging opportunities while mitigating technology-specific risks.

CFO Brice Hill’s comments during the earnings call underscore this positioning: “We have targeted our R&D investments to create new products and technologies that will enable even faster and more energy-efficient transistors, chips and systems and drive our growth in the years ahead.”

My Final Thoughts

Applied Materials faces a dynamic, complex operating environment through 2026 and beyond. Secular growth drivers, particularly AI computing, provide robust long-term demand support.

However, geopolitical tensions, competitive pressures, and cyclical uncertainty create near-term challenges requiring careful navigation.

The company’s strategic priorities for the coming years center on technology leadership, operational excellence, and geographic diversification. Management’s focus on inflection-focused innovation positions Applied Materials to capture disproportionate share of high-value technology transitions driving industry growth.

For investors, Applied Materials represents a leveraged play on semiconductor industry growth with concentration in the most dynamic segments.

The company’s competitive strengths and market positioning support positive long-term outlook, though volatility from external factors remains elevated. Those comfortable with cyclical technology exposure and geopolitical uncertainty may find Applied Materials’ combination of growth potential and market leadership attractive for long-term portfolio inclusion.

As CEO Gary Dickerson concluded in recent remarks: “Applied is in a tremendous position to benefit as AI computing fuels secular growth in semiconductors and wafer fab equipment.” This positioning, combined with strong execution and strategic clarity, provides the foundation for continued success navigating the opportunities and challenges ahead.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.

Reply