- Deep Research Global

- Posts

- Palantir - Company Analysis and Outlook Report (2026)

Palantir - Company Analysis and Outlook Report (2026)

Executive TL;DR

Palantir $PLTR ( ▲ 5.82% ) delivered exceptional growth in 2025 with revenue reaching $4.4 billion (53% YoY growth) and U.S. commercial revenue surging 121%, driven by explosive demand for its AIP platform

The company achieved a Rule of 40 score of 114% in Q3 2025, demonstrating exceptional operational excellence with 51% adjusted operating margins and accelerating revenue growth

Major catalysts include a $10 billion U.S. Army contract, S&P 500 and Nasdaq 100 inclusion, and valuation reaching $1 trillion within 2-3 years, according to bullish analysts

Key risks include extreme valuation multiples (244x forward P/E), intensifying competition from hyperscalers, and potential regulatory scrutiny as the company becomes more embedded in critical infrastructure

Also Read:

Table of Contents

Introduction

Palantir Technologies has transformed from a secretive government contractor into one of the most watched AI software companies. The Denver-based firm, co-founded by Peter Thiel and Alex Karp, generated returns exceeding 135% in 2025 alone.

The company’s Artificial Intelligence Platform (AIP) has become the primary growth catalyst. This shift from primarily government-focused to commercial enterprise adoption represents a fundamental transformation that investors must understand when evaluating future prospects.

Key Facts: Business Overview and Revenue Drivers

Core Business Model

Palantir operates as a software-as-a-service company specializing in data integration and advanced analytics. The business comprises two main platforms: Gotham for government clients and Foundry for commercial enterprises, with the recently launched AIP bridging both segments.

The company serves three primary markets: U.S. government, international government, and commercial clients. This diversification provides both stability and growth opportunities.

Revenue Performance (LTM)

Through Q3 2025, Palantir’s trailing twelve-month revenue reached approximately $4.5 billion. The company reported Q3 2025 revenue of $1.18 billion, representing 63% year-over-year growth and 18% sequential growth.

For full year 2025, management guidance ranges between $4.396 billion and $4.400 billion. This represents 53-54% growth over 2024 results.

Metric | Q3 2025 | YoY Growth | QoQ Growth |

|---|---|---|---|

Total Revenue | $1.18B | 63% | 18% |

U.S. Revenue | $883M | 77% | 20% |

U.S. Commercial | $397M | 121% | 26% |

U.S. Government | $486M | 52% | 15% |

International Revenue | $300M | 33% | 12% |

Key Product Lines

Palantir Gotham serves defense and intelligence agencies. This platform integrates disparate data sources to support operational decision-making in military and intelligence contexts.

Palantir Foundry targets commercial enterprises. It enables organizations to integrate data across silos, build pipelines, and create operational applications without extensive coding.

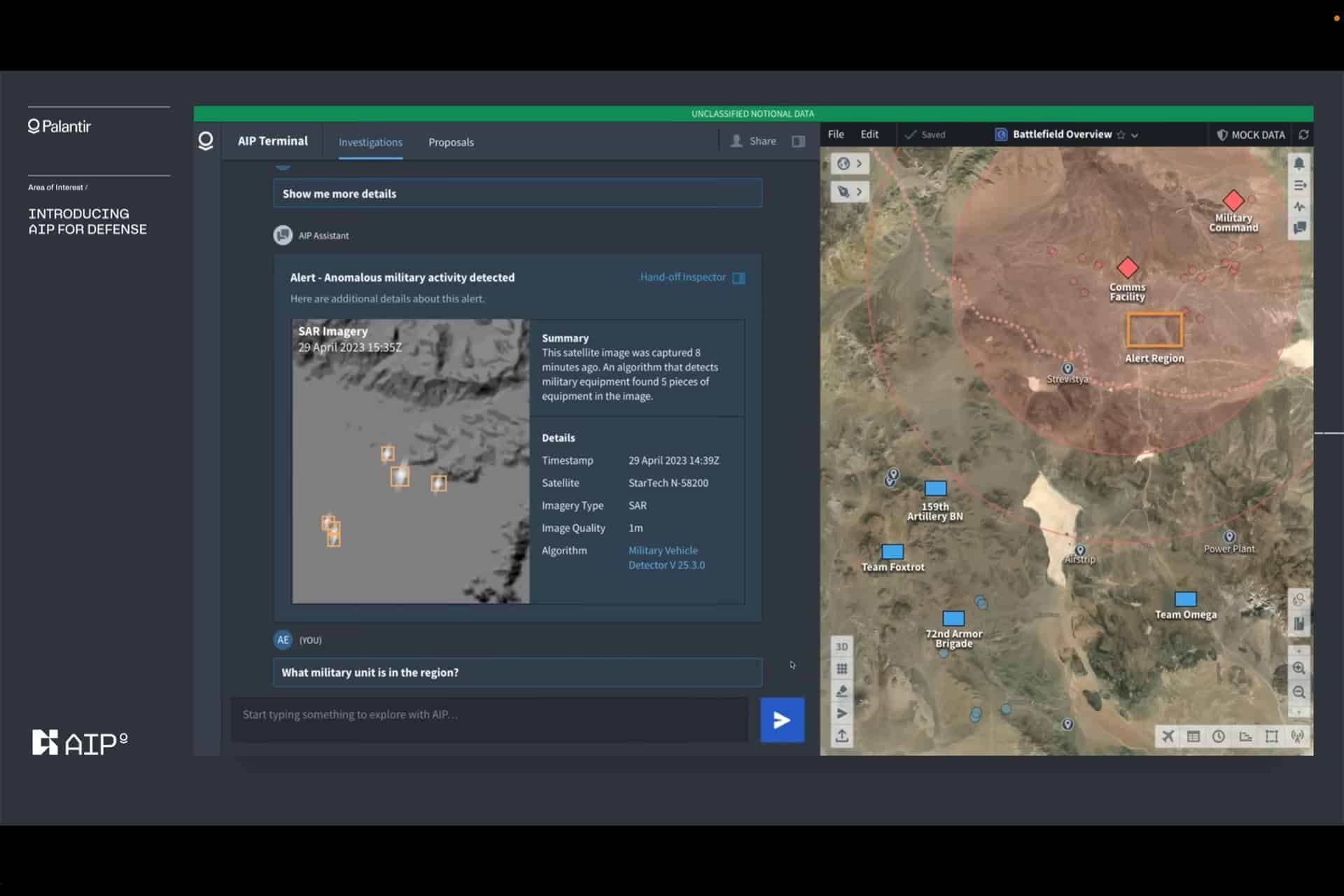

Artificial Intelligence Platform (AIP) represents the company’s newest innovation. Launched in 2023, AIP brings large language models directly into enterprise operations, enabling users to interact with their data through natural language.

The AIP platform includes pre-built AI applications called “Ontology” that can be deployed rapidly. This reduces implementation time from months to weeks, accelerating customer adoption.

Image source: defence.ai

AIP Platform: The AI Revolution Driving Growth

Explosive Commercial Adoption

The Artificial Intelligence Platform has become Palantir’s primary growth engine. U.S. commercial revenue growth of 121% demonstrates unprecedented enterprise appetite for operationalized AI.

The company’s “boot camp” strategy has proven exceptionally effective. These intensive sessions allow potential customers to experience AIP with their own data in real-world scenarios.

This approach dramatically shortens sales cycles compared to traditional enterprise software. Instead of lengthy proof-of-concept phases, customers see immediate value and convert quickly to paid contracts.

AIP Bootcamps: Unique Go-to-Market Strategy

Palantir’s AIP bootcamps represent a distinctive sales methodology. During these sessions, typically lasting several days, the company’s engineers work directly with customer teams to build AI-powered applications using the client’s actual data.

This hands-on approach delivers several advantages. Customers experience tangible results immediately, internal champions emerge naturally, and technical feasibility concerns evaporate when stakeholders see their specific use cases working.

The bootcamp model has generated strong momentum. In Q3 2025 alone, the company added 104 net new commercial customers, with total commercial customers reaching 498.

Integration with Enterprise Systems

AIP’s architecture allows seamless integration with existing enterprise technology stacks. The platform connects to data warehouses, cloud providers, legacy systems, and third-party applications.

This interoperability reduces friction in adoption. Companies don’t need to rip and replace existing infrastructure, a common barrier with enterprise software implementations.

The platform also maintains strict data governance and security controls. This addresses critical concerns for enterprises operating in regulated industries or handling sensitive information.

Government Contracts: Stable Foundation with Expanding Opportunities

U.S. Army’s $10 Billion Enterprise Agreement

In August 2025, Palantir secured a landmark contract with the U.S. Army valued at up to $10 billion over ten years. This Enterprise Agreement consolidates 75 separate contracts into a single comprehensive framework.

The deal represents a strategic shift in military software procurement. Rather than managing dozens of individual contracts, the Army gains a unified platform for data analytics and AI capabilities across numerous use cases.

This arrangement benefits both parties. The Army achieves operational efficiency and interoperability, while Palantir secures predictable, long-term revenue with opportunities for expansion within the agreement’s scope.

Defense and Intelligence Portfolio

Beyond the Army contract, Palantir maintains relationships across U.S. defense and intelligence agencies. The company works with entities including the Air Force, Navy, Special Operations Command, and various intelligence organizations.

U.S. Government revenue grew 52% year-over-year in Q3 2025 to $486 million. This demonstrates continued expansion within existing accounts and new program wins.

International government clients also contribute meaningfully. However, geopolitical considerations limit Palantir’s addressable market, as the company restricts sales to allied nations aligned with U.S. interests.

Government Budget Dynamics and Risks

Defense spending remains a political consideration. While the current geopolitical environment supports increased military budgets, potential administration changes could affect funding priorities.

Reports emerged in early 2025 about proposed Pentagon budget reductions of 8% annually over five years. Such cuts could pressure Palantir’s government revenue, though mission-critical AI and data analytics might receive protection given their strategic importance.

The company’s expanding commercial business provides diversification against government budget uncertainty. Commercial revenue now represents over 40% of total sales, up from 20-30% in earlier years.

Segment | Q3 2025 Revenue | % of Total | YoY Growth |

|---|---|---|---|

U.S. Commercial | $397M | 33.6% | 121% |

U.S. Government | $486M | 41.2% | 52% |

International | $300M | 25.4% | 33% |

Porter’s Five Forces Analysis

Threat of New Entrants: Medium

The data analytics and AI software market has moderate barriers to entry. Technical talent availability, cloud infrastructure commoditization, and open-source AI models lower some obstacles.

However, Palantir benefits from significant advantages. Deep government relationships require security clearances and proven track records that take years to build. The company’s 20-year operational history creates institutional knowledge difficult to replicate.

Enterprise trust also matters. Large organizations prefer vendors with established reputations when implementing mission-critical systems handling sensitive data.

Bargaining Power of Suppliers: Low

Palantir relies primarily on cloud infrastructure providers and technical talent. Multiple cloud options exist (AWS, Azure, Google Cloud), preventing supplier lock-in.

The software talent market remains competitive, but Palantir’s brand and interesting problem sets help attract top engineers. The company’s Denver headquarters offers geographic diversification from Silicon Valley.

Bargaining Power of Buyers: Medium to High

Government clients wield significant power through procurement processes and budget authority. However, once embedded in critical operations, switching costs become substantial.

Commercial clients have numerous alternatives, increasing their bargaining position. This puts pressure on pricing and contract terms, particularly as competitors offer similar capabilities.

Threat of Substitutes: High

Multiple alternatives exist across different segments. For data integration, companies like Snowflake and Databricks compete aggressively. For AI platforms, hyperscalers (Microsoft, Amazon, Google) bundle competing capabilities into their cloud offerings.

Open-source tools provide lower-cost alternatives for organizations with strong technical teams. While these require more effort to implement, they offer flexibility and cost advantages.

Competitive Rivalry: High and Intensifying

The AI software market has become crowded. Competition from Microsoft Azure AI, AWS SageMaker, Google Cloud AI, and specialized vendors intensifies pricing pressure.

Microsoft’s integration of AI capabilities across its enterprise suite creates formidable competition. Organizations already using Microsoft 365, Azure, and Power BI may prefer incremental AI additions over separate platforms.

Key Competitors and Market Position

Databricks competes in data lakehouse and analytics platforms. The company has raised significant venture capital and achieved a valuation exceeding $40 billion. Databricks appeals to data engineering teams with strong technical capabilities.

Snowflake offers cloud data warehousing with expanding analytics capabilities. While not directly competing in operational AI applications, Snowflake’s data platform can serve as the foundation for competing solutions.

Microsoft, Amazon, and Google represent the most significant competitive threat. These hyperscalers possess unlimited resources, existing enterprise relationships, and can bundle AI capabilities into comprehensive cloud offerings.

However, Palantir differentiates through operational focus. While competitors provide infrastructure and tools, Palantir delivers complete applications embedded in business processes.

Palantir holds a relatively small market share in the broader big data analytics space. According to 6sense data, Databricks leads with 17.30% market share, Azure Databricks has 16.61%, and Palantir captures approximately 1-2% of the total addressable market.

In government contracting, Palantir’s position appears stronger. The company competes against traditional defense contractors like Leidos, Raytheon, and CACI International, but holds technical advantages in AI and data analytics.

The company’s total addressable market is estimated at $335 billion for 2025, with current market penetration at just 1.3%. This suggests substantial growth runway if execution continues.

Switching Costs and Customer Retention

Once implemented, Palantir’s platforms create significant switching costs. The company’s ontology approach requires customers to map their enterprise data into a unified semantic layer.

This data modeling becomes institutional knowledge. Workflows, applications, and business processes get built on top of this foundation, making migration to competing platforms extremely disruptive.

Customer retention metrics reflect this dynamic. The company reported net dollar retention of 118% in recent quarters, indicating existing customers increase spending over time.

Financial Deep Dive: Profitability and Cash Generation

Revenue Growth Trajectory

Palantir’s revenue growth has accelerated dramatically. From 13% growth in 2023, the company expanded to 30% growth in 2024, and further to 53-54% expected growth in 2025.

This acceleration reflects AIP’s market reception. Commercial revenue grew from $645 million in 2023 to an expected $1.8+ billion in 2025, more than doubling in two years.

Analysts project 2026 revenue of $5.62 billion, representing 35% growth. While this marks deceleration from 2025’s blistering pace, it still constitutes exceptional growth for a company approaching $5 billion in revenue.

The law of large numbers will eventually constrain growth rates. However, with current market penetration below 2%, Palantir has substantial runway before saturation becomes a meaningful concern.

Profitability Metrics and Operating Leverage

Palantir has transitioned from losses to robust profitability. Q3 2025 GAAP operating income reached $113 million, representing a 16% margin. GAAP net income was $144 million, a 20% margin.

More impressively, adjusted operating income hit $601 million, yielding a 51% adjusted operating margin. This demonstrates significant operating leverage as the software-based business scales.

The company’s Rule of 40 score provides a comprehensive performance metric. By adding revenue growth percentage to operating margin percentage, companies scoring above 40 demonstrate strong performance. Palantir’s Rule of 40 score reached 114% in Q3 2025 (63% growth + 51% adjusted operating margin).

Few software companies achieve scores above 80. A score of 114 places Palantir among the elite performers in enterprise software.

Free Cash Flow Analysis

Free cash flow has become a critical focus for investors evaluating software companies. Palantir generates exceptional cash relative to revenue.

Q3 2025 cash from operations reached $420 million, while adjusted free cash flow hit $540 million. The adjusted FCF margin of 45.7% ranks among the best in software.

On a trailing twelve-month basis, adjusted free cash flow exceeded $1.9 billion. For full year 2025, management guided adjusted FCF between $1.8 billion and $2.0 billion.

This cash generation provides substantial financial flexibility. The company can invest in R&D, pursue strategic acquisitions, or return capital to shareholders without requiring additional financing.

Metric | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

Revenue | $1,180M | $1,020M | $905M | $767M |

Operating Cash Flow | $420M | $374M | $313M | $274M |

Adj. Free Cash Flow | $540M | $461M | $381M | $312M |

Adj. FCF Margin | 45.7% | 45.2% | 42.1% | 40.7% |

Balance Sheet Strength

Palantir maintains a fortress balance sheet. As of Q3 2025, the company held $6.4 billion in cash and cash equivalents with zero debt.

This financial position eliminates refinancing risk and provides strategic optionality. The company can weather economic downturns, invest aggressively in growth opportunities, or make strategic acquisitions without financial constraints.

The clean balance sheet also appeals to risk-averse government clients. Financial stability signals the company will remain a viable long-term partner for mission-critical systems.

Historical Margin Expansion

Examining margin progression reveals improving unit economics. Gross margins have remained consistently high above 75%, reflecting the software business model’s inherent leverage.

Operating margins have expanded significantly. From negative margins in 2020-2021, the company achieved breakeven in 2022, mid-teens GAAP operating margins in 2024, and is approaching 20% GAAP operating margins in 2025.

Management believes margin expansion will continue. As the customer base grows and AIP adoption accelerates, incremental revenue drops to the bottom line at high rates given the software’s scalability.

Current Valuation Metrics

Palantir’s valuation has reached levels that command attention. Trading at approximately $178 per share in mid-January 2026, the company commands a market capitalization near $400 billion.

Forward price-to-sales ratio exceeds 40x based on 2026 revenue estimates. Forward price-to-earnings ratio approaches 150-200x depending on earnings assumptions.

These multiples place Palantir among the most expensive stocks in technology. For comparison, Microsoft trades at roughly 10-12x sales, Nvidia at 15-20x sales, and even high-growth software companies rarely exceed 25-30x sales.

Valuation Metric | Current Multiple | 5-Year Average | Peer Median |

|---|---|---|---|

Price / Sales (FWD) | 42x | 18x | 12x |

Price / Earnings (FWD) | 180x | N/A | 35x |

EV / Revenue | 41x | 17x | 11x |

Price / FCF | 85x | 45x | 28x |

Discounted Cash Flow (DCF) Analysis

Multiple DCF analyses suggest significant overvaluation at current prices. SimplyWall.st estimates the stock is overvalued by 89%, implying fair value near $20 per share.

Alpha Spread’s DCF model calculates fair value at $27.54, suggesting 84% overvaluation compared to the $177 trading price.

These DCF valuations rely on assumptions about growth rates, margin expansion, and terminal values. One analysis noted that current prices require a 51% free cash flow CAGR through 2032 and 8% perpetual growth - assumptions the analyst characterized as “extremely aggressive.”

Bullish scenarios can justify higher valuations. If Palantir achieves $20+ billion in revenue by 2030 with 30-35% operating margins, fair value could support current prices.

Comparable Company Analysis

Finding appropriate comparables proves challenging given Palantir’s unique characteristics. Pure software comparables trade at 5-15x forward sales, while high-growth AI companies might command 15-30x sales.

ServiceNow, a similar-sized enterprise software company with strong growth, trades at roughly 15-18x forward sales. Snowflake, despite declining growth, trades at 10-12x sales.

Applying a 25x forward sales multiple (generous for software) to 2026 revenue estimates of $5.62 billion yields an implied market cap of $140 billion, suggesting 65% downside from current levels.

However, comparables analysis has limitations. Palantir’s AI positioning, government relationships, and growth acceleration may justify premium multiples if the company achieves its potential.

Valuation Sensitivity Analysis

Valuation outcomes vary dramatically based on assumptions. The table below illustrates market cap implications under different scenarios:

2030 Revenue | Sales Multiple | Implied Market Cap | % Return from Current |

|---|---|---|---|

$15B | 15x | $225B | -44% |

$20B | 20x | $400B | 0% |

$25B | 25x | $625B | +56% |

$30B | 30x | $900B | +125% |

This sensitivity analysis reveals the dependence on both growth execution and sustained multiple expansion. Bull cases require revenue reaching $25-30 billion with continued premium valuations.

Market Sentiment and Momentum Factors

Beyond fundamental valuation, market sentiment plays a significant role in stock pricing. Palantir has become a favorite among retail investors, with strong social media presence and passionate shareholder base.

The stock’s inclusion in the S&P 500 and Nasdaq 100 in 2025 triggered forced buying from index funds, providing price support regardless of fundamental valuation.

Options market activity indicates significant bullish positioning. High implied volatility and strong call option volume suggest investors anticipate continued appreciation despite elevated valuations.

Catalysts and Timeline: Events Driving Future Performance

Near-Term Catalysts (Q1-Q2 2026)

Q4 2025 Earnings (February 2026)

Palantir will report Q4 2025 results on February 2, 2026. Management guidance projects revenue between $1.327-$1.331 billion, representing 61% year-over-year growth.

This report will provide critical insights into full-year 2025 performance and initial 2026 guidance. Investors will scrutinize commercial growth sustainability and government contract momentum.

New Government Contract Awards

The federal fiscal year creates natural timing for contract announcements. Awards typically accelerate in Q4 (July-September) as agencies complete budget allocation.

Additional international government contracts could provide upside surprises. Expanded relationships with NATO allies represent a multi-billion dollar opportunity.

Medium-Term Catalysts (2026)

AIP 2.0 and Product Innovation

Palantir continues investing heavily in AIP capabilities. Enhanced multi-modal AI, improved integration with popular enterprise systems, and expanded pre-built applications could accelerate adoption.

The company’s R&D team focuses on reducing implementation complexity. Simpler deployment and faster time-to-value would expand the addressable market beyond current sophisticated customers.

Industry Vertical Expansion

Palantir has achieved traction in several verticals including healthcare, manufacturing, energy, and financial services. Deeper penetration in these sectors could drive sustained commercial growth.

Healthcare represents a particularly large opportunity. The industry’s data complexity and regulatory requirements align well with Palantir’s strengths.

Partnership and Integration Announcements

Strategic partnerships with cloud providers, system integrators, or technology vendors could significantly expand distribution. While Palantir has historically favored direct sales, partnerships could accelerate growth.

Integration with popular business intelligence, ERP, or CRM systems would reduce friction in enterprise adoption.

Long-Term Catalysts (2027+)

International Commercial Expansion

International commercial revenue remains relatively small but could provide substantial growth. Major enterprises in Europe and allied Asia-Pacific nations represent untapped opportunity.

Geopolitical constraints limit addressable markets, but allowed regions still contain trillions in enterprise IT spending.

Platform Effects and Network Economics

As more customers adopt Palantir, potential network effects could emerge. Shared learnings across similar industries, pre-built solutions, and ecosystem development could create competitive advantages.

The company’s Foundry platform enables customers to build applications for their ecosystems, potentially creating distribution channels and lock-in effects.

Margin Expansion and Operating Leverage

Continued margin expansion could significantly boost earnings even if revenue growth moderates. Software companies with strong market positions often achieve 40-50% operating margins.

If Palantir reaches 35-40% GAAP operating margins by 2028-2029, earnings power would increase dramatically even without revenue acceleration.

Key Risks: Challenges and Threat Scenarios

High Probability Risks

Valuation Compression (Probability: High)

Current valuation multiples exceed historical norms for software companies. Multiple analysts have noted that the stock faces significant downside if growth disappoints or market sentiment shifts.

Even minor disappointments in revenue growth, customer additions, or margin expansion could trigger sharp corrections given the premium valuation embedded in current prices.

Competitive Pressure (Probability: High)

Microsoft, Amazon, and Google continue building comparable capabilities. These hyperscalers possess larger R&D budgets, existing enterprise relationships, and ability to bundle AI into comprehensive offerings at attractive prices.

If competitors successfully replicate AIP’s core value propositions, Palantir’s differentiation and pricing power could erode quickly.

Growth Deceleration (Probability: Medium-High)

The law of large numbers suggests growth rates must eventually moderate. Analysts project deceleration from 53% growth in 2025 to 35% in 2026 to 25-30% in 2027.

If deceleration occurs faster than expected, the stock’s momentum-driven premium could evaporate rapidly.

Medium Probability Risks

Government Budget Cuts (Probability: Medium)

Political changes could affect defense spending priorities. While concerns emerged about potential 8% annual Pentagon cuts, actual implementation remains uncertain.

Government revenue represents over 50% of total sales. Material budget reductions would significantly impact growth prospects.

Regulatory and Privacy Concerns (Probability: Medium)

As Palantir becomes more embedded in critical operations, regulatory scrutiny increases. European privacy regulations, U.S. data protection laws, or AI-specific regulations could constrain business models.

The company’s work with defense and intelligence agencies creates reputational risks that could affect commercial customer acquisition, particularly in Europe.

Customer Concentration (Probability: Medium)

While improving, customer concentration remains a concern. The U.S. government collectively represents over 40% of revenue. Loss of major contracts or budget reallocations could materially impact results.

On the commercial side, landing large enterprise customers is positive, but creates dependency risks if major accounts reduce spending or churn.

Lower Probability but High Impact Risks

Technology Disruption (Probability: Low-Medium)

Fundamental shifts in AI architectures or data processing paradigms could obsolete current platforms. While Palantir invests heavily in R&D, a breakthrough technology could reduce moats.

The open-source AI ecosystem continues advancing rapidly. If open models achieve performance parity with commercial offerings, pricing pressure could intensify.

Geopolitical Instability (Probability: Low-Medium)

Palantir’s government business ties success to geopolitical stability and defense priorities. Major geopolitical shifts, such as peace in conflict regions or changed threat assessments, could reduce defense AI spending.

Conversely, escalating conflicts could accelerate defense spending but create other business risks including supply chain disruptions or talent shortages.

Key Person Risk (Probability: Low)

CEO Alex Karp’s leadership has been central to Palantir’s identity and strategy. His departure could create uncertainty about strategic direction and cultural continuity.

While the executive team has depth, Karp’s relationships with government clients and unique management philosophy make him difficult to replace.

Risk Category | Specific Risk | Probability | Potential Impact | Mitigation |

|---|---|---|---|---|

Valuation | Multiple compression | High | Severe (-50-70%) | None; function of market |

Competition | Hyperscaler threat | High | High (-30-50%) | Product differentiation |

Growth | Commercial slowdown | Medium-High | High (-30-50%) | Market expansion |

Government | Budget cuts | Medium | Medium (-20-30%) | Commercial diversification |

Regulatory | Privacy/AI regulation | Medium | Medium (-15-25%) | Compliance investment |

Technology | Platform disruption | Low-Medium | Severe (-40-60%) | R&D investment |

SWOT Analysis: Strategic Position Assessment

Strengths

Technical Differentiation

Palantir’s ontology approach creates a unified semantic layer that competitors struggle to replicate. This technical architecture provides meaningful advantages in complex enterprise environments.

The company’s engineering talent and problem-solving culture enable rapid innovation. The 20-year history of tackling difficult data integration challenges has created institutional knowledge.

Government Relationships and Security Clearances

Deep relationships with U.S. defense and intelligence agencies represent a significant moat. The $10 billion Army contract exemplifies trust built over decades.

Required security clearances for government work create barriers for competitors. Palantir’s cleared workforce and secure facilities provide structural advantages.

Financial Strength

The $6.4 billion cash position with zero debt provides exceptional financial flexibility. This enables aggressive investment in R&D, strategic acquisitions, or weathering economic downturns.

Exceptional cash flow generation provides self-funding growth capability. The company doesn’t face financing constraints that burden competitors.

Operational Excellence

The 114% Rule of 40 score demonstrates rare excellence in balancing growth and profitability. Few software companies achieve comparable performance.

Expanding margins while accelerating growth indicates improving unit economics and operating leverage.

Weaknesses

Valuation Premium

Trading at 40x+ forward sales creates significant downside risk. Any execution misstep or market sentiment shift could trigger sharp corrections.

This valuation limits margin of safety for new investors. The company must execute flawlessly to justify current prices.

Brand and Market Perception

Despite commercial progress, Palantir carries government contractor baggage. Privacy advocates and critics view the company with suspicion, potentially limiting commercial adoption.

The company’s relatively low public profile compared to tech peers creates awareness challenges in enterprise markets.

Sales Force and Go-to-Market

The AIP bootcamp model works well but may not scale efficiently. As customer volume grows, personalized intensive engagements become resource-constrained.

Building traditional enterprise sales capability takes time and cultural adaptation. Palantir’s engineering-first culture may resist necessary sales transformation.

Limited Product Breadth

Focusing on data integration and AI applications creates dependency on these market segments. Unlike hyperscalers offering comprehensive cloud stacks, Palantir lacks product breadth.

This focused approach provides clarity but limits cross-sell opportunities and customer lifetime value compared to platform vendors.

Opportunities

AI Market Expansion

The enterprise AI market is projected to grow dramatically over the next decade. Palantir’s TAM of $335 billion with 1.3% current penetration suggests vast growth runway.

As enterprises prioritize AI implementation, Palantir’s operational focus could capture disproportionate share.

International Growth

International commercial revenue remains underpenetrated. Major enterprises in Europe, Japan, Australia, and other allied nations represent substantial opportunity.

Government relationships in NATO countries could accelerate international expansion by leveraging defense relationships into commercial opportunities.

Vertical Market Dominance

Deep penetration in specific verticals could create dominant positions. Healthcare, energy, manufacturing, and financial services each represent multi-billion dollar opportunities.

Vertical-specific solutions and expertise could command premium pricing and create defensible market positions.

Platform Ecosystem Development

Building a developer ecosystem around Foundry could accelerate adoption. Third-party applications, integrations, and consulting partners would extend reach beyond direct sales.

Platform effects could create network economics and lock-in that strengthen competitive position.

Threats

Hyperscaler Competition

Microsoft, Amazon, and Google represent existential competitive threats. Their resources, enterprise relationships, and bundling capabilities could erode Palantir’s differentiation.

Azure’s AI services, AWS SageMaker, and Google Cloud AI continue improving. If they achieve feature parity, Palantir’s premium pricing becomes untenable.

Open Source Disruption

The open-source AI ecosystem advances rapidly. Large language models, data processing frameworks, and AI tools available freely could reduce willingness to pay for commercial solutions.

Sophisticated customers with strong technical teams may prefer building custom solutions on open-source foundations.

Regulatory Constraints

Increasing regulatory scrutiny on AI systems could constrain business models. Europe’s AI Act and potential U.S. regulations may require costly compliance or limit use cases.

Privacy regulations could restrict data integration capabilities, reducing platform value propositions.

Economic Recession

Enterprise IT spending contracts during recessions. While mission-critical systems receive protection, new AI projects could face budget cuts in economic downturns.

Palantir’s premium pricing makes it vulnerable to cost optimization initiatives during difficult economic periods.

PESTEL Analysis: Macro Environment Factors

Political Factors

Government relationships represent both opportunity and risk. Defense spending dynamics shift with political changes, creating uncertainty around a major revenue source.

U.S.-China tensions and technology export controls could affect international expansion. Restrictions on AI technology exports may limit addressable markets.

Bipartisan support for defense technology and AI competitiveness provides tailwinds. Both political parties recognize AI’s strategic importance, suggesting sustained defense spending.

Economic Factors

Interest rate environments affect technology stock valuations disproportionately. A dovish rates environment benefits long-duration growth stocks like Palantir.

Enterprise IT budgets correlate with economic growth. Strong economic conditions support increased spending on transformation projects like AI implementation.

However, elevated valuations create vulnerability to economic shocks. Risk-off sentiment during recessions typically punishes expensive growth stocks severely.

Privacy concerns affect enterprise software adoption. Palantir’s government work creates reputational challenges that may limit commercial growth in privacy-sensitive markets.

The AI skills shortage benefits platform vendors like Palantir. Organizations lacking in-house AI expertise seek turnkey solutions, expanding addressable markets.

Remote work trends increase data complexity in enterprises. Distributed operations create data integration challenges that play to Palantir’s strengths.

Technological Factors

Rapid AI advancement represents both opportunity and threat. New capabilities expand use cases, but also accelerate competitive intensity as barriers to entry decrease.

Cloud infrastructure maturation commoditizes computing resources. This levels the playing field, reducing advantages from proprietary infrastructure.

Edge computing and distributed AI could create new architectural requirements. Palantir must adapt platforms to emerging computing paradigms.

Environmental Factors

Environmental, social, and governance (ESG) considerations increasingly affect enterprise purchasing decisions. Palantir’s government defense work may conflict with some organizations’ ESG policies.

Data center energy consumption faces growing scrutiny. AI workloads require substantial computing resources, creating potential sustainability concerns.

Climate change creates data analysis opportunities. Resource optimization, supply chain resilience, and climate risk modeling represent application areas aligned with Palantir’s capabilities.

Legal Factors

Data privacy regulations like GDPR in Europe and emerging U.S. state laws affect data integration platforms. Compliance requirements increase complexity and costs.

AI-specific regulations remain under development. The EU’s AI Act and potential U.S. federal legislation could impose requirements affecting product design and deployment.

Government contract protests and litigation create risks. Competitors can challenge contract awards, potentially delaying revenue recognition or forcing re-competition.

Analyst Price Targets: Wall Street Perspectives

Recent Upgrades and Bullish Views

Citi Upgrade (January 2026)

Citi upgraded Palantir to Buy on January 12, 2026, raising the price target from $210 to $235. This represents 31% upside from the upgrade price.

The firm cited expectations for upward estimate revisions in 2026. Citi projects government revenue could rise 51% year-over-year, roughly 800 basis points above consensus.

Bank of America’s $255 Target

BofA Securities maintains a Buy rating with a $255 price target. The firm reiterated this view following investor meetings with company executives in South Korea.

BofA highlights commercial momentum and government contract stability as key drivers supporting continued growth.

Wedbush’s Trillion-Dollar Vision

Wedbush analyst Dan Ives selected Palantir as a top pick for 2026. Ives describes a “golden path” toward $1 trillion market capitalization within 2-3 years.

This implies stock appreciation to $400+ per share from current levels, requiring sustained revenue growth and margin expansion.

Morgan Stanley’s Upgrade

Morgan Stanley raised its target from $155 to $205 in November 2025. The firm upgraded from Equal Weight to Overweight, citing commercial growth sustainability.

Bearish and Cautious Perspectives

Valuation Concerns

Despite upgrades, average analyst targets of $175-188 suggest limited upside from current prices near $178. This implies Wall Street sees fair value near current levels on average.

Multiple analysts maintain Hold or Sell ratings based on valuation concerns. Goldman Sachs and others cite extreme multiples as limiting upside potential.

DCF-Based Downside

Fundamental valuation models suggest significant overvaluation. SimplyWall.st calculates 89% overvaluation, implying fair value below $20 per share.

These analyses highlight the gap between momentum-driven market prices and traditional valuation methodologies.

Consensus and Range

The 25 analysts covering Palantir show wide dispersion. The highest price target reaches $255, while the lowest sits around $140, creating a 45% range.

This dispersion reflects fundamental disagreement about growth sustainability and appropriate valuation multiples.

Summary of Latest Analyst Targets:

Citi: $235 (Buy, January 2026)

BofA Securities: $255 (Buy, December 2025)

Morgan Stanley: $205 (Overweight, November 2025)

Truist Securities: $223 (Buy, January 2026)

Wedbush: $200+ (Outperform, ongoing)

Average Target: $188 (LSEG consensus)

Median Target: $175-180

The average target of $188 implies roughly 6% upside from current prices, suggesting Wall Street views the stock as fairly valued to slightly expensive at present levels.

SEC Filings

Latest 10-Q (Q3 2025)

Filed November 4, 2025, Acc-no: 0001321655-25-000131

This quarterly report provides detailed financial statements, risk factors, and management discussion.

10-K Annual Reports

Annual filings contain comprehensive business descriptions, risk factors, financial statements, and management analysis. The 2024 10-K provides baseline comparison for 2025 performance.

Earnings Materials

Q3 2025 Earnings Release

November 3, 2025 release details Q3 results, guidance updates, and key metrics.

Investor Presentations

Quarterly investor presentations available on investors.palantir.com provide management’s strategic commentary and forward guidance.

Key Government Documents

U.S. Army Contract

USAspending.gov tracks federal contract awards and spending. This transparency database provides visibility into government revenue.

Defense Contract Awards

Department of Defense contract announcements detail new awards, modifications, and contract values for defense work.

Transcripts and Management Commentary

Earnings Call Transcripts

Quarterly earnings calls feature management discussion of results, strategy, and outlook. Transcripts available through investor relations website and financial data providers.

CEO Letters

Alex Karp’s shareholder letters provide strategic perspective on company direction and management philosophy.

My Final Thoughts

Palantir Technologies has successfully transitioned from government contractor to AI software leader, achieving rare financial performance with 63% revenue growth and 51% operating margins simultaneously.

The AIP platform’s commercial success validates years of platform investment. 121% U.S. commercial growth demonstrates that enterprises will pay premium prices for AI platforms that deliver operational results rather than experimental capabilities.

However, valuation creates asymmetric risk. At 40x+ forward sales, the stock prices in years of flawless execution. Any stumble in growth, margin expansion, or competitive positioning could trigger sharp revaluations.

For investors, the critical question centers on whether Palantir becomes an enterprise AI standard or faces commoditization pressure from hyperscalers. The company’s operational focus and high-touch customer engagement differentiate today, but Microsoft, Amazon, and Google continue building comparable capabilities.

The government revenue foundation provides stability, though political and budget risks persist. The $10 billion Army contract demonstrates mission-criticality, but represents only potential revenue rather than guaranteed spending.

Commercial momentum must continue. If U.S. commercial growth sustains above 50% through 2026 while maintaining profitability, the growth story remains intact. Deceleration below 40% would raise concerns about market saturation or competitive pressure.

Financial strength provides a cushion. The fortress balance sheet and exceptional cash generation enable aggressive investment without financial constraints. This differentiates Palantir from capital-constrained competitors.

Ultimately, Palantir exemplifies the challenge of investing in premium-valued growth. The business fundamentals shine, but valuations embed expectations that leave little room for disappointment. This creates opportunity for long-term believers willing to tolerate volatility, but significant risk for those underestimating competitive intensity or overestimating growth durability.

The next 18-24 months will prove critical. Sustained commercial growth, successful AIP adoption across industries, and continued margin expansion would validate current valuations.

Conversely, growth deceleration, competitive losses, or margin pressure would expose downside risk embedded in premium multiples.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and consult with financial advisors before making investment decisions.

Reply